As a researcher with years of experience in the cryptocurrency market and a keen interest in decentralized finance (DeFi), I find the performance of dYdX (DYDX) intriguing. While a whale selloff typically signals a bearish trend, the resilience of DYDX in the face of such selloffs is noteworthy.

On the dYdX decentralized trading platform, its native currency experienced a strong surge, even amidst significant selling by large investors (whales).

In the last 24 hours, dYdX (DYDX) experienced a notable jump of approximately 29%, currently standing at $1.28 per token. At this moment, its market capitalization is roughly around $820 million, and daily trading volume amounts to about $350 million.

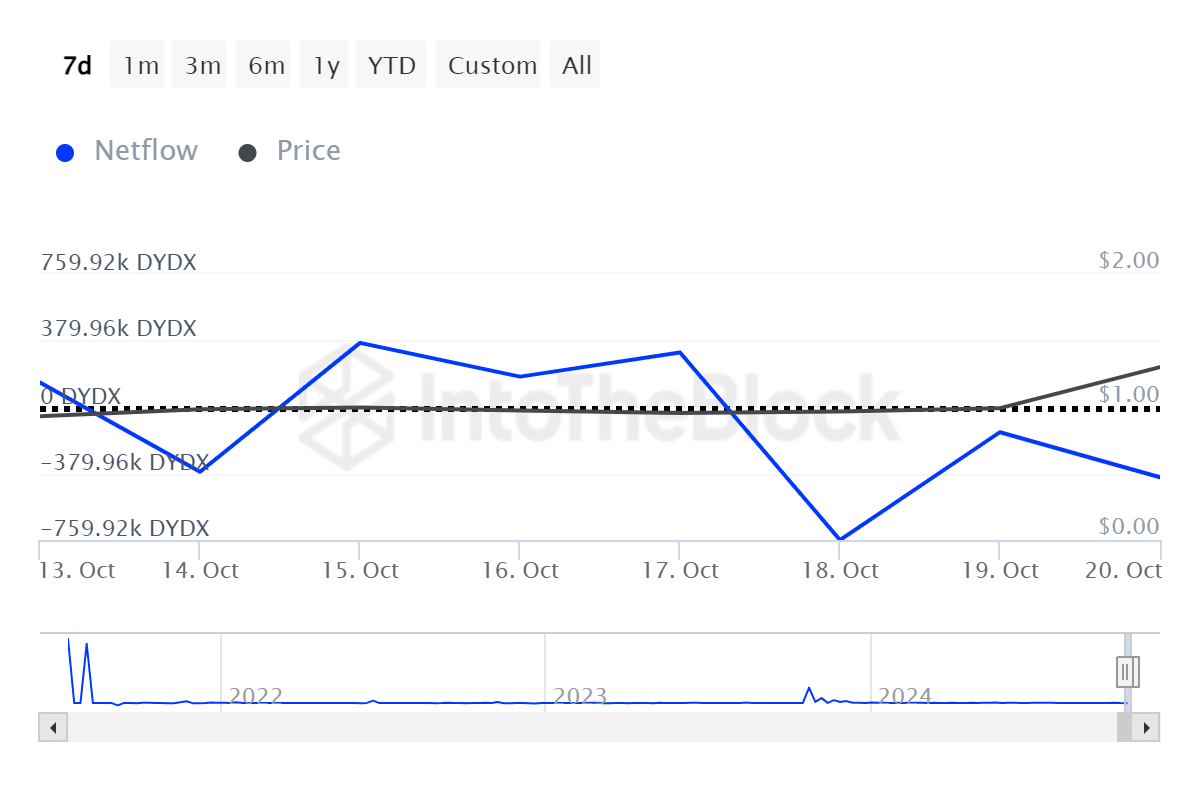

After reaching $1.31 for the first time since late July, there was a significant decrease in large investors holding the asset, as indicated by the data from IntoTheBlock. Specifically, on October 20th, while there was an influx of 6.42 million DYDX tokens from whales, there was also an outflow of 6.82 million DYDX tokens, resulting in a net outflow of approximately 401,270 DYDX on that day.

A sudden rise in big investors selling their holdings often indicates a mass sell-off driven by fear. However, on this occasion, the massive sale (or whale selloff) was counterbalanced because more people started buying as DYDX peaked at $1.33 for the past three months.

Conversely, there’s been a notable surge in inflows to the DYDX exchange starting from October 18th. According to ITB data, approximately 600,000 DYDX tokens were moved into centralized exchanges yesterday, indicating that more investors could be planning to cash out before potential price drops.

As a researcher, I’m observing that approximately 91% of DYDX holders are currently experiencing losses, while only 9% are managing profits at the moment. Given the asset’s current state, which is down by 72.5% from its peak of $4.53 in March, some investors might be considering strategies to minimize their losses.

On October 10th, CEO Antonio Juliano resumed his position at the company following a six-month tenure as chairman: “A clear vision is crucial for bringing people together and igniting passion. During my absence from dYdX, operations continued smoothly, but I noticed a gradual increase in questions like ‘What exactly are we working towards again?’

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Seven Deadly Sins Idle tier list and a reroll guide

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Cookie Run Kingdom Town Square Vault password

2024-10-21 09:44