What to know:

- Seemingly against all odds, a staggering 57% of U.S. financial advisors are planning a mad dash to increase their crypto ETF investments this year, with a bold 1% daring to decrease their allocations.

- Crypto equity ETFs are the new darlings among advisors, allowing them to bask in the glow of publicly traded companies dabbling in the crypto world, such as Tesla – you know, the one with the flashy cars.

- Spot and multi-token ETFs are surging too, with 22% of advisors looking to dive into spot crypto ETFs and a cheeky 19% interested in those that joyfully hold multiple tokens.

Oh, Las Vegas—where the cards are high and the crypto dreams are higher! Financial advisors are throwing caution to the wind, ready to embrace their love for crypto ETFs this year.

During a riveting presentation at the Exchange conference, TMX VettaFi’s Todd Rosenbluth and one of the brightest minds, Cinthia Murphy, revealed survey results suggesting that crypto is now, shockingly, “part of everybody’s conversation today” — who knew?

The results unwrapped the delightful fact that 57% of advisors are gearing up to increase their allocations, while 42% maintain their current stance. A timid 1%, almost a ghost of a number, wish to shy away from crypto investing.

“Last year, advisors whispered of reputational risks. Today, presenting a decent crypto conversation is required at dinner parties,” quipped Murphy, while stealthily eyeing her audience for confirmation.

While the U.S. Securities and Exchange Commission approved those long-anticipated spot bitcoin ETFs in January 2024—because we all know they can never be too late—the tides shifted dramatically with the new administration’s eager embrace of the crypto culture. Shocking, isn’t it? Regulators seem to have turned from crypto-phobia to fearless blockchain buddies.

Advisors are particularly enamored with crypto equity ETFs. Yes, the funds that flirt with publicly traded companies like Strategy (a.k.a. MicroStrategy, of course!) and Tesla, the shimmering idol of all things electric.

“Can we even keep up with this whirlwind? Perhaps that’s why crypto equity is on the rise—it’s far more comprehensible than, say, calculating your WiFi data’s worth!” Murphy observed, a sly smile painting her face.

Ever since Trump assumed his gracious role in the Oval Office, Michael Saylor’s MSTR stocks have experienced a dizzying 100% rally, turning crypto-linked equities into the “it” investment—much to the delight of both retail and institutional investors, reminisce about those glory days, anyone?

Spot and multi-token ETFs

Not to be outdone, crypto equity-linked ETFs are merely the tip of the iceberg! Around 22% of survey respondents admitted they’re eyeing capital allocation to those thrilling spot crypto ETFs—BTC and ETH, oh my!

The third group—those peeking from behind the curtain—19% are captivated by crypto asset funds wielding a bunch of tokens. In the wild world of crypto, variety is the spice of life!

