After the introduction of the RUNES protocol, which led to a significant increase in transactions and record-breaking fees, miners may encounter challenges with persistently low fees and a stable hashrate despite the cryptocurrency’s halving event, according to industry experts.

Following the latest halving where the Bitcoin reward decreased from 6.25 to 3.125 coins, mining earnings have unexpectedly surged due to increased transaction fees, as suggested by CryptoQuant’s recent assessment.

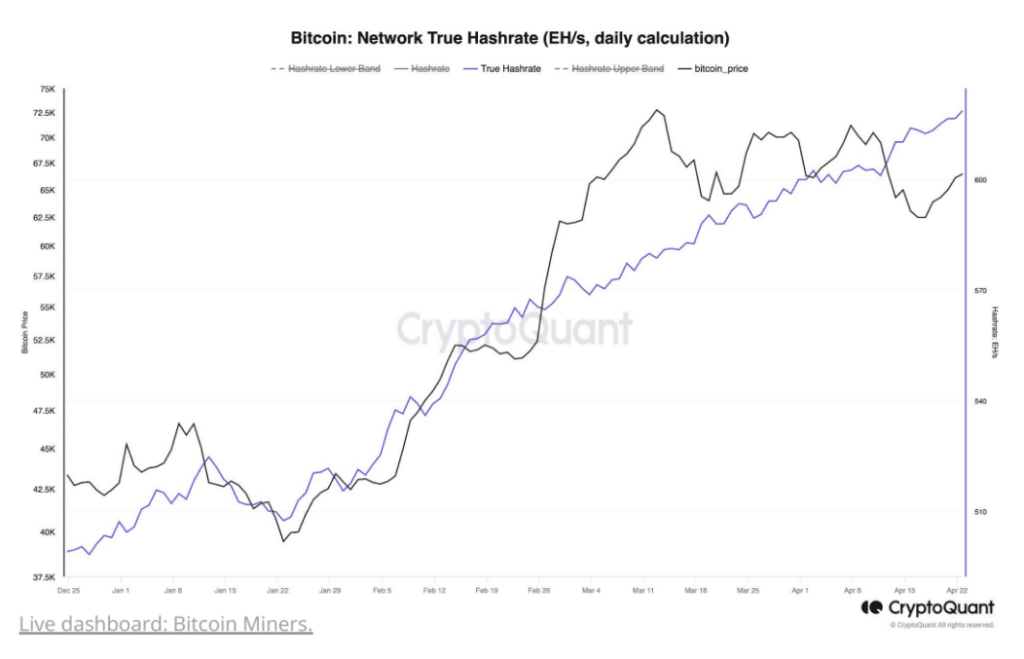

Analysts pointed out that Bitcoin’s transaction fees reached new peaks in relation to miner revenue on the day of the halving, indicating that mining activities seemed unchanged from before the event. CryptoQuant reported that despite the network upgrade, the total hashrate remained stable between 617 and 620 EH/s.

Miners have kept up with their mining activities at the same pace as before the halving, but it’s too soon to tell if this will lead to lasting increases or decreases in the network hashrate.

CryptoQuant

Analysts explained that the rise in fees was due to the introduction of the RUNES protocol, a new standard for creating and transferring interchangeable tokens on the Bitcoin system, which is recorded using OP_RETURN data.

The upcoming April 2028 Bitcoin halving is creating buzz, with many comparing its scarcity to that of gold. Notably, Glassnode analysts point out that for the first time ever, the rate at which new Bitcoins are issued now falls below the rate of new gold being mined, following the latest halving on Apr. 20, 2022. This signifies a major change in the conversation surrounding these assets.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Grimguard Tactics tier list – Ranking the main classes

- Maiden Academy tier list

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Fortress Saga tier list – Ranking every hero

- Kingdom Rush 5: Alliance tier list – Every hero and tower ranked

- Hero Tale best builds – One for melee, one for ranged characters

- Call of Antia tier list of best heroes

- Best teams for Seven Deadly Sins Idle

2024-04-25 10:03