As a seasoned crypto investor with a few years of experience under my belt, I’m excited about the U.S. SEC’s approval of the first spot Ethereum (ETH) ETFs for trading. After witnessing the positive impact of the spot Bitcoin (BTC) ETFs that were approved back in January, I’m optimistic that this development will bring similar outcomes for Ethereum.

The Securities and Exchange Commission (SEC) of the United States has given its approval for the launch of the first exchange-traded funds (ETFs) based on Ethereum (ETH) spots in the American market. These ETFs are scheduled to start trading on July 23.

On July 22, the SEC in the United States approved the securities submissions for several Ethereum (ETH) ETFs, enabling their trade from Tuesday onwards, as originally planned.

Eight different issuers, including heavyweights Fidelity, Blackrock, and VanEck, along with 21Shares and Bitwise, had their Ethereum ETF proposals endorsed by the SEC.

The SEC gave its nod to the ETH ETFs’ applications towards the end of May. However, before these ETFs could begin trading, their registration statements (S-1 filings) required approval from the SEC. Last week, the SEC communicated that issuers must complete and submit their finalized S-1 documents by July 17 in order to initiate trading on July 23.

How will the price of ETH react?

According to a recent report by Kaiko Research, released today, the future price direction of Ethereum following the launch of spot Ethereum Exchange Traded Funds (ETFs) is uncertain. The research firm pointed out that the demand for Ethereum futures-based ETFs when they were introduced last year was relatively low.

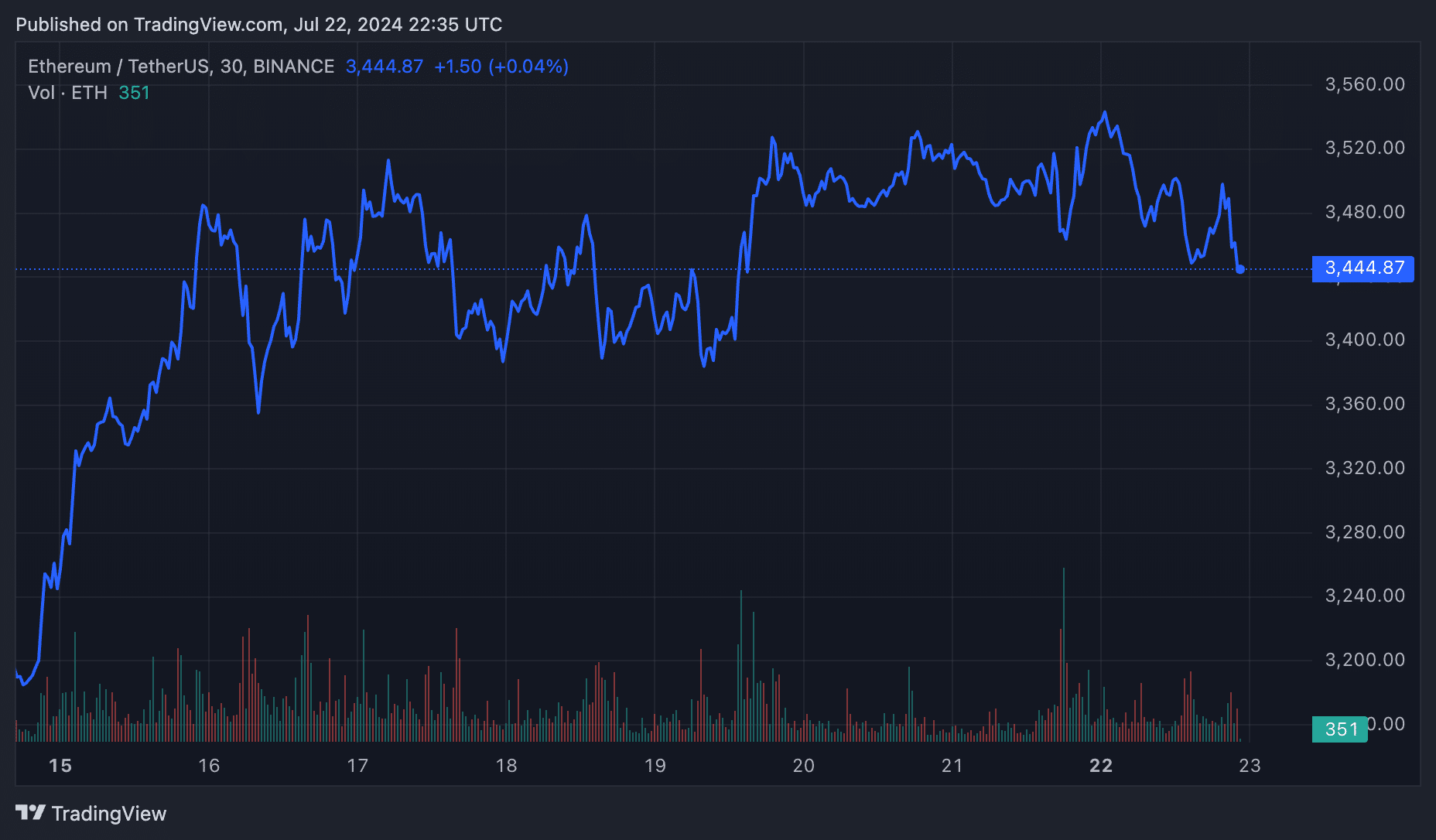

Over the last 24 hours, the cost of Ethereum has decreased by approximately 2.5%, now hovering around $3,400. Analysts from IntoTheBlock have pointed out that Ethereum’s price may encounter significant resistance at the $3,500 mark.

