As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I find myself intrigued by the recent developments surrounding Stacks (STX). The Nakamoto upgrade and the upcoming sBTC release certainly hint at substantial long-term growth potential for this layer-2 solution.

The Bitcoin-based technology known as Stacks is generating interest lately due to recent advancements suggesting promising long-term expansion possibilities.

As an analyst, I’ve observed a significant spike in activity on the Stacks network post the Nakamoto upgrade that occurred on October 29, 2024. This upgrade, which aims to enhance transaction speed and scalability for Stacks (STX), appears to have been successful, based on data from Artemis.

As reported by CEX.IO experts, there’s been a significant increase in Stacks’ active addresses (up by 97%) and transactions (up by 94%). Furthermore, the Nakamoto update paves the way for the forthcoming sBTC release, an innovative feature enabling smart contracts to be tied to Bitcoin (BTC).

In simple terms, sBTC (Stacks-Bitcoin) is designed to overcome past obstacles faced by Bitcoin by enabling Decentralized Finance (DeFi) features on its network. This could potentially position Stacks as a significant force within Bitcoin’s rapidly expanding DeFi sector, which has already experienced a staggering 770% growth in the year 2024, according to recent analysis.

Although Stacks has doubled this year, it hasn’t seen the same level of growth in terms of Total Value Locked (TVL) compared to other Bitcoin Layer 2 solutions. For instance, Core has been growing at a quicker pace, while up-and-coming platforms like Merlin Chain and Bitlayer have experienced swifter advancements in their TVL. As a crypto investor, it’s important to keep an eye on these trends.

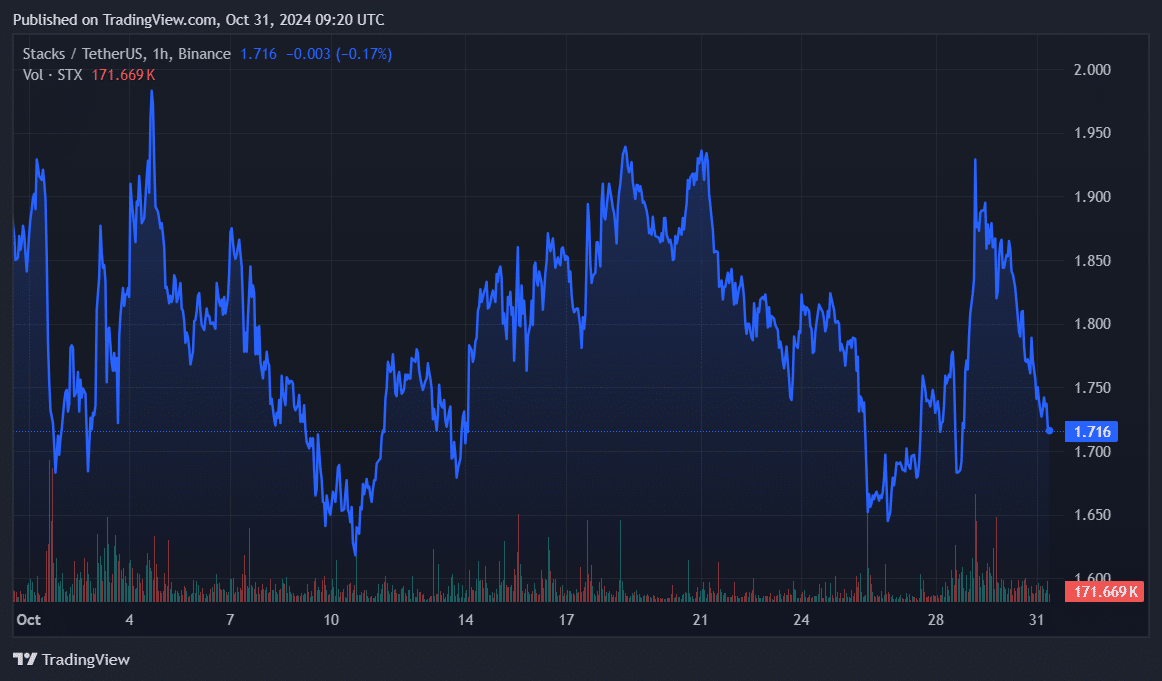

STX price action

According to analysts from CEX.IO, the token STX has displayed positive trends after the Nakamoto update. Lately, its value surged by approximately 11%, returning to a resistance point that’s been in place for over a month.

Although there have been occasional changes in speed suggested by the four-hour graph, suggesting possible minor adjustments at $0.75 and $0.70, the larger-scale weekly data shows more optimistic trends, as the analysis suggests.

Significantly, STX has decreased by 6.69% in the last 24 hours and is currently valued at $1.71. This decline follows a surge to $1.9 on October 29, and is linked to the broader market pullback. Similarly, Stacks has experienced a 6.79% drop this month.

According to a recent report from CEX.IO, both STX and BTC have experienced a MACD (Moving Average Convergence Divergence) bullish crossover. This pattern is typically followed by extended increases in price, and interestingly, STX shows a strong correlation with Bitcoin’s price movements.

Nevertheless, Illia Otychenko, the Lead Analyst at CEX.IO, contends that due to its relatively smaller market size, STX tends to have larger price fluctuations – approximately five to six times greater than average. This pattern was evident during the initial stage of the current bull run, where BTC rose by 172%, whereas STX soared by an impressive 739% within the same timeframe.

As a researcher examining the potential of STX, I’m intrigued by the prediction that Bitcoin might hit $200,000, according to Matt Hougan, Bitwise CIO. If this trend repeats for STX, it could potentially surge significantly. If a recovery gathers pace, its initial significant resistance level would likely be at around $2.033.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom Town Square Vault password

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-10-31 13:07