On March 28, the Stanford Blockchain Club unveiled a research piece detailing “Type III Stablecoins,” a fresh classification of digital money with built-in earning potential. This innovative concept is the brainchild of Benjamin and Jae from Cap Labs.

Yield Without Compromise? Type III Stablecoins Propose a Trustless Path Forward

The paper published in the Stanford Blockchain Review outlines a paradigm shift in decentralized finance (DeFi) with “Type III Stablecoins,” a model leveraging self-enforcing smart contracts to autonomously manage yield generation and user protections. Authored by Benjamin and Jae from Cap Labs, the research positions Type III as a solution to scalability and safety limitations plaguing existing yield-bearing stablecoins.

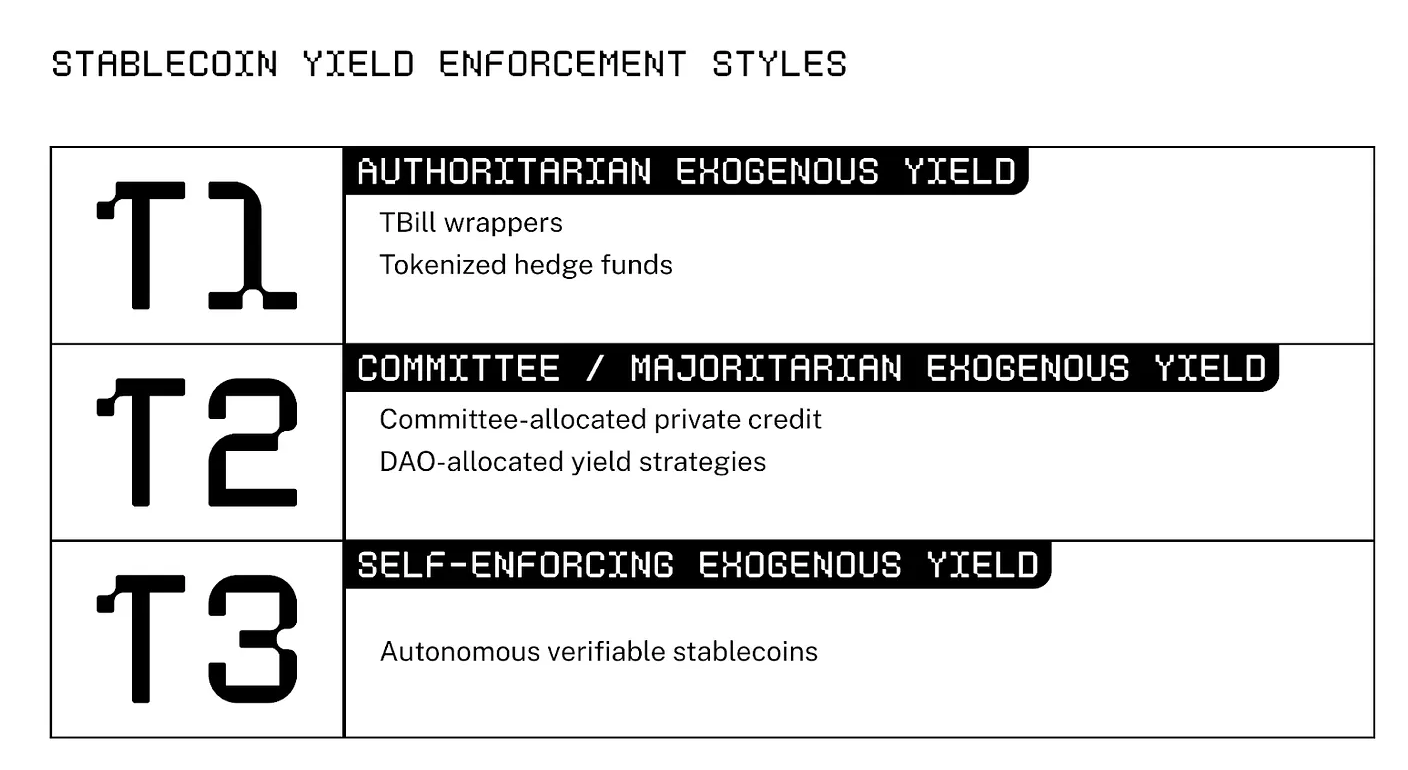

Type III bitcoin.com/what-are-stablecoins-a-simple-explanation-of-the-digital-asset-bridging-crypto-and-fiat/”>stablecoins eliminate human governance by encoding rules for capital allocation, operator oversight, and recourse into immutable smart contracts. Unlike Type I (centralized) or Type II (DAO-managed) models, Type III delegates decision-making to “restakers” who collateralize assets to back third-party operators. These operators generate yield through strategies like lending, with restakers incentivized to prioritize safety due to direct exposure to slashing risks if strategies fail.

The framework, presented by Benjamin at ETH Denver’s Stable Summit, addresses key challenges in current yield models. Type I stablecoins rely on centralized teams prone to obsolescence, while Type II faces corruption risks in decentralized committees. Cap Labs’ solution automates strategy shifts via market-driven interest rates and redistributes slashed funds to users during failures, ensuring verifiable recourse without legal intermediaries.

However, the paper acknowledges trade-offs. Complex smart contract dependencies introduce technical risks, and initial adoption will be restricted to accredited institutions for security. Despite this, proponents argue the model’s latency reduction and permissionless long-term vision could unlock mass adoption of yield-bearing stablecoins, which currently represent just 10% of the $200B stablecoin market.

Cap Labs’ groundbreaking development comes at a time when Traditional Finance institutions are delving into Decentralized Finance collaborations. However, stablecoins continue to be limited by the flaws inherent in human judgment and discretionary management. The paper suggests that yield-bearing versions will struggle to expand on a large scale if human intervention is not removed from capital allocation. The design of Type III, which relies on algorithmic accuracy, aims to align objectives among operators, validators, and users by employing code-based governance.

In the role as pioneer of Type III, Cap Labs plans to roll out deployment gradually, first focusing on partnering with institutional collaborators to build a solid base of trust before making it accessible to all. This design represents a significant shift in conceptualizing stablecoins, not just as tools for transactions, but as dynamic, yield-focused assets backed by cryptographic responsibility.

Read More

- Ludus promo codes (April 2025)

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Cookie Run Kingdom Town Square Vault password

- DEEP/USD

- Maiden Academy tier list

- Tap Force tier list of all characters that you can pick

- 10 Hardest Bosses In The First Berserker: Khazan

- ZEREBRO/USD

- Grimguard Tactics tier list – Ranking the main classes

- Realms of Pixel tier list – What are the best heroes in the game?

2025-04-01 00:59