As a seasoned crypto investor who has navigated through numerous market fluctuations and exchange dramas, I must say that the current situation with WazirX leaves me feeling like a chess piece being moved around without my consent. The recent hack and the “my way or highway” approach by Nischal Shetty have left millions of users in limbo.

Approximately two months following the Rs 2000 crore hack at WazirX cryptocurrency exchange, its co-founder Nischal Shetty has presented a “take it or leave it” proposal to its vast user base in India, potentially stranding them. Now, users must decide whether they will back the “restructuring plan” of WazirX and accept proportionate losses, or remain patient until the legal battle between Binance and the exchange is resolved.

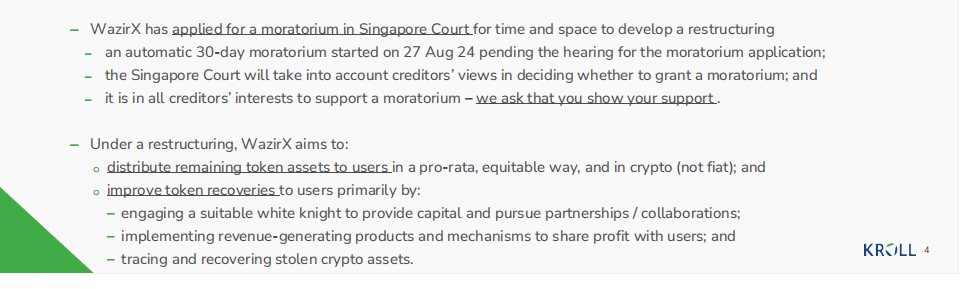

In my role as an analyst, I’m sharing information based on the latest supplementary affidavit submitted by Zettai Pte Ltd, the parent company of WazirX, in Singapore High Court. Essentially, users of the WazirX exchange are being asked to support a moratorium application filed by Shetty. If approved, this moratorium will grant protection from legal actions for the next six months. This period is intended to allow Zettai and WazirX to develop a restructuring scheme.

As reported by Shetty, so far, approximately 0.01% (or 441 out of 4.4 million) of WazirX’s active users have expressed their support. At present, WazirX is embroiled in a legal disagreement with Binance regarding the control of cryptocurrency assets for platform users, in comparison to Zettai.

If a pause isn’t allowed, the chances of a restructuring being successful will significantly decrease. Users on the platform may have to endure the ongoing dispute between Zettai and Binance before they can get back their cryptocurrency tokens, as Zettai can only hold these tokens under protest until the dispute is settled. This means that users won’t know who owns the platform and its cryptocurrency tokens until the dispute with Binance is resolved. The duration of this process remains uncertain,” stated Nischal Shetty in his affidavit.

Since the moratorium application was submitted on August 27, 2024, and a decision is yet to be made during the ongoing hearing, the WazirX team clarified their restructuring plan and emphasized the need for creditor support to get this application approved in the Singapore High Court.

It’s important to highlight that the restructuring plan doesn’t come with a specific deadline for execution. Furthermore, legal counsel for WazirX has cautioned that users may incur an equitable loss of approximately 43% once the plan is carried out.

Highlights of WazirX Singapore Restructuring Scheme

The process of restructuring initiates when Zettai submits an application for a moratorium on August 27, 2024, asking the court to allow a pause in debt collection activities temporarily.

After a three-week period following the court’s approval of the application, we will move on to the significant creditors’ meeting. During this gathering, they will cast their votes on whether to accept the proposed plan. For the moratorium application to be successful, the Scheme must gain approval from more than half of the creditors and at least 75% or more of the overall debt value for each category of creditors.

Given that the Scheme conforms to these prerequisites and receives approval, Zettai plans to petition the Court for final endorsement within thirty days. Subsequently, it’s anticipated that the Court will schedule a hearing to scrutinize the application and ratify the Scheme within twenty-one days.

Granted approval, Zettai gets a reprieve to present their debt restructuring proposal, free from creditor pressure. In this interim, they disseminate comprehensive details about the proposal to all creditors, including projected recoveries for each creditor category. Upon approval, the plan is swiftly put into action, enabling Zettai to manage its debts and progress with their recovery strategy.

If, unfortunately, the creditors do not accept the proposed plan (the Scheme), Zettai will reconsider their choices. This scenario isn’t favorable for creditors as it could lead to revising the plan for another vote or returning to the initial course of action. This might involve resuming legal battles with Binance, a process that could last indefinitely and potentially leave users in uncertain circumstances.

Conclusion

In essence, this affidavit presents two options for recovering funds: either opt to participate in the restructuring process, or alternatively, decide to observe the lengthy and arduous resolution process related to the legal disagreement with Binance.

Read More

- Gold Rate Forecast

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Castle Duels tier list – Best Legendary and Epic cards

- EUR CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Mini Heroes Magic Throne tier list

- Pop Mart’s CEO Is China’s 10th Richest Person Thanks to Labubu

- Why The Final Destination 4 Title Sequence Is Actually Brilliant Despite The Movie’s Flaws

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

2024-09-11 16:36