Welcome to the US Morning Briefing—where the crypto world spins faster than a drunk ballerina on a merry-go-round. 🎠

Grab your coffee, because today’s FOMC meeting is about to drop like a poorly timed meme. Will Bitcoin soar? Will it crash? Or will it just sit there, mocking us all? Meanwhile, global trade tensions are hotter than a jalapeño in a sauna, and recession fears are climbing faster than a squirrel on Red Bull. 🐿️

FOMC, Trade Tensions, and Bitcoin: The Circus Continues 🎪

With global markets on edge, traders are watching the FOMC minutes like hawks—or, more accurately, like pigeons eyeing a breadcrumb. Will there be emergency rate cuts? Will trade negotiations save the day? Or will it all go up in smoke like a bad ICO? 🌬️

Meanwhile, the Russia-Ukraine war has taken a bizarre turn with reports of captured Chinese POWs. Because, of course, why not add more chaos to the mix? 🎭

Amid this madness, Bitcoin is testing critical support levels, and analysts are parsing technical signals like they’re reading tea leaves. Spoiler: no one really knows what’s going to happen. 🍵

“Risky assets are trying to mount a short covering rebound,” says BRN Analyst Darren Chu, who clearly has a knack for stating the obvious. “Anticipation is growing for an emergency Fed rate cut, but let’s be real—this is the Fed we’re talking about. They’ll probably just print more money and call it a day.” 💸

“Meanwhile, the Russia-Ukraine conflict is further complicated by the revelation that Chinese POWs have been captured. Because, you know, what’s a global crisis without a little extra drama?” 🎬

On Bitcoin’s price action, Chu had this gem:

“BTCUSD is now nearing the 61.8% Fib retrace of last August to February’s Bull Market extension. Or, in layman’s terms, it’s about to take a nosedive. But hey, at least it’ll look pretty on the chart!” 📉

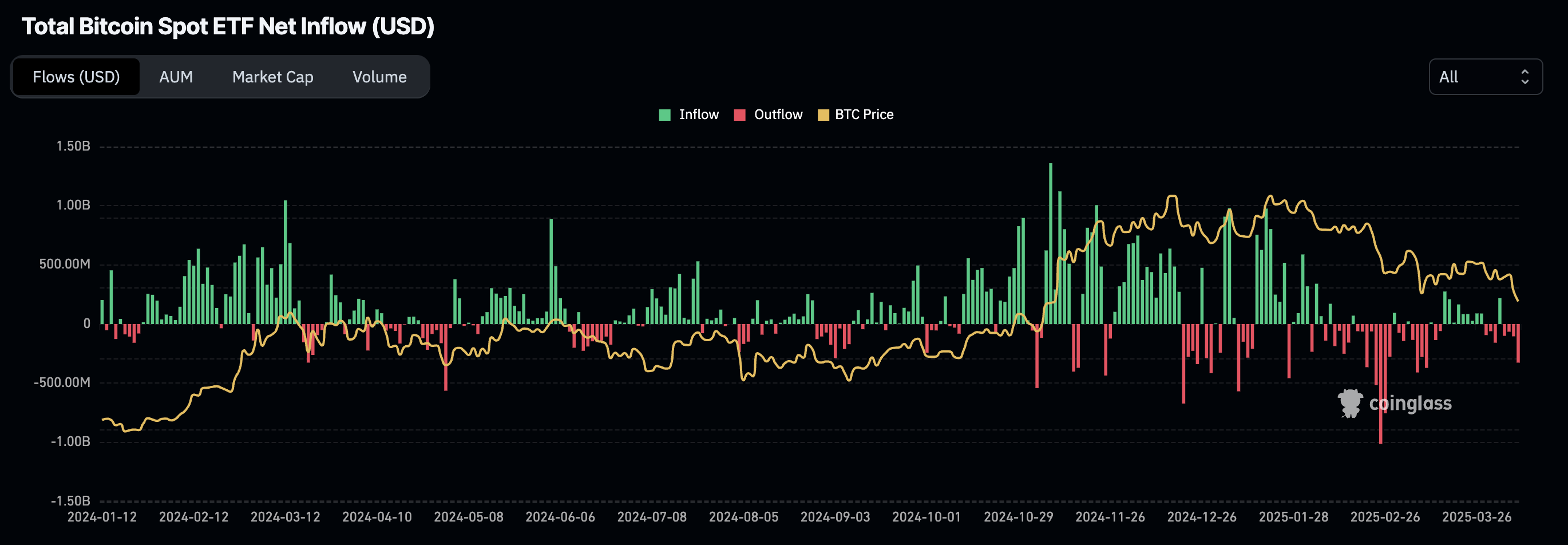

Crypto Chart of the Day 📊

Bitcoin Spot ETFs had the biggest daily outflows ($326 million) since March 11. Because nothing says “confidence” like a mass exodus. 🏃♂️

Byte-Sized Alpha 🧠

– Goldman Sachs now sees a 45% chance of a US recession in 2025 but is doubling down on Bitcoin. Because when the world burns, why not throw some digital gold on the fire? 🔥

– Analyst Ben Sigman says rising trade war tensions could fuel Bitcoin’s growth. Or, you know, it could just make everything worse. Who knows? 🤷♂️

– Crypto whales are splitting—some dumping assets amid panic, others quietly buying in anticipation of a rebound. Because when in doubt, follow the money. 🐋

– Analysts warn the Fed may be quietly injecting liquidity. Because nothing says “transparency” like stealth QE. 🕵️♂️

– Bitcoin ETFs faced $326 million in outflows—the largest since March. Because institutional investors love a good panic sell. 🏦

– Trump’s new tariffs threaten US Bitcoin mining dominance. Because why not make everything more expensive? 🇺🇸

– The US DOJ will no longer pursue crypto exchanges and wallets for user actions. Because who needs oversight when you’ve got chaos? 🎲

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Cookie Run Kingdom Town Square Vault password

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2025-04-09 17:22