On this fine day, May 29, 2025, Bitcoin finds itself in a rather peculiar position, trading at a staggering $108,776. With a market capitalization that could make a small country envious—$2.16 trillion—and a trading volume that would make even the most seasoned traders raise an eyebrow at $32.47 billion, the price dances between $107,107 and $109,057, reflecting a delightful chaos that we have come to expect from our dear Bitcoin.

Bitcoin

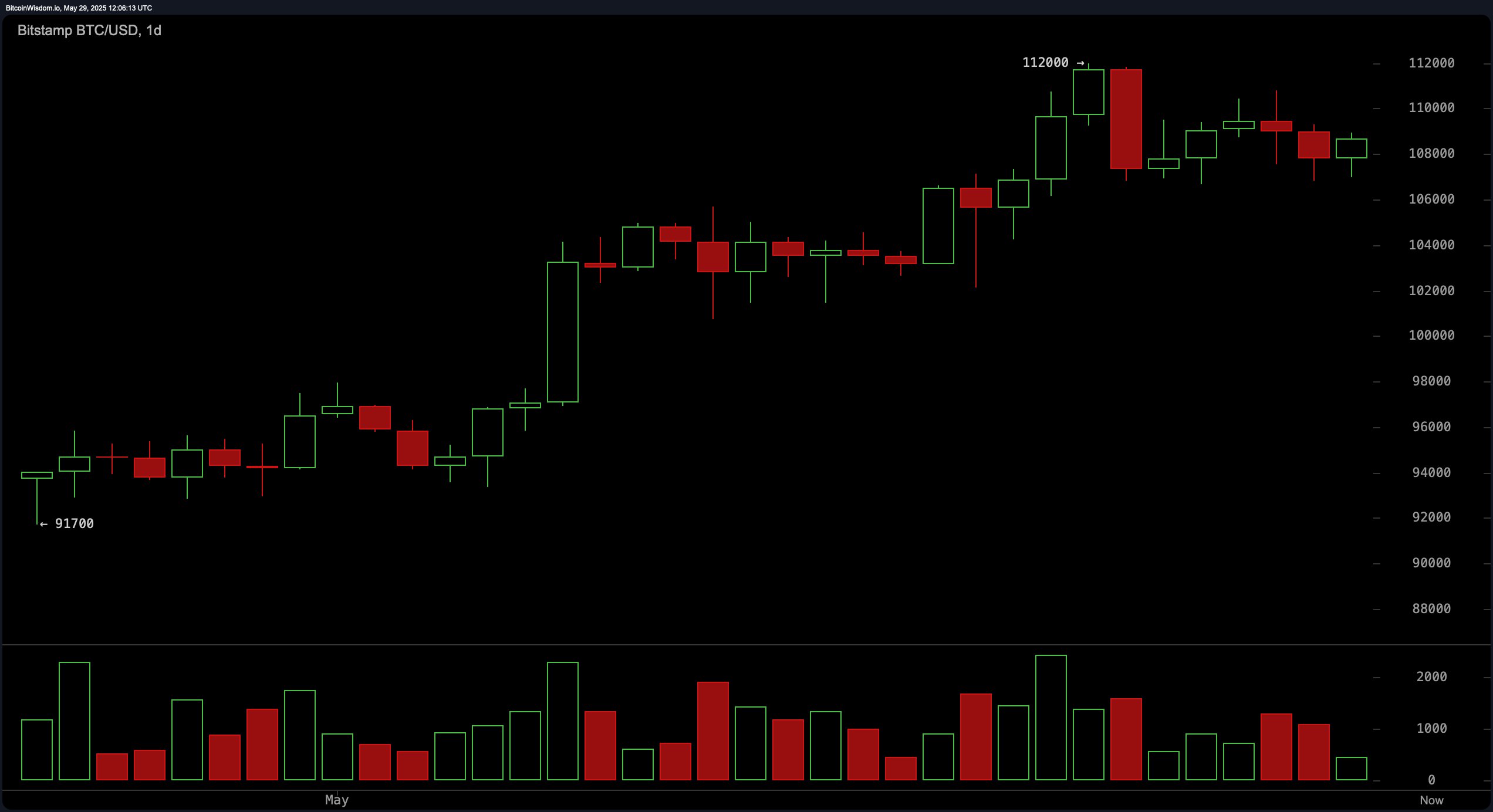

Ah, the daily chart! It reveals that our beloved Bitcoin is clinging to an uptrend that began near the humble $91,700. Yet, as the candles flicker like the last embers of a dying fire, we see signs of a waning bullish momentum after a peak that flirted with $112,000. The price action around $108,000 to $109,000 is like a shy child at a party—hesitant and lacking the enthusiasm to join the fun. A dominant red candle, followed by smaller, indecisive candles, paints a picture of uncertainty. For those brave swing traders, the $105,000–$106,000 zone is a historical treasure trove, while resistance lurks ominously near $111,000–$112,000. A break above or a rejection at these levels could very well dictate our near-term fate.

