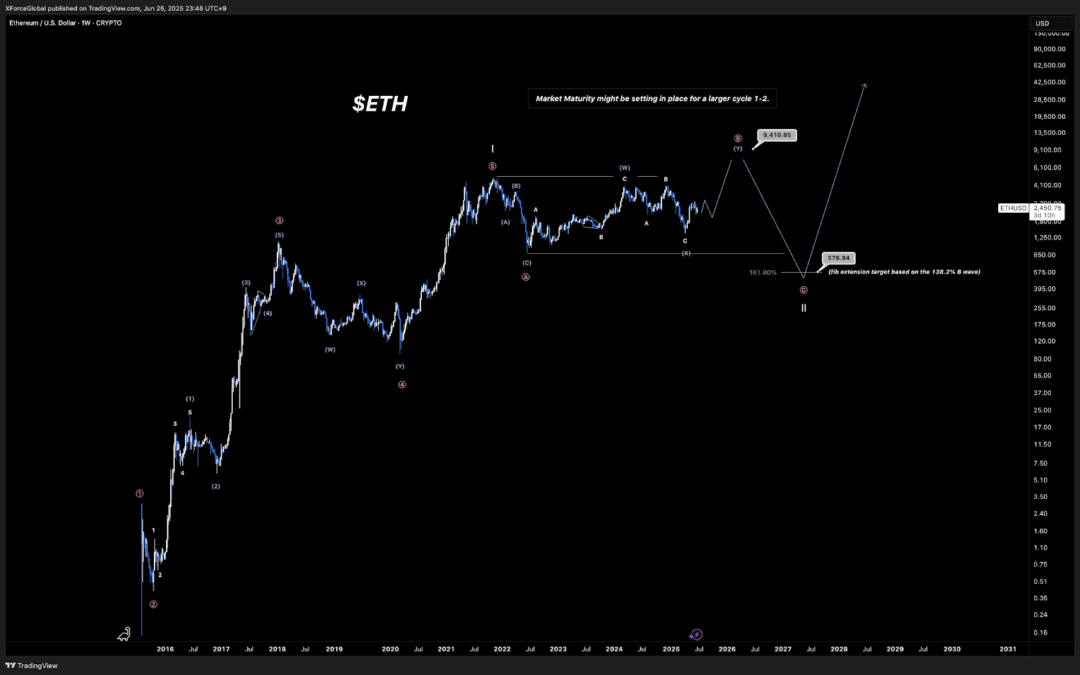

Ethereum Price Shocker: Will ETH Hold On or Take a Tumble? 🤔

But what ho! Ethereum (ETH) must have missed the memo, or perhaps it simply fancied a spot more drama today, as it’s dipped a modest 1.14% over the last 24 hours. Well done, ETH, for keeping everyone on their toes 👟.