As a researcher with a background in blockchain technology and cryptocurrency, I am closely following the developments in the industry, particularly the role of key players like A16z Crypto in shaping regulatory policies. The recent announcement of A16z Crypto’s increased donation to Fairshake, a pro-crypto super PAC, is an important sign of industry commitment to advocating for favorable regulations on Capitol Hill.

A16z Crypto, a venture firm specializing in Web3 projects, significantly increased its contribution to the influential blockchain political action committee, Fairshake.

Chris D Harrison, founding partner at Andreesen Horowitz’s crypto wing A16z, announced a $25 million contribution to Fairshake, a politically influential committee, dedicated to advocating for favorable cryptocurrency regulations in Washington D.C.

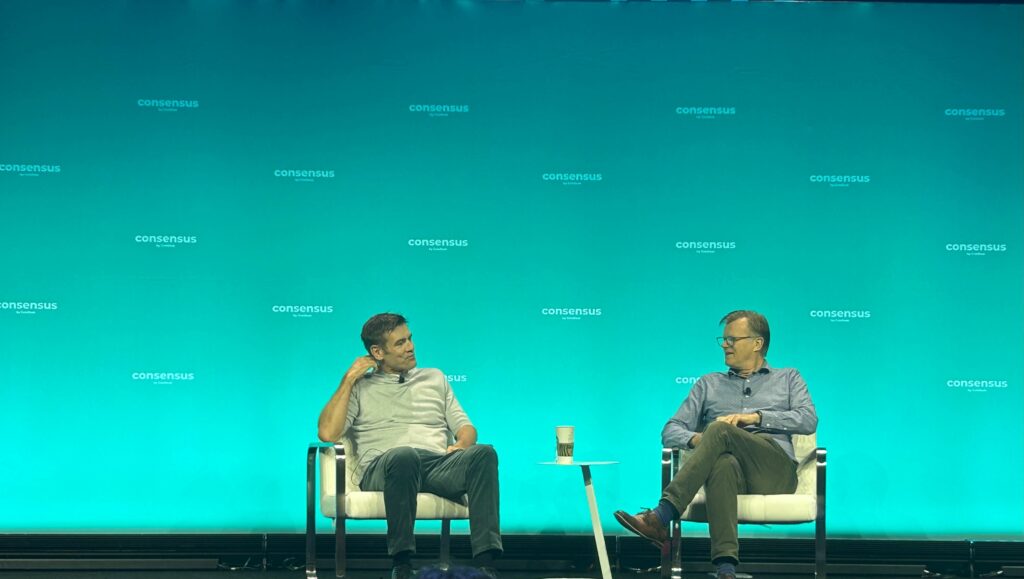

As a crypto investor, I’m thrilled to share that my financial contributions will bolster the campaigns of politically committed candidates in the US. These leaders are dedicated to safeguarding internet freedom, fostering open-source blockchain advancement, and championing the cause of cryptography. I made this announcement at Consensus 2024.

As a crypto investor, I’m thrilled to be part of the growing community that’s making a difference in shaping the future of digital assets. Recently, I’ve been proud to contribute significantly to Fairshake and its affiliated Political Action Committees (PACs) through a16z Crypto. My latest donation has brought our total contribution to an impressive $47 million. I join other industry leaders like Coinbase and Ripple in this important endeavor, as we pool our resources together to counteract anti-crypto sentiments in Washington. Together, we’re making a strong statement that the crypto industry is here to stay and will continue to innovate and grow.

As a researcher in the industry, I believe it’s crucial for us to maintain our progress and demonstrate that the United States is at the forefront of developing the next generation of blockchain technology.

After a successful week in Washington D.C. and a string of pro-crypto election victories, we’re thrilled to reveal an extra $25 million in fresh donations for Fairshake and associated organizations. This new funding raises our overall amount to $47 million. 🇺🇸

This recent contribution, along with other investments from the following:

— cdixon.eth (@cdixon) May 30, 2024

At the recent blockchain conference, Marvin Ammiri, Chief Legal Officer of Uniswap Labs, advocated for Fairshake’s support of bipartisan candidates and legislators. Ammori recommended that the crypto industry adopt this approach, as he believes maintaining a nonpartisan stance could be most beneficial for the sector during his discussion with Messari CEO Ryan Selkis. Crypto should avoid aligning itself with any political party to ensure industry growth and success.

A16z Crypto and industry stakeholders join hands

In the wake of unprecedented crypto lobbying in the previous year, Fairshake has amassed substantial contributions amounting to tens of millions from prominent figures in the blockchain sector and digital currency suppliers during the year 2024.

Ripple, the company behind XRP, made a commitment of $25 million to the Super PAC on May 29th, repeating their previous year’s donation. In addition, the Winklevoss brothers, co-founders of Gemini exchange, contributed $4.9 million to Fairshake during April.

During an election year, crypto businesses are channeling substantial revenues into Super PACs and their affiliated groups, potentially influencing future U.S. regulations concerning digital assets. With nearly half of American voters either holding digital assets or viewing blockchain technology as a significant consideration when selecting candidates, the crypto voting bloc has gained prominence (as per a poll published by crypto.news in March).

As a crypto investor, I can tell you that we’re at a pivotal moment in the world of digital assets. Regulatory bodies like the U.S. Securities and Exchange Commission (SEC) and influential policymakers such as Senator Elizabeth Warren are scrutinizing service providers more closely than ever before. This increased attention could potentially bring about stricter regulations, which may impact our investments in various ways.

Read More

- BODEN PREDICTION. BODEN cryptocurrency

- GHST PREDICTION. GHST cryptocurrency

- BETA PREDICTION. BETA cryptocurrency

- STRD PREDICTION. STRD cryptocurrency

- Mango Markets Exploiter Found Guilty Of Fraud And Manipulation

- GBP EUR PREDICTION

- MATIC PREDICTION. MATIC cryptocurrency

- LOOKS PREDICTION. LOOKS cryptocurrency

- BRN/USD

- TNSR PREDICTION. TNSR cryptocurrency

2024-05-30 22:12