As a seasoned researcher with a decade of experience in the crypto market, I find myself constantly intrigued by the dynamics that drive this ever-evolving landscape. The latest Copper Research report has certainly sparked my interest, particularly the contrasting fortunes of Bitcoin and Ethereum.

Based on my latest analysis of the copper research report, I’ve observed that global events have put a temporary halt on Bitcoin‘s price growth. However, Ethereum‘s restricted supply could potentially trigger a significant increase in its market value.

In their most recent “Opening Bell” publication, Copper Research notes that Bitcoin’s (BTC) ability to withstand the German government selling 40,000 coins is impressive, but the broader market conditions have been tough, causing losses since Bitcoin reached its peak in March, undoing previous gains.

As a researcher delving into the dynamics of Bitcoin transactions, I’ve found compelling evidence pointing towards reduced buying activity. This decrease seems to be primarily attributable to heightened market volatility, which appears to have been triggered by a succession of significant global events. Among these events are the U.S. election, the unrest in the UK, escalating tensions in the Middle East, and adjustments in Japanese central bank policy. These occurrences seem to have had a profound impact on Bitcoin’s market stability, leading to increased volatility that has subsequently dampened buying activity.

At first, investors purchased the drop during Germany’s selling spree, but the report suggests that current market turbulence has dampened appetite for risky investments, leading to limited Bitcoin purchasing actions.

As an analyst, I’ve noticed that despite the unexpected surge in supply from Germany, the markets appear to be holding steady, with no significant net additions overall. Since Bitcoin reached its peak in March, ETFs have only accumulated approximately 40,000 coins. Remarkably, the current trading prices are within the same range we saw during the German sell-off, as per the report’s findings.

Ethereum’s surge at the end of the year

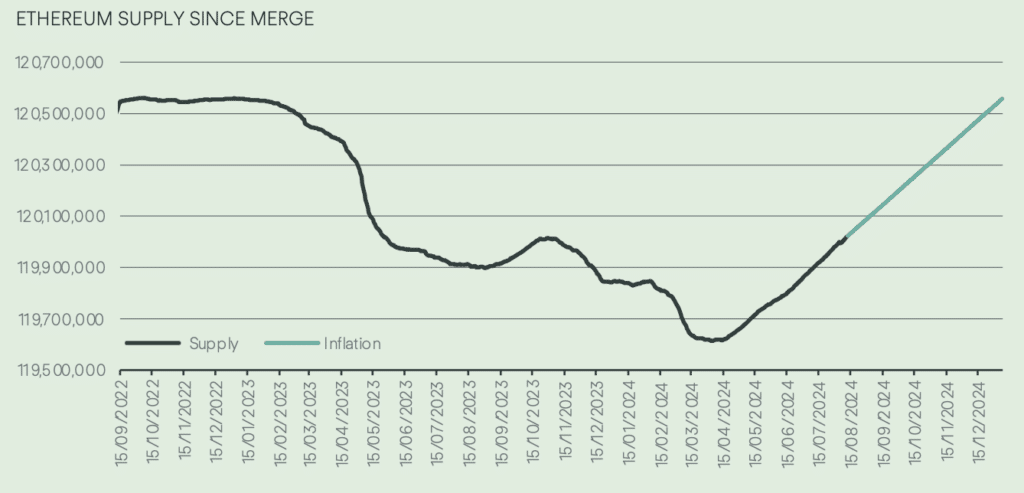

The inflow of attention towards Ethereum’s (ETH) supply structure includes examining how its shift towards Layer-2 adoption has made it an inflationary currency since around April midway. Yet, a substantial amount of ETH is currently being secured within smart contracts.

By the end of the year, there might be a decrease in the available amount, leading to increased demand and potentially causing prices to rise.

By August 12th, approximately 66% of Ethereum accounts have realized a profit, as the cryptocurrency trades slightly over $2,600. Compared to the previous week, this represents a rise in profitable accounts from 63%.

Yet, even though we’ve seen an increase, it’s important to note that this profit level is lower than the 75% achieved when ETH was priced above $3,159 earlier in the month. Specifically, around 3.59 million Ethereum addresses would need the price to rise between $2,679 and $2,755 to become profitable again.

Surge in tokenized assets

Additionally, the study highlighted a significant surge in the development of tokenized assets, as the integration of blockchain technology has resulted in approximately $1 billion worth of tokenized government products being added to the market this year.

McKinsey predicts that the market worth of digital representations of real-life assets could potentially surge to as high as $4 trillion by 2030, fueled by aspects such as mutual funds and bond investments.

BlackRock’s BUIDL product plays a key role in more than half of the recent growth, demonstrating robust market activity. Meanwhile, products like Franklin Templeton’s BENJI 0.6 and Ondo Finance’s USDY and USDG are also experiencing considerable popularity.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Cookie Run Kingdom Town Square Vault password

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-08-12 20:00