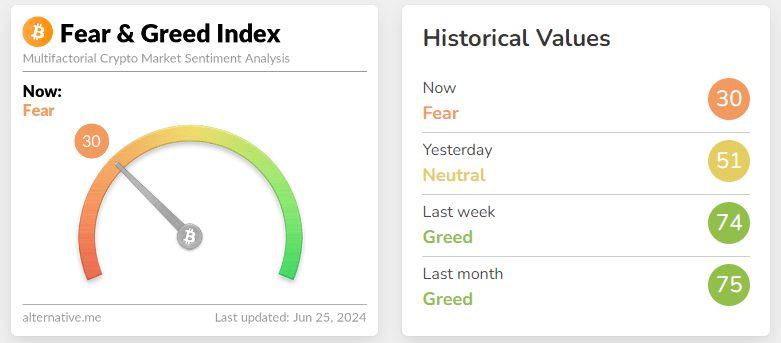

As a seasoned crypto investor with over five years of experience in this volatile market, I’ve seen my fair share of extreme fear and greed cycles. The current state of the Crypto Fear and Greed Index, which has dropped below 30 for the first time since early 2023, fills me with a sense of unease.

The Crypto Fear and Greed Index, which reflects the current mood in the Bitcoin and broader cryptocurrency market, has reached its lowest point in the past 18 months.

On June 25th, the index experienced a decline of 21 points, dropping below the 30-mark for the first time since January 11, 2023. This significant dip brought Bitcoin prices down to around $17,200 following the collapse of FTX crypto exchange.

Over the recent past, this event represents one of the most substantial one-day decreases. A week prior, its value was at 74, a level often referred to as “Greed” territory. Bitcoin experienced its lowest point in seven weeks on June 24, reaching $59,471.

As a researcher studying the cryptocurrency market, I’ve observed a significant shift in investor sentiment over the past 10 trading sessions. To the tune of over $1 billion, investors have pulled their funds from spot Bitcoin Exchange-Traded Funds (ETFs). This withdrawal comes amidst several concerns that have arisen in the market.

As an analyst, I’ve come across the perspective of a Galaxy Digital executive who thinks the market might be exaggerating its response to the Mt. Gox incident. Simultaneously, due to a declining network hashrate, Bitcoin miners have been compelled to sell more Bitcoins than typical, thereby intensifying the negative sentiment in the market.

As a researcher studying the Crypto Fear and Greed Index, I can explain that this particular metric takes into account several factors to determine the current sentiment in the crypto market. Specifically, it considers market volatility (accounting for 25% of the index), trading volume (also 25%), Bitcoin’s dominance within the crypto market (10%), and trends (another 10%). However, it is important to note that surveys, which previously accounted for 15% of the index, are currently not being measured.

The current Crypto Fear and Greed Index, showing a subdued level, reflects the heightened sense of caution pervading the cryptocurrency market due to numerous unfavorable events and reactions.

Read More

- Ludus promo codes (April 2025)

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Cookie Run: Kingdom Topping Tart guide – delicious details

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Grand Outlaws brings chaos, crime, and car chases as it soft launches on Android

- Seven Deadly Sins Idle tier list and a reroll guide

- Val Kilmer Almost Passed on Iconic Role in Top Gun

- Grimguard Tactics tier list – Ranking the main classes

- Maiden Academy tier list

- Tap Force tier list of all characters that you can pick

2024-06-25 08:04