As a seasoned crypto investor with a few years under my belt, I’ve seen my fair share of market volatility and regulatory developments. The latest news about the potential approval of spot Ethereum ETFs by the SEC has certainly piqued my interest.

As a researcher studying the cryptocurrency market, I’ve observed that Ethereum‘s price has shown resilience in recent days due to heightened prospects for spot ETF approvals. The ETH token was priced at $3,455 on Friday, slightly above this week’s lowest point of $3,233. Despite this, Ethereum remains within a correction zone following its 13% decline from the peak it reached this month.

The SEC’s expected approval of a spot Ethereum ETF serves as the primary driving force behind Ethereum’s growth. As we previously mentioned on Thursday, there is an increasing likelihood that such Ethereum ETFs will become available for trading in the near future.

As a researcher, I’ve observed an increasing sense of excitement following VanEck’s submission of form 8-A for their proposed exchange-traded funds (ETFs). According to Eric Balchunas, a seasoned ETF analyst at Bloomberg, we can expect these funds to begin trading as early as July 2nd.

VanEck recently submitted an 8-A form for Ethereum spot ETF, marking a step forward in the approval process. Notably, they filed for a Bitcoin spot ETF 7 days prior to its launch last year. This historical precedent could indicate a potential July 2nd debut for this Ethereum product. However, keep in mind that nothing is certain and we may receive further updates soon.

— Eric Balchunas (@EricBalchunas) June 25, 2024

As a crypto investor, I can tell you that the approval of spot Ethereum ETFs (Exchange-Traded Funds) would be a significant development in the world of digital assets. Institutional investors have shown a tremendous interest in cryptocurrencies, and Ethereum’s approval as an ETF would make it easier for these large entities to invest in this promising technology. This increased institutional involvement could lead to higher demand for Ethereum, potentially driving up its price.

Just like the Grayscale Ethereum Trust (ETHE), with its $10 billion in assets and management fee of 2.5%, experiences high demand due to its affordability among retail and institutional investors, so too will cheaper funds.

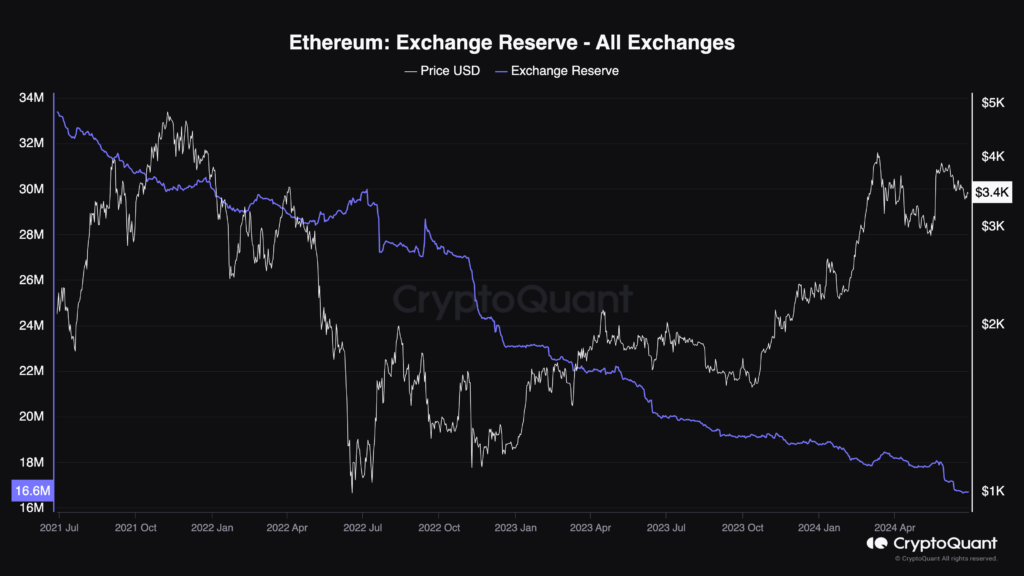

The trading of Ethereum ETFs is set to begin concurrently with a persisting decline in exchange balances, as depicted in the following graph.

Ethereum reserves in exchanges

As a crypto investor, I’m pleased to note that Ethereum’s ecosystem remains robust despite the ongoing crypto market sell-off. With a total value locked (TVL) of over $108.95 billion and nearly $80 billion in stablecoins, Ethereum continues to be a major player in the crypto space. Additionally, the network has generated impressive fees amounting to $1.65 billion, surpassing the combined fees of Tron and Bitcoin.

Analysts are bullish on Ethereum price

Several prominent cryptocurrency analysts are optimistic about Ethereum’s upcoming price surge. According to Rekt Finance in a recent discussion on X forum, the increasing open interest in Ethereum’s futures market indicates growing institutional demand, potentially hinting at upcoming Exchange-Traded Fund (ETF) approval.

The speaker further pointed out that Ether is a deflationary token with a shrinking supply. He anticipates that the approval of the ETH ETF will lead to a price surge for Ether, followed by consolidation or correction due to Grayscale Ethereum Fund investors seeking cheaper alternatives, and eventually continuing its upward trend.

Crypto Rover, with a large following of over 700k on Twitter, pointed out in another post that Ethereum was displaying a falling wedge pattern within a descending channel on its chart. Typically, such a bullish configuration foreshadows the possibility of an imminent price increase as the wedge’s sides converge. According to Crypto Rover, this anticipated breakout is likely to occur soon.

Read More

- Ludus promo codes (April 2025)

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Cookie Run: Kingdom Topping Tart guide – delicious details

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Grimguard Tactics tier list – Ranking the main classes

- Grand Outlaws brings chaos, crime, and car chases as it soft launches on Android

- Seven Deadly Sins Idle tier list and a reroll guide

- Maiden Academy tier list

- ‘SNL’ Spoofs ‘The White Lotus’ With Donald Trump Twist: “The White POTUS”

- Tap Force tier list of all characters that you can pick

2024-06-28 18:33