As a seasoned crypto investor with a decade of experience navigating the volatile digital asset landscape, I find the recent moves by MARA and MicroStrategy both intriguing and prudent. Having witnessed the meteoric rise of Bitcoin since its early days, I have learned that those who dare to take calculated risks often reap significant rewards.

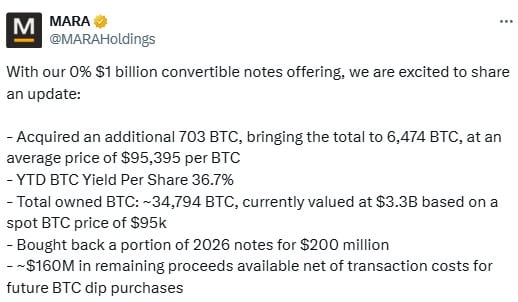

In a daring step within the Bitcoin sector, MARA (previously known as Marathon Digital) recently disclosed that they purchased approximately 6,474 Bitcoins. This acquisition was facilitated by their recent $1 billion offering of convertible notes, which came with zero percent interest rates.

Besides the initial purchase of 5,771 BTC priced at roughly $95,395 per token, MARA has subsequently bought an extra 703 BTC. As a result, they now have a total of 34,797 BTC in their reserves, which is currently valued at approximately $3.3 billion.

This method follows a strategy similar to MicroStrategy’s, who since 2020, have accumulated Bitcoin using corporate loans. More recently, MicroStrategy raised $3 billion by selling senior convertible notes with zero percent interest, which they used to buy more Bitcoin.

From November 18th through November 24th, the company acquired a total of 55,000 Bitcoins, with each one costing an average of $97,862. This purchase increased their overall Bitcoin holdings to approximately 386,700 coins.

The fact that MARA and MicroStrategy are increasing their investments in Bitcoin might indicate a rising corporate curiosity towards digital assets, or it could be an unproven risk they’re taking.

Read More

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Gold Rate Forecast

- EUR CNY PREDICTION

- Pop Mart’s CEO Is China’s 10th Richest Person Thanks to Labubu

- Kendrick Lamar Earned The Most No. 1 Hits on The Billboard Hot 100 in 2024

- Why The Final Destination 4 Title Sequence Is Actually Brilliant Despite The Movie’s Flaws

- EUR NZD PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Roblox: Project Egoist codes (June 2025)

2024-11-28 09:24