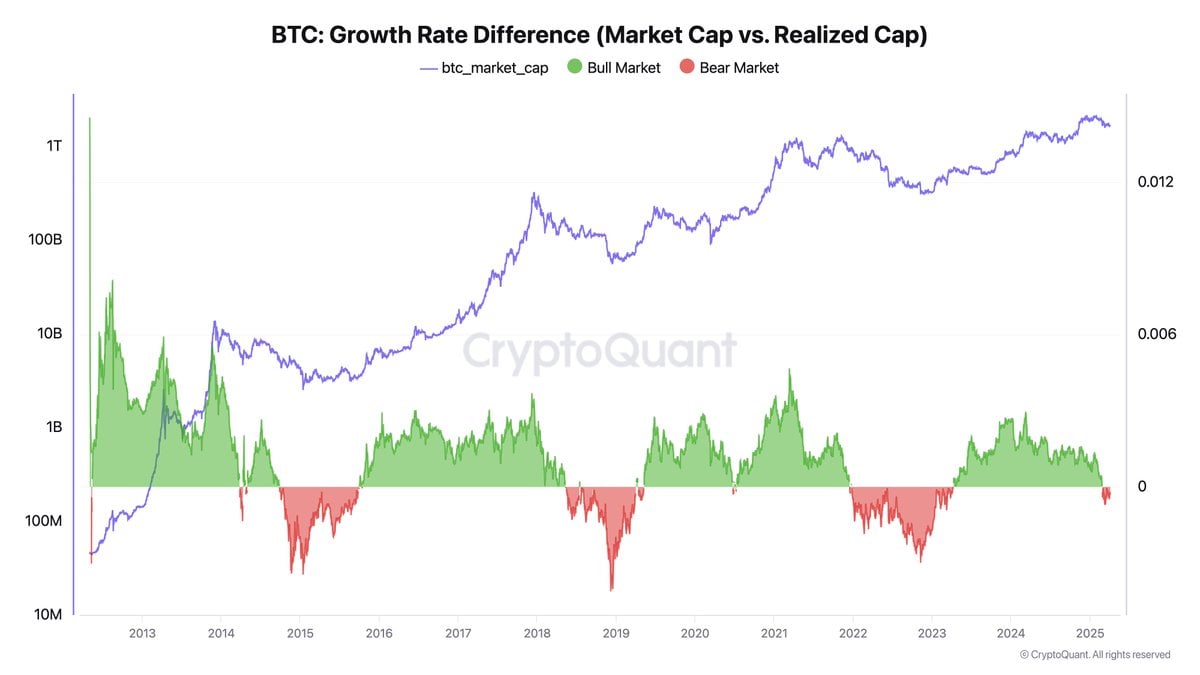

Ah, the ever-complex dance of digits and values in the vast ether of cryptocurrency! Ki Young Ju, the sage of Cryptoquant, has proclaimed this weekend that the jubilant bull cycle of bitcoin has met its untimely demise. Forsooth, he points to a growing chasm between the realized cap and the market cap—an omen of a bear market lurking in the shadows! 🐻⚰️

The Paradox of Caps: A Delicate Juggling Act

Realized cap, that elusive on-chain metric meticulously chronicling the average cost basis of BTC holdings, endeavours to reflect the actual inflow of capital. Meanwhile, the market cap, a fickle creature based on the last traded price of BTC, seeks to measure the perceived value of our digital savior. Ju, in his infinite wisdom, elucidates that when the realized cap waltzes upwards whilst the market cap remains as stagnant as a murky pond, we witness the macabre emergence of bearish tendencies. What audacity! 🥴💸

On the contrary, should the market cap surge while the realized cap remains as flat as a pancake, it hints at a fervent bullish spirit fueled by sheer speculation. Amidst this theatrical panorama, Ju observes current data portraying realized cap rising as investors fervently scoop up BTC, yet prices remain anchored by the weight of overwhelming selling pressure. He casts our thoughts towards Strategy’s (MSTR) ploys—those convertible bonds that add a layer of artificial buoyancy to the financial waters. 🎭💔

“Yet, in the face of relentless sell pressure, even exuberant purchasing fails to elevate the price,” muttered the Cryptoquant oracle. “When bitcoin frolicked near the $100K realm, volumes were grandiose, yet the price barely stirred. Isn’t that a hilariously tragic comedy?” 😂

Ju acknowledges that skeptics may scoff, arguing on-chain data is but a mere shadow of off-exchange reality, yet he rebuffs such notions, asserting that the grand currents of capital—exchanges, custodial movements, and ETF machinations—are faithfully captured within the on-chain realm. History, oh sweet history, suggests that bear market reversals take no less than six moons to unfurl, leaving short-term jubilations as mere fancies of a restless mind. 🌒⏳

Though the prevailing metrics signal a cautionary tale, bitcoin has always danced to the rhythm of defiance against predictable outcomes. If institutional zeal, regulatory edicts from Trump’s enigmatic reign, or fortuitous shifts in the economy were to converge, we may once again court the sweet embrace of bullish momentum. A fortuitous twist of fate could summon fresh capital to revive the harmony between the Realized and Market Caps, as if to mock all expectations! 🍀📈

Read More

- DEEP PREDICTION. DEEP cryptocurrency

- CRK Boss Rush guide – Best cookies for each stage of the event

- Ludus promo codes (April 2025)

- Summoners Kingdom: Goddess tier list and a reroll guide

- Mini Heroes Magic Throne tier list

- Maiden Academy tier list

- CXT PREDICTION. CXT cryptocurrency

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

2025-04-07 03:57