As a seasoned researcher with years of experience in the cryptocurrency market, I have seen my fair share of ups and downs, bull runs, and bear markets. The recent outflows from U.S. spot Bitcoin ETFs are reminiscent of similar events in the past, but the current situation seems more ominous due to the convergence of several negative factors.

This week, withdrawals from American Bitcoin ETFs reached over $706 million, driven by bearish sentiment that pushed the price of Bitcoin down to $53,304 – a level not seen since August 5.

Based on figures provided by SoSoValue, a total of $169.97 million was withdrawn from Bitcoin Exchange-Traded Funds (ETFs) occupying the 12th position on September 6. Notably, Grayscale and Fidelity were the primary contributors to these outflows.

-

Fidelity’s FBTC shed $85.5 million, with the fund experiencing negative flows for the past seven trading days.

Grayscale’s GBTC added to the exit liquidity, with $52.9 million leaving the fund, bringing total losses to over $20 billion since its inception. Over the past eight days, the fund has lost $279.9 million, continuing its outflow streak since Aug. 27.

Bitwise’s BITB saw outflows of $14.3 million

ARK 21Shares’ ARKB, $7.2 million

Grayscale’s Bitcoin mini trust, $5.5 million

Valkyrie’s BRRR, $4.6 million

BlackRock, WisdomTree avoid outflows

As a researcher examining the recent trends in Bitcoin Exchange-Traded Funds (ETFs), I noticed an interesting pattern: BlackRock’s IBIT and WisdomTree’s BTCW were unique in that they managed to maintain their assets over the past week, avoiding outflows. Yet, it’s worth noting that neither of these ETFs saw any fresh influxes of funds in the last two days.

The reluctance shown by investors corresponds with a recent drop in Bitcoin’s value. At the moment of this writing, the flagship cryptocurrency had risen to $54,333, having briefly fallen to $52,690—its lowest since August 5. However, Bitcoin saw a 3% decrease over the past day.

Bitcoin has dropped approximately 10.4% from its highest point this week and a substantial 17.5% since it reached $64,648 on August 26th. In the last day, the market turbulence has escalated, with around $113.86 million worth of Bitcoin positions being liquidated, according to Coinglass.

The decrease in Bitcoin’s value occurred during a time when there was increasing apprehension within the cryptocurrency market, which was exacerbated by the so-called “Redtember” downturn and doubts about possible U.S. interest rate reductions. These elements led to a decline in investor confidence and amplified market fluctuations.

As an analyst, I’ve been tracking the Crypto Fear and Greed Index, and as of now, it remains at 23 – a level not seen in over a month. This low reading suggests that investors are feeling quite anxious about the crypto market, indicating a risk-averse climate we need to be mindful of.

Further downside expected

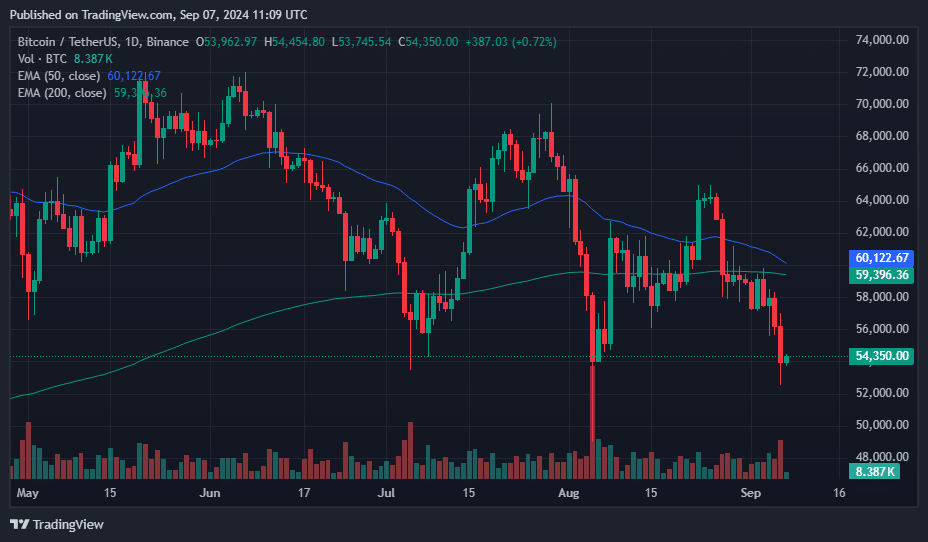

The technical data indicates that a convergence, known as a ‘death cross,’ may occur shortly between the 50-day and 200-day Exponential Moving Averages. These types of crossovers are often seen as a cause for concern within technical analysis. Notably, Bitcoin experienced a significant drop (over 67%) after a death cross was formed in January 2022.

Experts on social media site X generally held a pessimistic viewpoint, while digital cryptocurrency expert Pushpendra Singh contends that Bitcoin is currently trapped within a descending channel formation known as a falling wedge pattern.

A potential surge beyond the $57,800 to $58,000 band (which resembles a wedge) might trigger a robust upward trend.

If Bitcoin (BTC) falls below the trendline of support at roughly $54,000, it might trigger more price declines, as an investor, I’d be keeping a close eye on this level.

In agreement with this careful opinion, a Bitcoin versus US Tether (BTC/USDT) chart posted by crypto analyst Nika similarly pointed out that Bitcoin has been finding it difficult to surpass the $58,000 mark.

Should the cryptocurrency not manage to break through its current resistance area, it may encounter a steeper decline, with possible floor levels at around $45,000 and $42,000.

Read More

2024-09-07 15:58