As a researcher with experience in the cryptocurrency market, I find the recent development surrounding Circuits of Value (COVAL) deeply concerning. The asset’s value has taken a significant hit after Coinbase, one of the leading crypto exchanges, decided to suspend trading for COVAL.

The value of Circuits of Value (COVAL) has taken a significant hit following Coinbase’s announcement to halt trading for this asset.

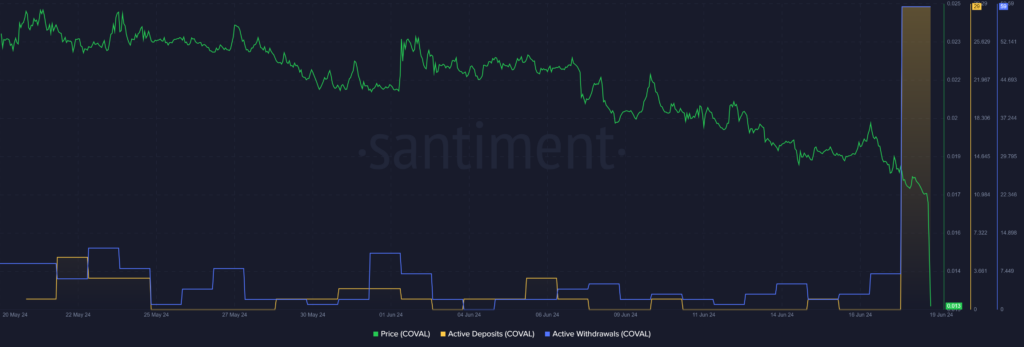

As a crypto investor, I’ve noticed a significant downturn in the value of COVAL today. The price has dropped by 41% within the last 24 hours and is currently at $0.01. This unfortunate event has resulted in a market capitalization of $18.4 million for COVAL, positioning it as the 892nd largest crypto asset. On the brighter side, there’s been an enormous surge in daily trading volume, which now stands at an impressive $6.75 million – a staggering increase of 2,760%.

After experiencing a significant price decrease, COVAL now stands at a value that’s only 0.01% of its peak price of $133.01, which it reached in January 2022.

The native digital currency, COVAL, is part of the Circuits of Value system, where it powers an asset management platform and a trading exchange. It made its debut on the Ethereum blockchain back in early 2015.

Today’s sudden drop in COVAL price has left some Coinbase users displeased, as they claim the exchange unexpectedly announced its decision to stop supporting the asset with a brief notice. This abrupt delisting has sparked criticism from the user community.

Coibase did not respond to crypto.news’ immediate request for comment on the matter.

As a researcher, I came across a claim from a single X user named Satoshi Kakaroto who alleges that the team responsible for COVAL has engaged in manipulation of the token’s price.

$coinbase decided to remove trading for $coval.

We pointed out manipulation several months ago.

— Satoshi kakaroto, PhD (@Nayomchski) June 18, 2024

Three Circuits of Value developers were accused of draining a large quantity of the token’s supply on March 3, labeling the project as a “Pump & Dump” scheme.

Based on Santiment’s data, there was a significant increase in COVAL active exchange deposits, rising from none to 29 within the last 24 hours.

Additionally, there was a significant rise in COVAL active exchange withdrawals, going from just seven to 59 within the last 24 hours. This trend suggests that investors have been actively attempting to transfer or cash out their COVAL assets following the Coinbase delisting announcement.

Read More

- Ludus promo codes (April 2025)

- Cookie Run: Kingdom Topping Tart guide – delicious details

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Grand Outlaws brings chaos, crime, and car chases as it soft launches on Android

- Grimguard Tactics tier list – Ranking the main classes

- Fortress Saga tier list – Ranking every hero

- Tap Force tier list of all characters that you can pick

- ZEREBRO/USD

- Val Kilmer Almost Passed on Iconic Role in Top Gun

2024-06-19 11:12