On Good Friday, more than $2.2 billion worth of Bitcoin and Ethereum options contracts expire today. Because nothing says “holy day” quite like financial earthquakes and existential dread in crypto land.

While families are hunting for chocolate bunnies and pretending to be spiritual, crypto markets are busy unraveling thanks to global economic weirdness. Our sometime reality-TV star, President Donald Trump, is telling Jerome Powell at the Fed to slash interest rates like cutting a Black Friday deal, but Powell’s standing firm—probably ignoring the Twitter messages.

The $2.2 Billion Egg That’s About to Hatch… or Explode

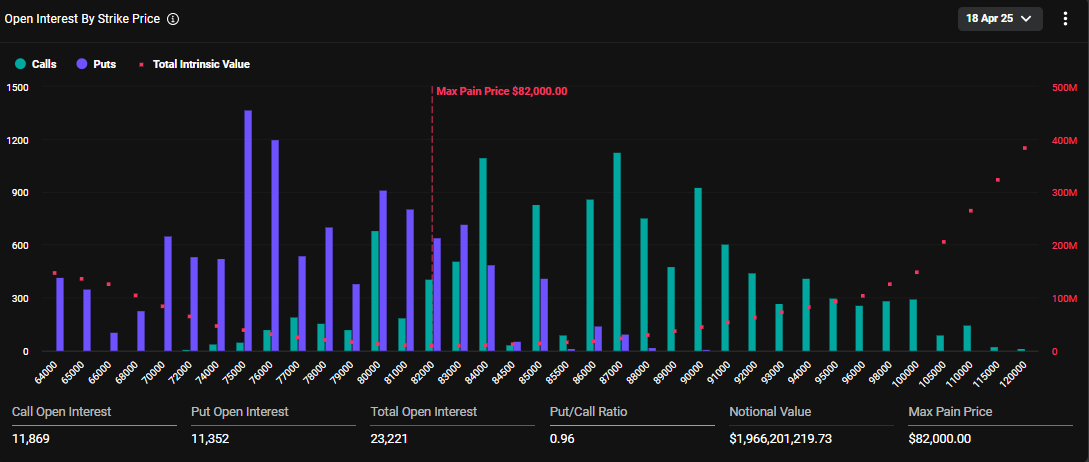

April 18—Good Friday, the ultimate irony—23,221 Bitcoin options contracts are expiring like your leftover Easter candy’s shelf life. The grand total? Nearly $2 billion in Bitcoin (BTC) toys tossed onto the altar of market fate, courtesy of Deribit data.

The put/call ratio is 0.96, which basically means more people are buying calls than puts. Translation: traders are Optimist Prime, and everyone’s hoping BTC rockets instead of nosediving.

The “maximum pain” price sits at $82,000—a cruel poke in the ribs where the most holders may feel the sting. Imagine celebrating with your crypto portfolio screaming “OUCH.”

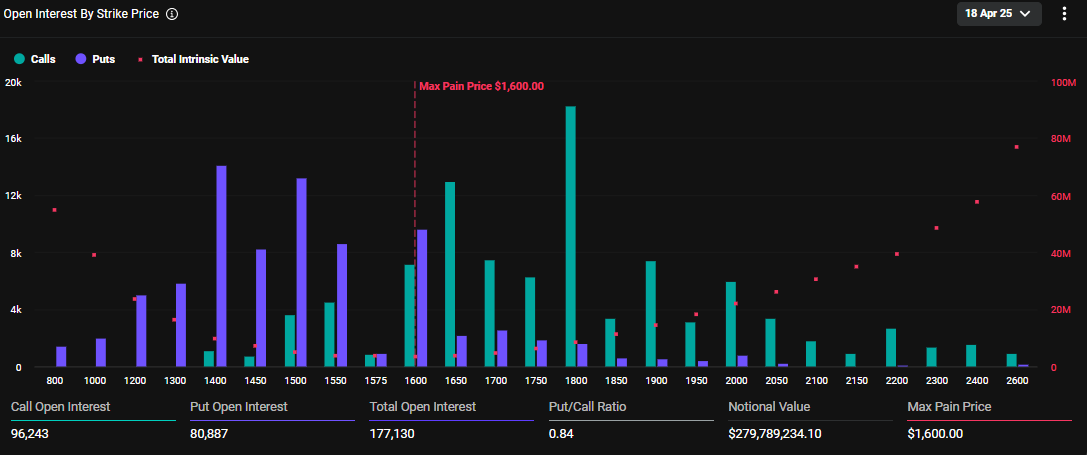

On the Ethereum side, 177,130 contracts worth around $280 million also ignite expiry fireworks, with a put-to-call ratio of 0.84. That “maximum pain” is $1,600 — because, yes, even digital coins love a little drama.