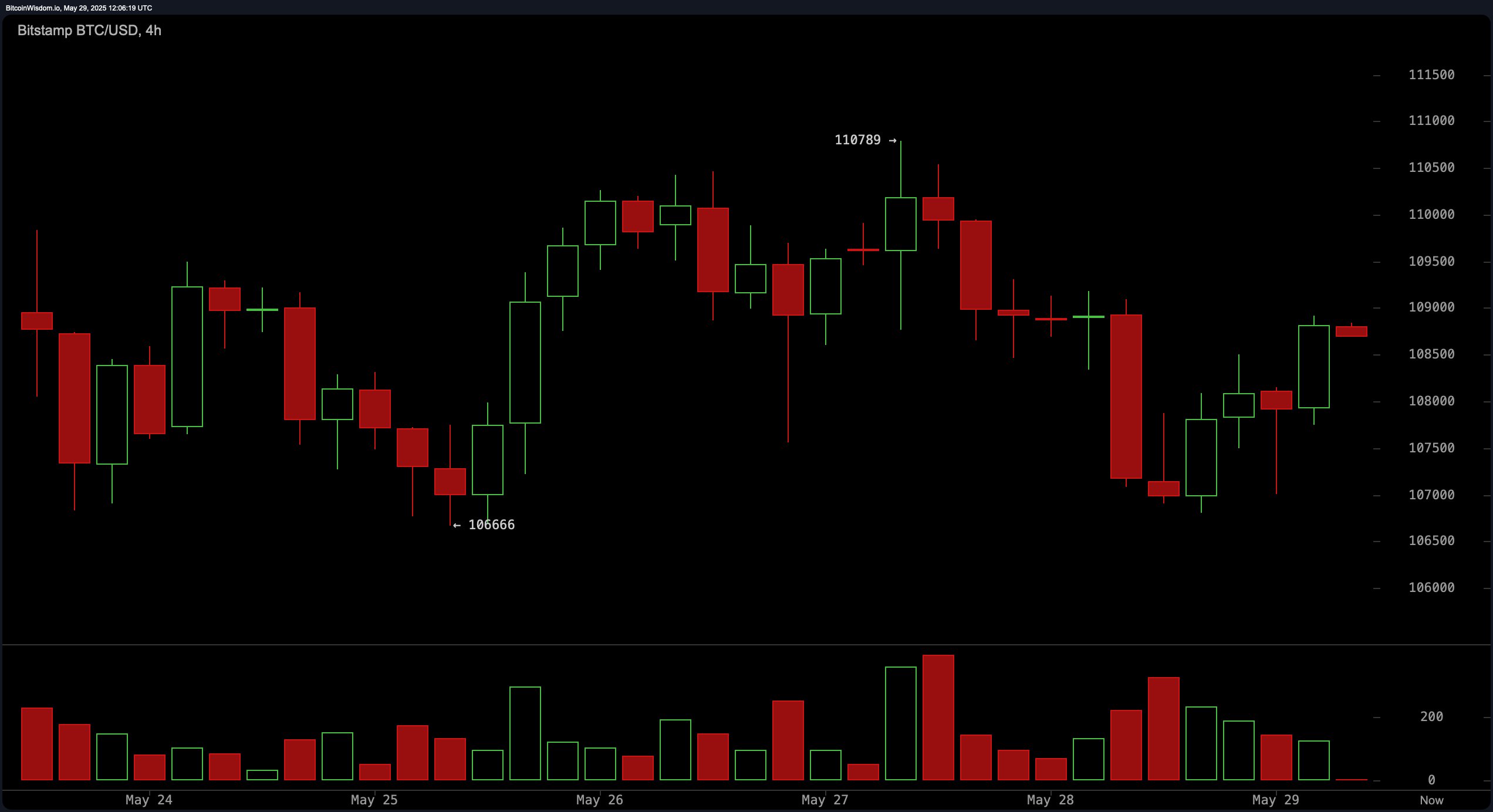

Now, let us turn our gaze to the 4-hour chart, where Bitcoin’s price behavior resembles a cat on a hot tin roof. After reaching a dizzying height of $110,789 and then plummeting to a rather ominous $106,666, Bitcoin has formed a bullish engulfing pattern—oh, the irony! This indicates a short-term relief rally, yet the pattern of lower highs remains stubbornly intact, leaving us in a state of delightful confusion. Entry opportunities may arise between $107,000 and $107,500, targeting exits near $110,000, where selling pressure has previously made its presence known. A recent sharp sell-off, marked by a red candle, suggests potential capitulation—traders, keep your eyes peeled!

