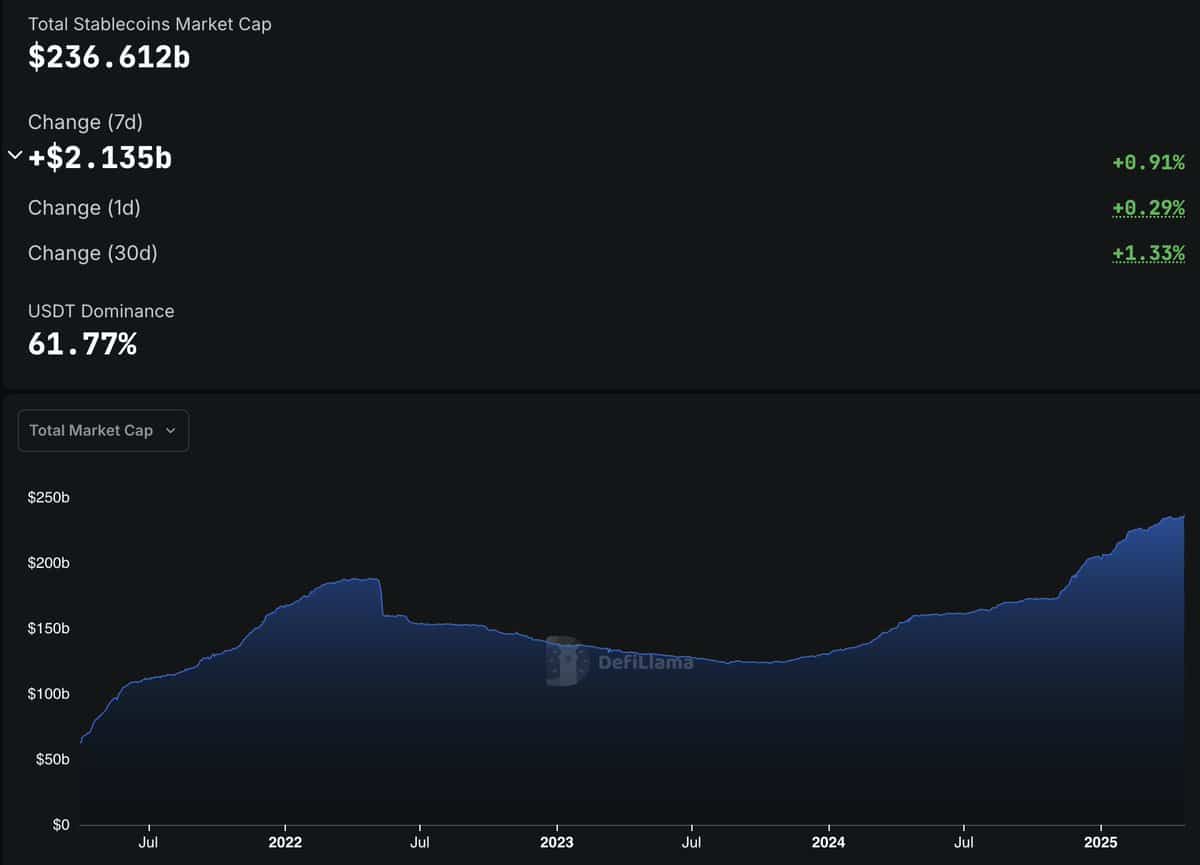

- The supply of stablecoins has skyrocketed to a staggering $236.6 billion.

- Bitcoin is leading the charge with a 10% rise, while altcoins see a 16% surge in their total market cap.

According to the ever-diligent DefiLlama data, stablecoin supply has grown by an impressive $2.135 billion in the last week alone, sending the grand total to a jaw-dropping $236.6 billion.

Oh yes, rising liquidity… it’s like the rich uncle of markets, standing there with a wallet full of dry powder, just waiting to throw it all at riskier assets like Bitcoin [BTC] and altcoins.

As the history books will tell you (if you can bother to look), a surge in stablecoin supply often signals a market rally. It’s almost like it’s a harbinger of doom—or, in this case, maybe fortune, but who’s counting?

Bitcoin: Up 10% – Is It Time to Pop the Champagne?

Bitcoin, bless its volatile little heart, surged by 10% this week, reaching $93K, thanks to a miraculous recovery from a key support zone. But who’s surprised? It’s Bitcoin, after all. Nothing says “I’m back!” like a nice strong rebound.

Sentiment remains firmly on the bullish side, with investors now eyeing the mythical $100K mark, like it’s some sort of golden beacon calling them home. And let’s be real—this rally is not just about numbers on a screen. Capital is flooding in, and the charts are probably already sick of showing the same thing over and over again.

Let’s not forget the classic inverse correlation between Bitcoin and stablecoin supply. It’s like that classic “two sides of the same coin” scenario—more stablecoins means more people are jumping on the Bitcoin bandwagon. Who could have guessed, right?

Altcoins: The Silent Partner in Bitcoin’s Dance

Not to be outdone, the altcoin market is quietly flexing its muscles, gaining 16% in the last week after a bounce from a key demand zone. A surge of epic proportions that some might say mirrors Bitcoin’s moves. Coincidence? Maybe, maybe not.

As of this very moment, the total altcoin market cap (excluding Ethereum [ETH] and Bitcoin) is resting comfortably at $821 billion. Not too shabby, eh?

The correlation is uncanny. Just like a devoted understudy, the altcoin market often follows Bitcoin’s lead. If Bitcoin keeps up its momentum, there’s a very real chance the altcoins will start to shine, albeit fashionably late.

Sentiment: A Solidly Bullish Vibe, Everyone’s in a Good Mood

With Bitcoin leading the charge and stablecoin reserves soaring, the market sentiment is downright optimistic. It’s like a parade of happiness, with investors smiling all the way to their crypto wallets. Capital is being funneled into crypto assets faster than you can say “blockchain.”

As Bitcoin charges toward $100K, the altcoins are prepping for the second act—much like an eager understudy waiting to take the stage once the lead is safely in place.

In conclusion (and for those still with us), it seems like the perfect storm is brewing. Stablecoin inflows, Bitcoin’s dominance, and the waiting altcoin army are all positioned for what could be a rather wild ride. Hold on tight, it might get bumpy… or maybe we’ll all be sipping mimosas at the $100K party.

Read More

2025-04-26 11:07