As an analyst with over two decades of experience in the financial markets, I’ve witnessed numerous market cycles and trends. The recent surge in the cryptocurrency market, particularly Bitcoin, has been nothing short of spectacular. Hedge funds like Brevan Howard and Galaxy Digital have capitalized on this momentum brilliantly, delivering exceptional returns that outpace the broader hedge fund industry.

Remarkably high profits have been reaped by prominent hedge funds like Brevan Howard and Galaxy Digital, as a result of the significant increase in the cryptocurrency market.

The duo has risen as standout performers following Bitcoin’s rise to $108,000.

2024 data shows that cryptocurrency-centric hedge funds surged ahead with a massive 46% increase in November, bringing their year-to-date earnings up to an impressive 76%. This stellar performance significantly outstrips the broader hedge fund sector’s more conservative 10% gain over the first eleven months of 2024.

Hedge funds capitalize on market momentum

Under the leadership of CEO Aron Landy, Brevan Howard Asset Management currently oversees approximately $35 billion in assets. Remarkably, their primary cryptocurrency fund experienced a rise of 33% just in November last year. This significant increase led to a total gain of 51% for the first eleven months of the year 2024.

Under the guidance of billionaire Mike Novogratz, Galaxy Digital has achieved exceptional outcomes. The company’s hedge fund approach yielded a 43% return in November alone, and an impressive 90% growth throughout 2024.

The New York-based company has increased the amount it manages to a staggering $4.8 billion, in part by strategically purchasing assets from struggling cryptocurrency businesses.

Momentum for the current surge grew stronger after Donald Trump’s win in the U.S. presidency. Many investors see this as a possible trigger for more regulations favorable to cryptocurrencies.

The selection of venture capitalist David Sacks as the cryptocurrency advisor by Trump, along with the possible succession of SEC Chair Gary Gensler by Paul Atkins, a supporter of digital currencies, is bolstering market trust and optimism in the crypto sector.

It was during Gensler’s tenure that the crypto sector saw significant growth in January 2024, as the SEC gave the green light to 11 exchange-traded Bitcoin (BTC) funds. This decision expanded avenues for both institutional and individual investment. However, this week the market has seen a minor dip due to the Federal Reserve’s announcement of fewer rate cuts than anticipated for the upcoming year.

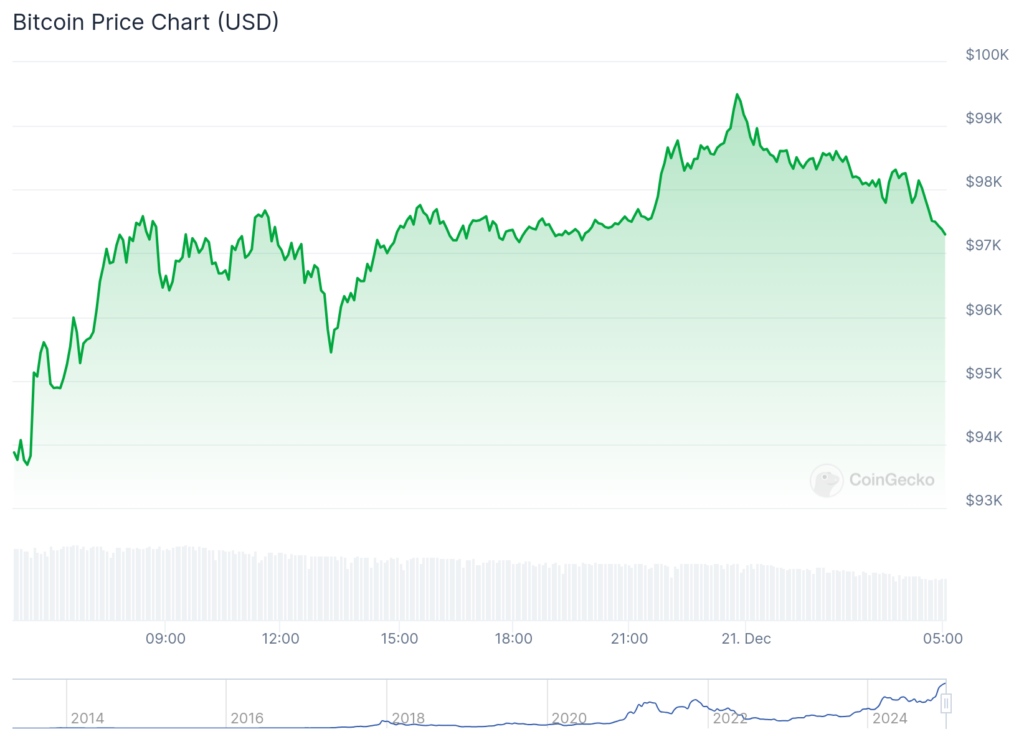

The value of Bitcoin has skyrocketed by about 130% this year and currently stands around $108,000, but it recently experienced a dip that took its price down to $92,175. By the latest check on Saturday, Bitcoin was being traded at approximately $97,232.

Read More

- Roblox: Project Egoist codes (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

- Run! Goddess tier list – All the Valkyries including the SR ones

- Castle Duels tier list – Best Legendary and Epic cards

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Mini Heroes Magic Throne tier list

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Brown Dust 2 celebrates second anniversary with live broadcast offering a peek at upcoming content

- King Arthur: Legends Rise tier list

2024-12-21 16:12