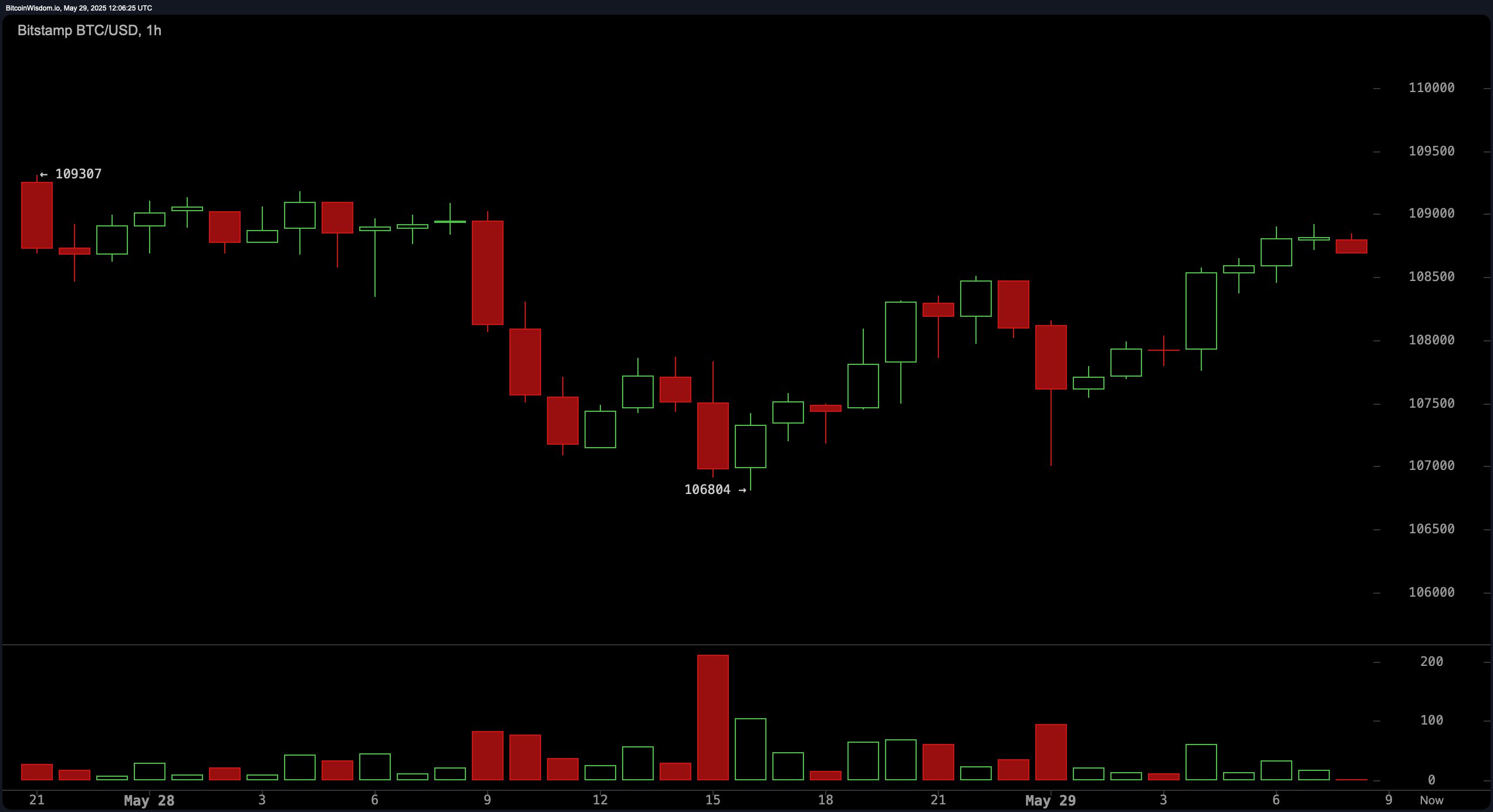

On the 1-hour BTC/USD chart, we witness a V-shaped recovery from $106,804 to around $109,000, a testament to strong intraday buying. However, the price increase on diminishing volume suggests a possible stall—like a car running out of gas just before the finish line. The near-term structure hints that micro pullbacks to the $107,500 level could be the golden ticket for entry, provided we see bullish confirmation signals, perhaps a hammer candlestick? Resistance remains steadfast near $109,300, the previous intraday high. The current trend favors short-term buyers, but alas, further gains require the support of volume, which seems to be playing hard to get.

As we delve into the oscillator readings for today, we find ourselves in a state of neutrality. The relative strength index (RSI) sits at a comfortable 63, Stochastic at 66, commodity channel index (CCI) at 56, and average directional index (ADX) at 29—all suggesting a delightful equilibrium without any extreme momentum in either direction. The Awesome oscillator at 6,524 reflects this neutrality, while momentum indicates a positive signal at 3,130. However, the moving average convergence divergence (MACD) level suggests a bearish signal at 3,261, revealing a divergence that calls for caution—like a cat eyeing a cucumber.

Let us not forget the Fibonacci retracement levels drawn from February’s swing low at $91,700 to the high at $112,000, which identify key support areas. The 23.6 percent retracement level at approximately $106,210 marks current support, while deeper levels at 38.2 percent ($103,460), 50.0 percent ($101,850), and 61.8 percent ($100,240) offer additional cushions for our weary bulls. A break below $106,000 could trigger further retracement toward the 38.2 percent level or even lower. For our bullish friends, maintaining above the 23.6 percent retracement is critical to keep the upward pressure alive.

