As a seasoned crypto investor with battle-tested nerves, I can’t help but feel a sense of deja vu looking at Coinbase’s current predicament. The last time we saw such a prolonged losing streak was when Lehman Brothers decided to take an unexpected nap, and we all know how that ended… or rather, began.

For eight consecutive days, Coinbase’s shares experienced a downturn, marking the longest such period since July, coinciding with the ongoing decline of cryptocurrencies.

Coinbase is facing major headwinds

In recent months, both decentralized and traditional cryptocurrency trading platforms (exchanges) have faced increased stress due to a decline in crypto transaction volumes.

As a crypto investor, I’ve been keeping an eye on the trading volumes across Decentralized Exchanges (DEXs) and Centralized Exchanges (CEXs). According to DeFi Llama, the volume traded on DEXs hit a high of $260 billion in March, only to dip down to $175 billion by August. On the other hand, the trading volume on CEX platforms was recorded at $1.2 trillion in August, a significant decrease from the $2.48 trillion seen in March.

The value of this particular volume has decreased significantly because Bitcoin (BTC), along with other alternative cryptocurrencies, have shown poor performance recently. Bitcoin, currently in a bear market, has plummeted more than 23% from its peak this year. Likewise, Ethereum (ETH) has dipped by approximately 41% since reaching its highest point this year, and Solana (SOL) has experienced a drop of over 36%.

Generally speaking, the trading activity (volume) on crypto exchanges tends to mirror price fluctuations. For instance, Coinbase’s total trading volume during Q1 reached over $300 billion due to the rise in cryptocurrency values. However, as prices declined, the volume dropped to $226 billion in Q2.

The drop in Coinbase’s stock price has happened at the same time as a slowdown in the performance of Ethereum and Bitcoin Exchange-Traded Funds (ETFs). According to SoSoValue, Bitcoin ETFs have seen a decrease in assets for the past seven days straight. Similarly, Ethereum ETFs have lost assets in five out of the last seven weeks. Since Coinbase is the preferred custodian for most funds, the flow of assets into and out of these ETFs plays a crucial role in its performance.

Simultaneously, Base – our layer-2 network – has also experienced asset losses within the last week. With over $1.4 billion in assets, it ranks as the sixth largest chain in the sector. The trading volume of coins on its DEX platforms decreased by 10% to reach approximately $3.06 billion, accumulating a total of more than $93 billion.

Coinbase stock has formed risky patterns

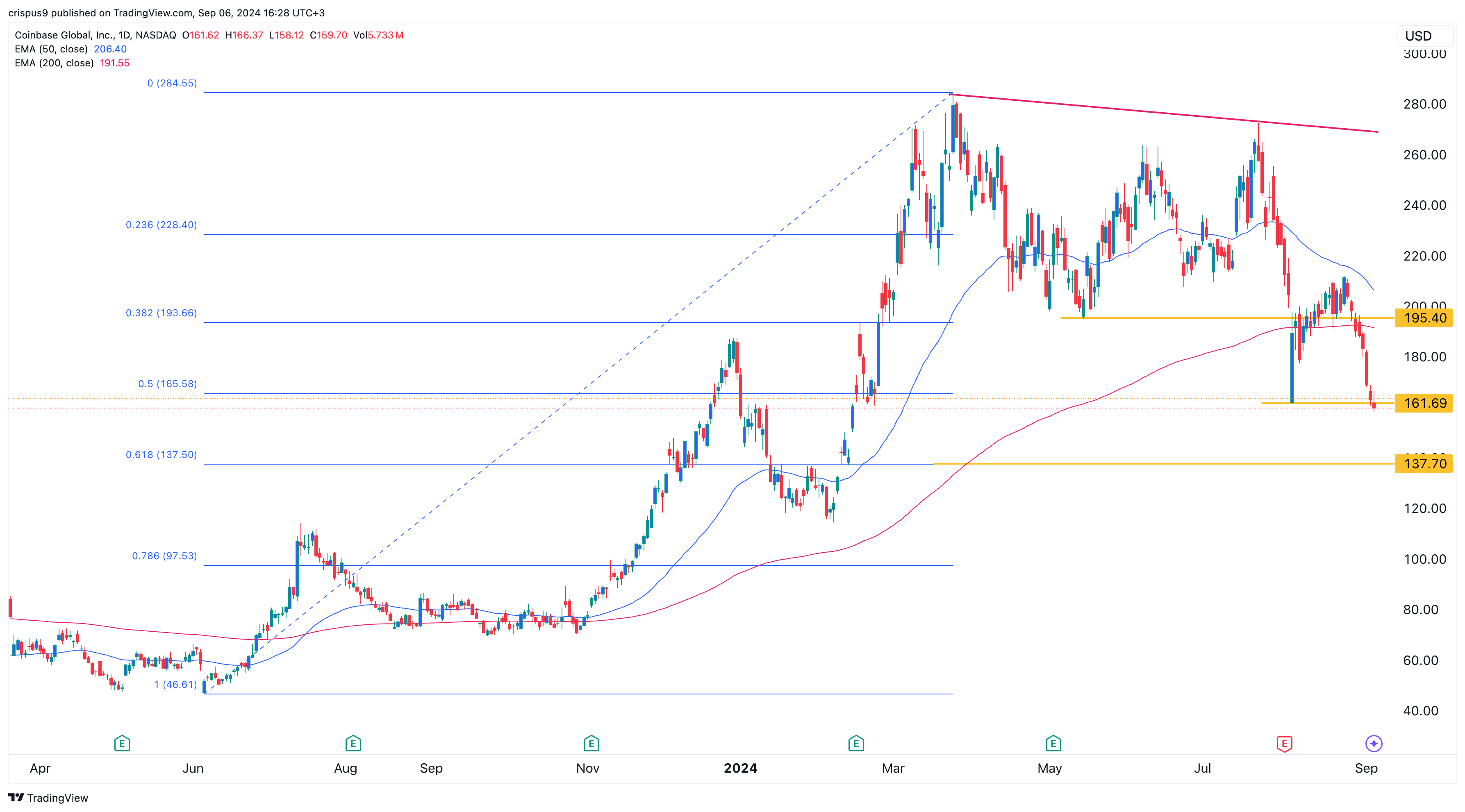

In simpler terms, the graph of Coinbase’s stock shows several signs that could lead to a further price decrease. One such sign is a sloping double-top formation, where the $195.40 level, hit on May 14, acts as a potential resistance point. The stock fell below this level last week, which might indicate a bearish trend continuation.

The share price has dropped beneath both the 50% Fibonacci retracement line and the 200-day Exponential Moving Average. More significantly, it dipped below a key support point at $162, which marks its lowest point in August. This dip disrupted a potential double-bottom pattern that was emerging.

Consequently, the most likely direction for the trend is moving lower, and a key level to keep an eye on is around $137.70, which represents the 61.8% Fibonacci retracement level and is approximately 15% below the Sept. 6 level.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- 9 Most Underrated Jeff Goldblum Movies

- Castle Duels tier list – Best Legendary and Epic cards

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Can the Switch 2 Use a Switch 1 Charger?

2024-09-06 17:06