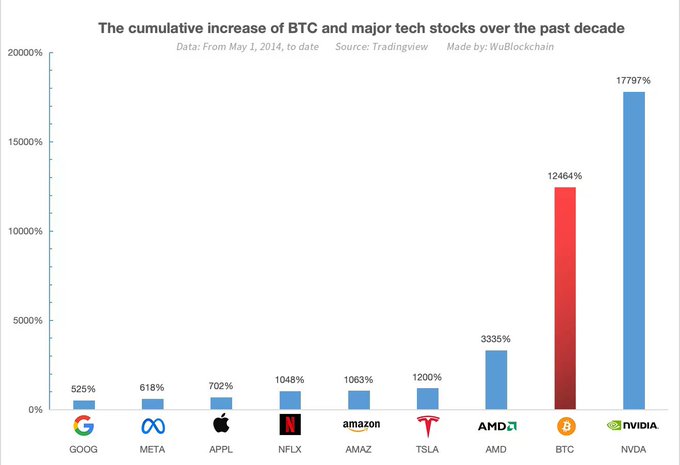

As an experienced financial analyst, I have closely observed the market trends and growth patterns of various investments over the last decade. Among them, Bitcoin’s extraordinary performance has caught my attention. In just ten years, this decentralized digital currency outperformed tech giants like Amazon, Google, and Netflix, displaying a remarkable 12,464% growth.

Over the past decade, Bitcoin, the leading cryptocurrency, has outperformed tech behemoths like Amazon, Google, and Netflix in terms of growth. According to WuBlockchain’s data, Bitcoin has achieved an impressive 12,464% increase in value.

The price of each token is currently at $61,766, representing a 17% decrease from its highest point. Nvidia’s stock has experienced an impressive surge of 17,797%, surpassing Bitcoin’s growth. Among other notable tech investments, AMD, Tesla, and Amazon have also shown significant gains.

As a researcher studying the cryptocurrency market, I’ve observed that the latest Bitcoin halving has brought about a reduction in block reward for miners. This strategic move is designed to preserve scarcity in the Bitcoin supply. Although short-term price fluctuations are expected, experts predict long-term beneficial consequences.

Moricz from DCL.Link expressed worries about Bitcoin’s mining centralization and highlighted the unavoidable increase in Bitcoin’s price. He proposed that a market adjustment would occur first, followed by continued price rises as a result of Bitcoin’s finite availability.

“I believe that after a minor correction with some volatility, the market will regain its strength for the next bull run. The scarcity of Bitcoin is undeniable – there are only 21 million coins in existence.”

As a crypto investor, I’m excited about the increasing institutional interest in Bitcoin. The prospect of a Bitcoin ETF is just one example of this trend. This growing recognition of Bitcoin’s value reinforces my belief that it will continue to play an important role in the evolving financial landscape. Long-term, I see a positive outlook for Bitcoin as more institutions jump on board.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-05-04 08:20