Bitcoin’s moving averages (MAs) as of today present a unified bullish bias. All short- and long-term averages are positioned below the current price, suggesting support across timeframes. The exponential moving averages (EMAs) and simple moving averages (SMAs) for the 10, 20, and 30 periods indicate bullish signals, with the EMA (10) at $108,017 and the SMA (10) at $108,749. Similarly, longer-term EMAs and SMAs—such as EMA (100) at $95,521 and SMA (200) at $94,601—underline the strength of the trend. As long as the price remains above these averages, the structural integrity of the uptrend is maintained, much like a well-constructed dacha.

Bull Verdict:

Bitcoin’s price action remains supported by a consistent series of higher lows on larger timeframes, combined with broad buy signals across all key moving averages. The maintenance above the 23.6 percent Fibonacci retracement and resilience at intraday support zones indicate that bulls still have control, particularly if the price stays above $107,500. A breakout above $109,300 could reignite momentum toward $112,000 and beyond, like a firework on New Year’s Eve!

Bear Verdict:

Despite the prevailing uptrend, signs of exhaustion are becoming evident. Bearish divergences such as weakening volume during rallies, a sell signal from the moving average convergence divergence (MACD), and a stalling RSI raise caution. If Bitcoin breaks below $106,000 with conviction, it may trigger a deeper retracement toward $103,000 or even $101,000, eroding recent gains and shifting momentum in favor of sellers—like a thief in the night.

Final Verdict:

Bitcoin stands at a technical crossroads, balancing between bullish continuation and corrective pullback. As long as key support levels hold and moving averages remain aligned, the trend favors further upside—but caution is warranted amid weakening momentum indicators. Traders should remain agile, with stop-losses in place and eyes on the $106,000 threshold as the short-term inflection point, much like a cat watching a mouse.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Cookie Run Kingdom Town Square Vault password

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-05-29 15:58