Bitcoin’s Boring Phase: Why It’s Not the Wild West Anymore 🥱

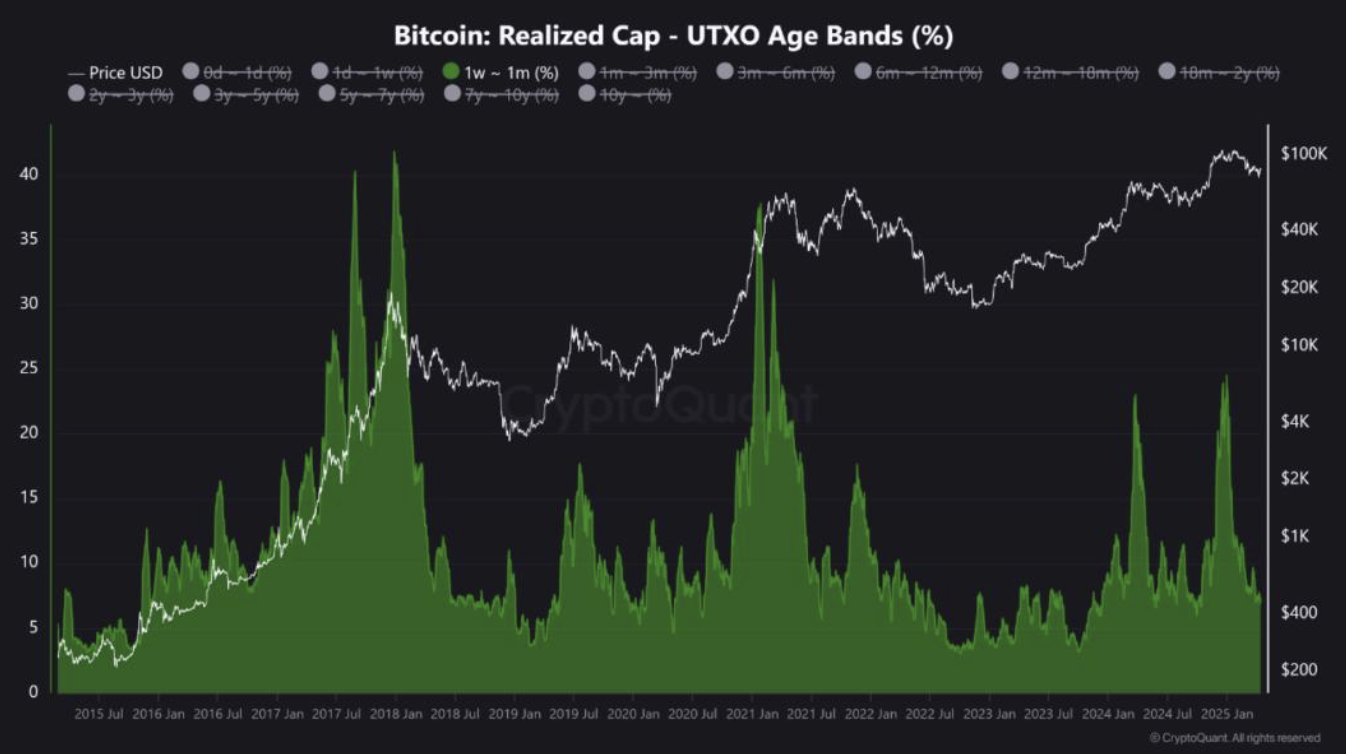

Dan, with the gravitas of a man who’s seen too many charts, points out the glaring absence of speculative capital and short-term participants. Gone are the days when retail investors would throw their life savings into Bitcoin like it was a carnival game. “In past cycles,” Dan mused, “the market would heat up faster than a microwave burrito. But now? It’s more like a slow-cooked stew.” He attributes this to macro tightening and the institutionalization of the crypto market — because nothing kills a party like a suit with a spreadsheet.