Tron’s Having a Panic Attack 🚨

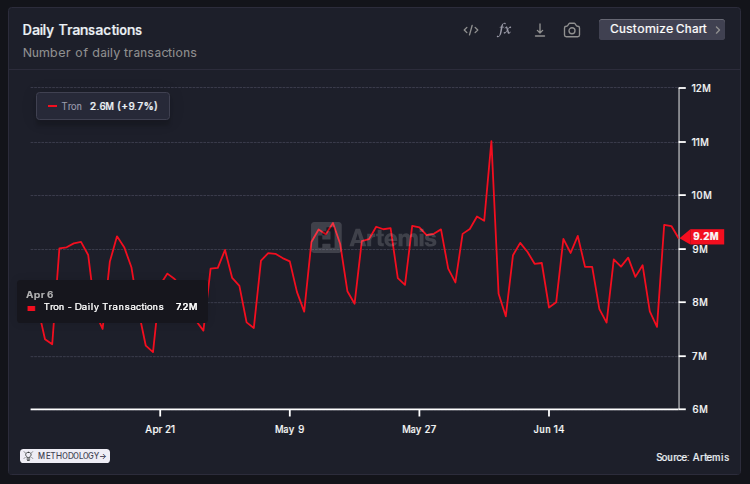

According to Artemis, daily transaction counts shot up to over 9 million, which is like, a lot. And active addresses? Forget about it. They’re at 2.7 million, which is the highest level since June 6. But here’s the thing: most of this traffic is just people moving their stablecoins around, not actually investing in Tron.