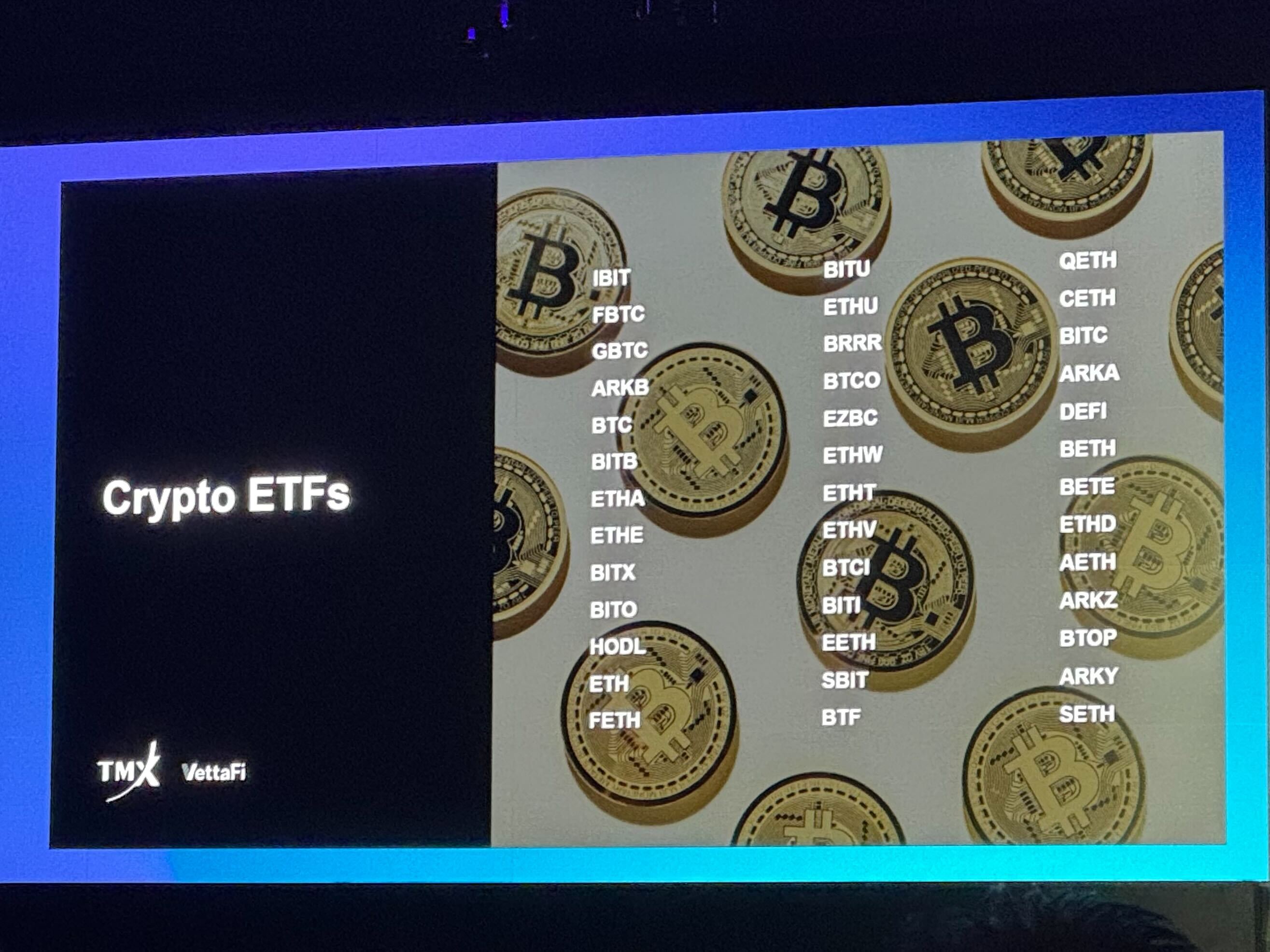

With a plethora of crypto ETFs already strutting their stuff on exchanges, more are surely waiting for their Hollywood moment of SEC approval. This might just become the latest blockbuster sensation.

In recent months, index-based ETFs have multiplied like rabbits, holding bundles of crypto assets while still giving Bitcoin and Ether a run for their money. Some audacious launches even promise downside protection, ensuring that the tumble from grace is not too grim.

As more daring issuers file to unleash spot crypto ETFs—including Solana (SOL), XRP, and Litecoin (LTC)—the SEC sits back with popcorn, yet to unveil its verdict.

“This is a wild and ever-evolving space, and I strongly recommend you become familiar with the experts involved because, trust me, this is moving faster than you can say ‘blockchain’,” Murphy advised, perhaps referring to crypto’s tale that even the best storytellers can barely keep up with.

Cheyenne Ligon contributed to the story.

To add, our dear Cheyenne Ligon has played a part in sprinkling a touch of insight on this tale.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- 9 Most Underrated Jeff Goldblum Movies

- Castle Duels tier list – Best Legendary and Epic cards

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Can the Switch 2 Use a Switch 1 Charger?

2025-03-24 22:20