Ah, dear reader! In this grand theater of financial folly, we find ourselves amidst a market crash that would make even the most stoic of souls chuckle. XRP, the beloved offspring of Ripple Labs, seems to be preparing for a dramatic plunge, despite its recent flirtation with recovery. Today, on this fateful day of March 7, 2025, the crypto market has taken a nosedive, only to rise like a phoenix—albeit a rather confused one—before what some predict to be an imminent price catastrophe. 🎭

XRP Technical Analysis and Upcoming Level

According to the so-called experts, who wield their charts like wands, XRP is continuing its downward spiral with all the grace of a drunken ballet dancer. The daily chart, a veritable tapestry of despair, shows XRP retesting its recent breakdown of the key support level at $1.95. Oh, the drama!

But wait! In a twist worthy of a Russian novel, XRP has breached the neckline of a bearish head and shoulders pattern, closing a daily candle below the 200 Exponential Moving Average (EMA). This is the first time our dear XRP has fallen below its 200 EMA, marking its transformation into a creature of the night—strongly bearish, indeed!

With the candle closing below this pivotal level, the path to a catastrophic price crash is wide open, as the next support level is as distant as a dream of summer in the depths of winter. ❄️

According to the oracle of CoinPedia, should XRP fail to reclaim the $1.95 level, we might witness a staggering 39% drop, sending it tumbling to the next support at the $1.20 level. Oh, the humanity!

Current Price Momentum

As we speak, XRP is trading at a precarious $1.88, having suffered a decline of over 6.50% in the past 24 hours. Amidst this chaos, it even dipped to a low of $1.64. Such volatility has attracted the attention of traders and investors alike, resulting in a staggering 420% surge in trading volume. It seems everyone loves a good spectacle! 🎪

$35.40 Million Worth of Bullish Bet

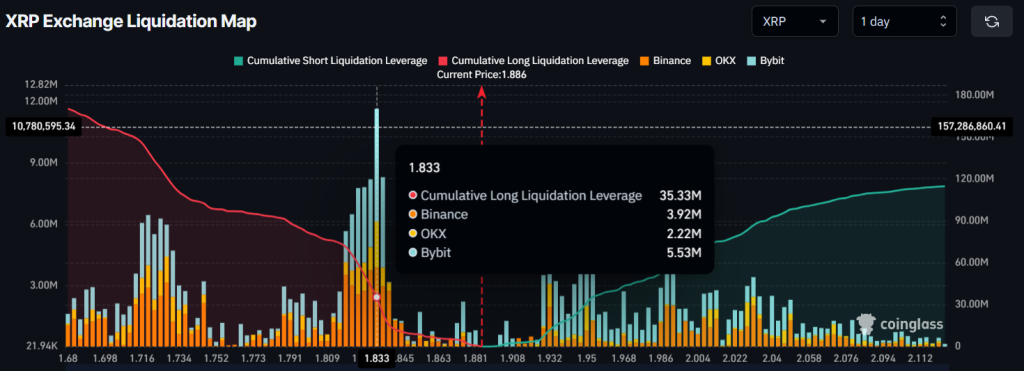

Yet, in this swirling maelstrom of uncertainty, trader sentiment appears to be shifting. According to the on-chain analytics firm Coinglass, traders are now betting on the bullish side, as if they were placing their hopes on a three-legged horse in a race. 🐴

Data reveals that traders are currently over-leveraged at $1.833 on the lower side (support) and have amassed a staggering $35.40 million worth of long positions. Meanwhile, on the upper side (resistance), at $1.932, they have built $11.80 million worth of short positions. The irony is delicious!

On-chain data suggests that the bulls are back, as the price seems to be retesting its breakdown level. Will they triumph, or will they be trampled underfoot? Only time will tell! ⏳

Read More

- DEEP PREDICTION. DEEP cryptocurrency

- CRK Boss Rush guide – Best cookies for each stage of the event

- Summoners Kingdom: Goddess tier list and a reroll guide

- Ludus promo codes (April 2025)

- CXT PREDICTION. CXT cryptocurrency

- Maiden Academy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Mini Heroes Magic Throne tier list

- Kingdom Rush 5: Alliance tier list – Every hero and tower ranked

- Grimguard Tactics tier list – Ranking the main classes

2025-04-07 23:08