Analysts and the industry as a whole view the introduction of a spot Bitcoin (BTC) ETF as a positive sign for increased acceptance among mainstream investors. Traditionally, ETFs are bought and sold on established exchanges using brokerage accounts. With this development, more conventional investors can now invest in Bitcoin and Ethereum (the two largest cryptocurrencies by market capitalization) through a familiar trading mechanism.

First Bitcoin, now Ethereum

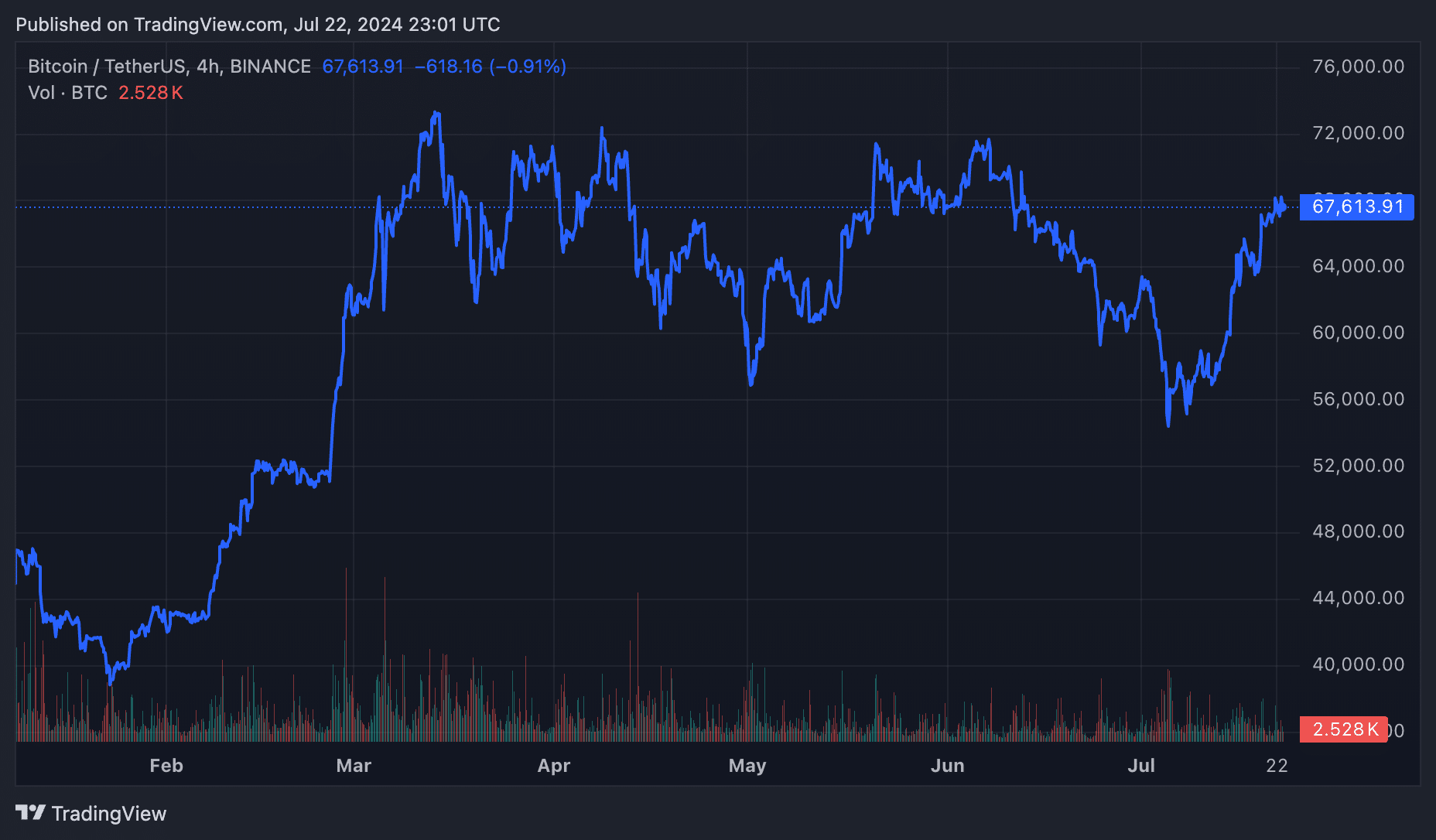

In the United States, Spot Bitcoin Exchange-Traded Funds (ETFs) became available for trading in January. Since then, these ETFs have experienced significant inflows. The value of Bitcoin has surged nearly 50% since the inception of these ETFs, currently hovering around $67,700.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Fortress Saga tier list – Ranking every hero

- Outerplane tier list and reroll guide

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- Call of Antia tier list of best heroes

- Best teams for Seven Deadly Sins Idle

2024-07-23 02:32