As an analyst with over two decades of experience in the financial markets, I must admit that the current Bitcoin bull run is nothing short of astonishing. The cryptocurrency market has shown remarkable resilience and growth, especially after the recent U.S. presidential elections.

Over the last week, I’ve noticed that Bitcoin has consistently reached unprecedented peaks. This surge appears to be a direct response to the bullish momentum sweeping through the cryptocurrency market following Donald Trump’s victory in the U.S. presidential election, as investors seem to have interpreted this event as potentially positive for the economy and, consequently, for Bitcoin.

Bitcoin (BTC) experienced a 18% increase over the last seven days and has risen by 3% within the past 24 hours. The top digital currency peaked at an all-time high of $81,858 earlier today, but has since dipped slightly to its current trade price of $81,000 due to a minor correction.

Due to ongoing increases in value, the total market capitalization of Bitcoin recently exceeded $1.6 trillion. Additionally, its daily trading volume has nearly doubled, reaching a staggering $92 billion. At this moment, Bitcoin’s market control is holding steady at approximately 55.4%.

In simple terms, this digital currency, often referred to as ‘digital gold’, surpassed Meta’s market value of $1.48 trillion, making it the ninth most valuable asset globally.

The surge in Bitcoin’s value has sparked optimism among investors in digital assets, causing a ripple effect across the market that brings it near to reaching the peak levels of 2021. As per information from CoinGecko, the total market capitalization of cryptocurrencies rose by approximately 3% over the past day and currently stands above $2.9 trillion.

This level hasn’t been seen since mid-November 2021.

According to data from CoinGecko, the overall cryptocurrency trading volume has surged by a staggering 80%, reaching an impressive $306 billion. This significant rise indicates a heightened level of interest among market players.

Why is Bitcoin rising?

The surge in Bitcoin’s value and a broader market upswing began following Donald Trump’s victory in the U.S. presidential election against Kamala Harris, with many in the cryptocurrency community hailing him as the first U.S. president supportive of digital currencies.

The victory of Trump sparked significant growth in the cryptocurrency market, causing a sense of urgency or “fear of missing out” (FOMO) among those who invest in digital currencies.

As a researcher immersed in the dynamic world of cryptocurrencies, I’ve observed an interesting trend. The price surge of Bitcoin beyond its March ATH of $73,000 has set off a ripple effect, causing a spike in short liquidations. Intriguingly, data from Coinglass reveals that this 24-hour period has seen a staggering $630 billion worth of crypto assets being liquidated.

Approximately $121 million worth of Bitcoin positions were terminated (liquidated) recently, with $38 million being long positions and $83 million short positions, as per Coinglass data. Historically, such a large amount of short liquidations tends to trigger an upward trend in the market, and investors often anticipate increased volatility.

As trade activity increases, it contributes to broader market instability since prices are generally climbing in line with the electoral process. This could lead to an anticipated adjustment or downturn in the market.

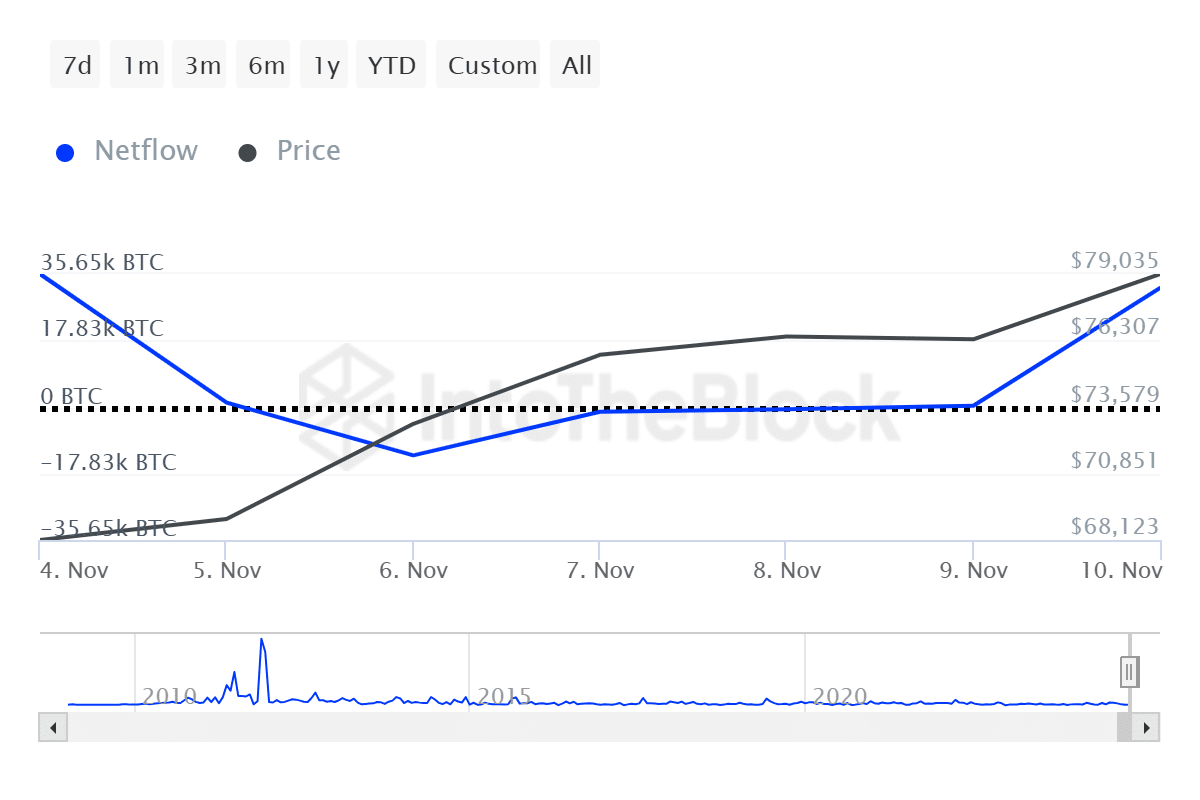

Based on information from IntoTheBlock, approximately 32,000 Bitcoin were acquired by large holders (referred to as “whales”) on November 10th. As the graph indicates, the activity of these large holders has been aligning with the price trend of Bitcoin since November 6, which coincides with the U.S. election day.

The sudden surge in Bitcoin’s whale accumulation also suggests FOMO among market participants.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Seven Deadly Sins Idle tier list and a reroll guide

- Hero Tale best builds – One for melee, one for ranged characters

2024-11-11 09:30