Michael Saylor, from MicroStrategy, seems to suggest another potential Bitcoin purchase through a cryptic tweet which appears to allude to the inauguration of President-elect Donald Trump as well.

On Sunday, Saylor posted that things will change starting tomorrow. This comment follows MicroStrategy increasing its Bitcoin (BTC) holdings to a total of 450,000.

Things will be different tomorrow.

— Michael Saylor⚡️ (@saylor) January 19, 2025

Fred Thiel, the CEO of Bitcoin mining company MARA Holdings, and his Vice President of Investor Relations, Robert Samuels, hold very much alike opinions on a particular matter.

On January 17th, the duo struck a pose in a photograph alongside Saylor, during the Crypto Ball – an occasion designed to celebrate Trump’s reentry into the White House as a crypto enthusiast.

Samuels stated that our team, collaborating with Saylor, had a meeting with the whole new Trump Administration cabinet. We are thrilled about the potential future of mining in the United States.

Will MicroStrategy add to its coffers?

The tweet, complete with a screenshot from Saylortracker – a site tracking MicroStrategy’s Bitcoin acquisitions – holds significant importance considering Saylor’s latest trend of behavior.

On January 13, a day after his latest suggestion, he made a purchase worth approximately $243 million, buying 2,530 Bitcoins at an average price of around $95,972 each.

As an analyst, I anticipate that Trump’s proposed crypto-friendly executive orders could be advantageous for MicroStrategy, given their strategic approach towards Bitcoin acquisition.

So far, the Tysons Corner, Virginia-based firm inked several purchases since December 2024:

- January 13: 2,530 BTC at $95,972 ($243 million)

- January 6: 1,070 BTC at $94,004 ($101 million)

- December 30: 2,138 BTC at $97,837 ($209 million)

- December 23: 5,262 BTC at $106,662 ($561 million)

- December 16: 15,350 BTC at $100,386 ($1.5 billion)

- December 9: 21,550 BTC at $98,783 ($2.1 billion)

- December 2: 15,400 BTC at $95,976 ($1.5 billion)

The company’s investments in Bitcoin have yielded a potential profit of $19.09 billion, equating to an impressive 67.7% increase in value that has yet to be realized.

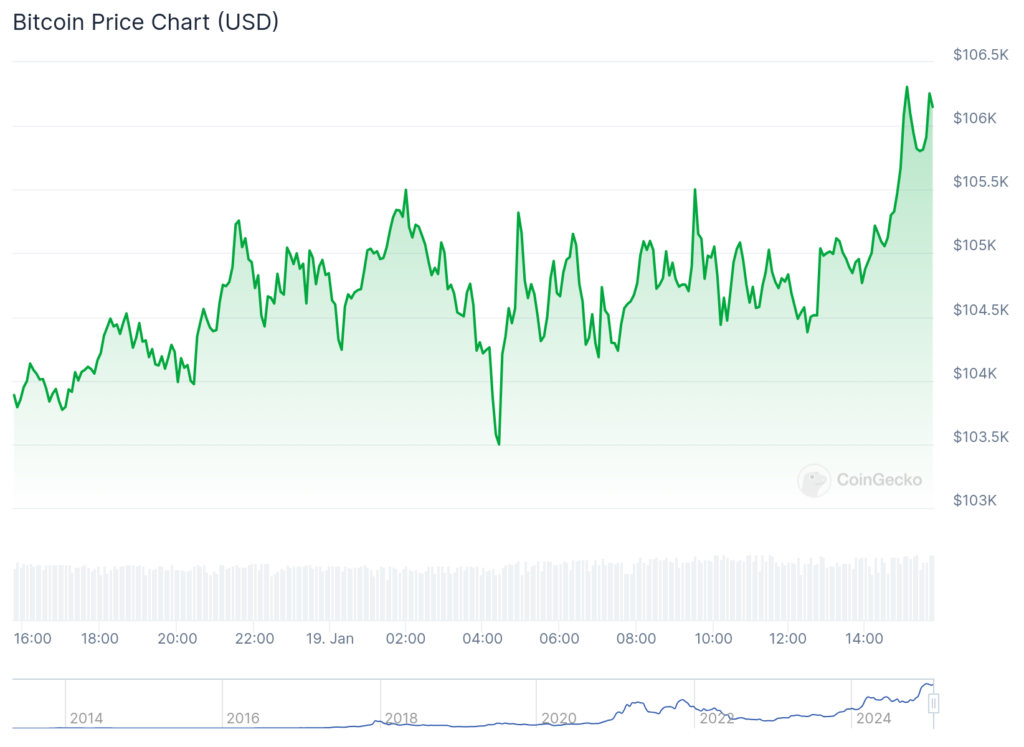

At last check on Sunday, Bitcoin is currently trading at over $106,000. See below.

Should Saylor’s advice lead to another Bitcoin acquisition, it will only serve to bolster MicroStrategy’s status as the biggest corporate Bitcoin owner.

In the past few months, the company’s bold approach to acquisitions has been quite lucrative. Almost all purchases made since December have yielded favorable results, with returns varying from a solid 7.35% to a robust 11.18%.

Buying this could be another step in MicroStrategy’s declared aim of consistently adding Bitcoin to its corporate treasury, according to their plan.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Castle Duels tier list – Best Legendary and Epic cards

- Gold Rate Forecast

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Mini Heroes Magic Throne tier list

- 9 Most Underrated Jeff Goldblum Movies

- USD CNY PREDICTION

- Henry Cavill Reveals Struggles Behind the Scenes of ‘Warhammer 40k’ Live-Action Series

2025-01-20 00:24