Last week’s expiry party was even bigger at $2.5 billion, but this one still promises the usual market jitters that could make your portfolio feel like it’s had a few too many espresso shots.

Traders should probably keep guacamole close and monitor this romp; options expiry often means volatility will tango with your net worth. That said, put-to-call ratios below 1 suggest the market is tiptoeing optimistically toward price gains.

Deribit analysts deliver their version of a weather forecast: “Low volatility, flat skew,” which is just a fancy way of saying, “all calm before the crypto-storm.” But CoinGlass reminds us that after expiry, prices like to throw temper tantrums, so buckle up.

“With volatility crushed and skew flat, is the market setting up for a post-expiry move?” they ponder, probably clinging to their third cup of coffee.

Black Swan Alert: The Greeks Warn of More Chaos (And Possibly Tears)

Meanwhile, Greeks.live—a name that makes you expect a toga party but delivers market analysis—reports the mood as mostly bearish to neutral. The bulls seem to be taking a nap, while bears sharpen their claws, expecting choppy waters until Bitcoin revisits its $80k-$82k hangout spot.

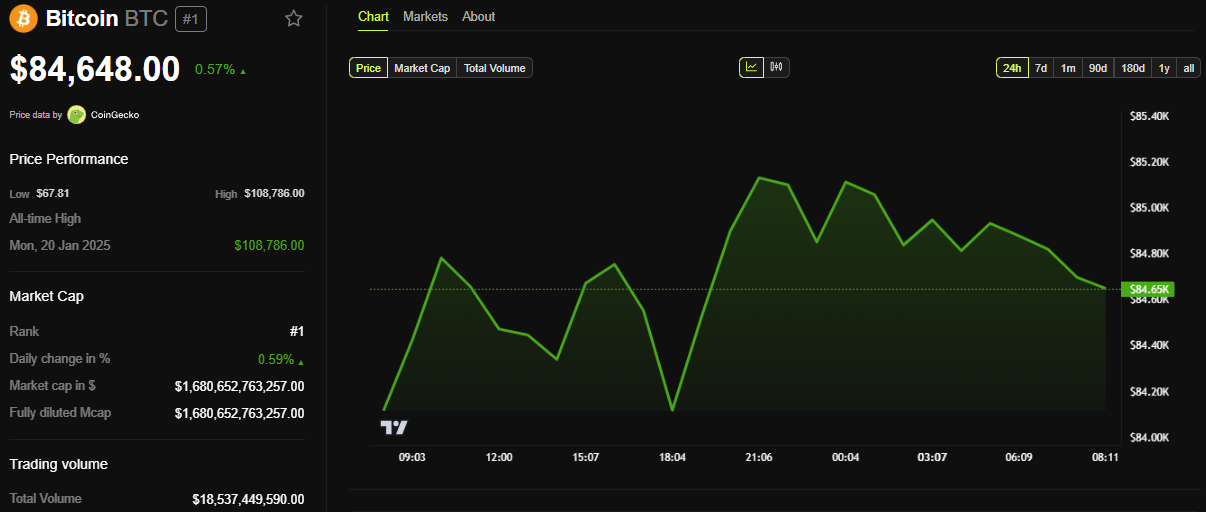

Bitcoin, at press time, was flirting with $84,648—cocky little thing—just above that pesky maximum pain price. The Max Pain theory suggests prices tend to drift toward this strike price, sort of like a sad magnet pulling on investors’ wallets.

Greek.live blames the relative quiet for the market’s calm on Trump’s low news output this week. No scandals, no tweets, just a rare moment of peace before the trade wars and tariff tantrums resume their soap opera.

“We expect the trade and tariff wars to be far from over, and the uncertainty in the market will continue for a long time, as will the volatility in the market,” they lament like forecasters predicting yet another hurricane.

Powell’s refusal to entertain the idea of rate cuts put a mild damper on expectations, tying crypto’s fate more tightly to the traditional markets than a reluctant first date.

With this cocktail of tension, Greeks.live warns of a black swan event—an unexpected freak occurrence that could shake the market more than a toddler in a toy store.

“…it is now a period of pain when the bulls have completely turned to bears, and investor sentiment is relatively low. In this worse market of bulls turning to bears, the probability of a black swan will be significantly higher,” they diagnosed, probably while nervously checking their portfolios.

Their advice? Buy out-of-the-money (OTM) put options. Fancy financial speak meaning: hedge your bets by betting some more, preferably on things that seem worthless now but might not be when the market gets really messy.

Read More

2025-04-18 10:12