As a seasoned professional with a background in accounting and finance, Krystal Zhang has proven herself to be a trailblazer in the blockchain industry. Her impressive tenure at PwC and Huobi, followed by her co-founding of Owlto Finance, speaks volumes about her dedication and expertise.

As a seasoned investor with over two decades of experience in the financial markets, I must say that this month has been nothing short of extraordinary for Bitcoin (BTC). The surge in whale transactions and the subsequent market “purge” of short-term holders is reminiscent of the wild west days of internet stocks in the late 90s. I’ve seen similar patterns play out before, and history often repeats itself.

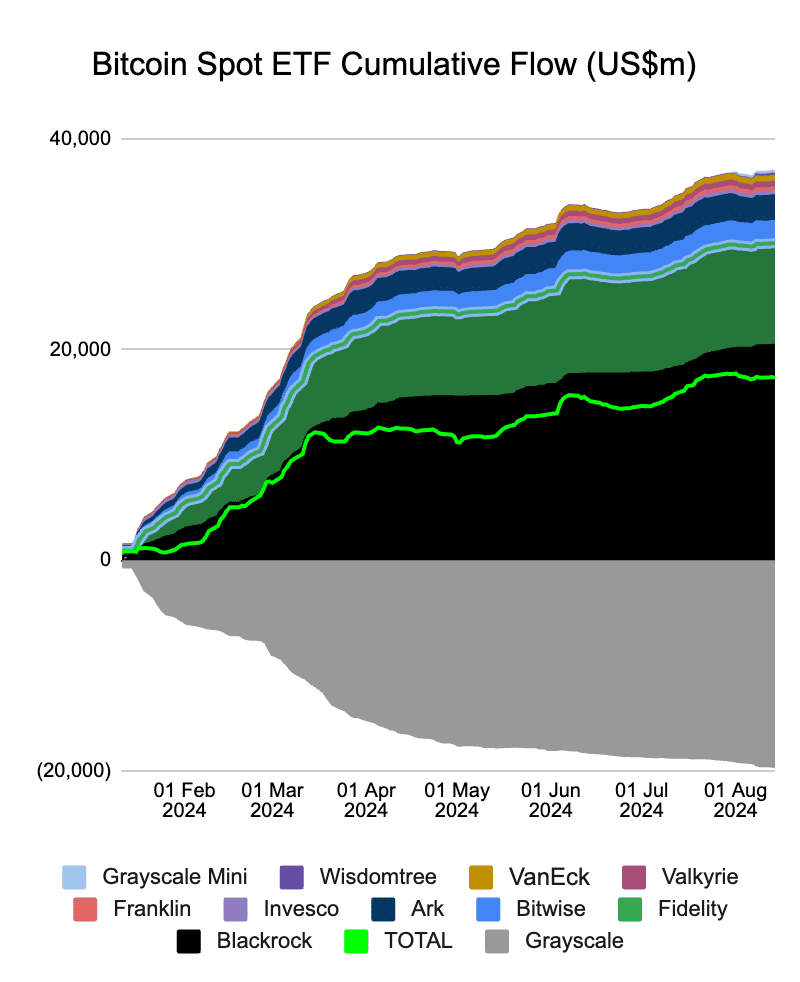

Meanwhile, investors are ‘buying the dip,’ and spot Bitcoin ETFs recorded some of the highest single-day inflows.

In a seemingly paradoxical scenario, temporary turbulence and chaos are occurring alongside optimism and increased interest, as David Canellis of Blockworks recently pointed out.

“…We may be finally ready to put the worst dramas in crypto history to bed, for good.”

As a researcher, I am observing an unprecedented revival in the world of Bitcoin, moving beyond the traditional perception of its value simply increasing or decreasing. Instead, it’s evolving, surpassing the ‘digital gold’ label and broadening its usefulness.

1. “At last, Bitcoin (BTC) can be considered a ‘useful asset’ due to the advancement of Bitcoin DeFi, or BTCfi. Moreover, platforms like Stacks are introducing programmability to the most decentralized and secure blockchain in existence – Bitcoin. This blockchain is becoming a hub for modern decentralized applications (dApps), with Stacks leading the charge in this $1 trillion opportunity. Early adopters and consistent contributors have shown us an important lesson.”

Slowly at first, then all at once

As an analyst, I find that the economic foundation of Bitcoin and its associated ecosystem operates under the philosophy of long-term thinking, or low-time preference. This isn’t a flaw; rather, it’s one of its defining features. Just as Rome wasn’t built overnight, the growth and development of this digital currency takes time. Amidst the clamor in the crypto world, it can be challenging to maintain this perspective, but it is crucial for understanding and appreciating the potential of Bitcoin.

2023 marked a significant shift in the spotlight and recognition for BTCfi, following the launches of Ordinals and BRC20. These developments demonstrated that Bitcoin could offer more than just being a store of value, as they represented the first practical applications. However, foundational elements for a fully operational BTCfi had been under development for a considerable period before this. For example, Stacks was introduced in 2013, and in 2021, it presented Clarity – a programming language designed for smart contracts compatible with Bitcoin.

What stands out most is their creation of the Proof of Transfer (PoX) consensus algorithm, which allows Layer 2 chains to benefit from Bitcoin’s security without requiring extra energy usage.

“People have attributed the paucity of innovation to a lack of #BTC functionality…But is there another way? A way to bring smart contracts more directly to Bitcoin without needing changes in the core?This is the promise of Proof of Transfer (PoX).”— stacks.btc (@Stacks) December 16, 2020

These initial advancements established a solid base for the thriving Bitcoin Layer 2 infrastructure, which presently manages over $2 billion in Total Value Locked (TVL). However, it was not until Runne significantly increased network transaction fees following the halving that the importance of scaling Bitcoin on the second layer became starkly evident.

Previously mentioned that Bitcoin transaction fees might increase by up to 500 times? That’s why we have been developing Layer 2 solutions for Bitcoin. Enjoy the halving, everyone! Next up, the era of Satoshi Nakamoto could be upon us!

— muneeb.btc (@muneeb) April 20, 2024

As someone who has witnessed and been part of technological advancements throughout my career, I have come to appreciate the unique and intriguing nature of lasting changes in this field. At first glance, these changes may appear slow and almost imperceptible, but over time they gradually build up momentum until suddenly, they burst forth all at once. This transformation can be awe-inspiring, yet it is often those unsung heroes – the visionaries who tirelessly work behind the scenes to develop practical solutions – who reap the most significant rewards when their ideas finally take flight.

Is it working or not? — That’s the question

Although it possesses many advantages, arriving first isn’t the ultimate goal. The crypto community has grown weary of hollow promises throughout the years. What they truly crave is tangible outcomes at this moment. In essence, the focus should be on the outcome’s significance, and that’s commendable.

Many current Bitcoin Layer 2 (L2) solutions struggle to address the Impossible Trinity, often being weakly connected to the Bitcoin Layer 1 at best or overly centralized at worst. Only a handful of projects like Stacks have managed to make the necessary compromises, even if it has ruffled some feathers among Bitcoin purists. Allegiance to the core principles of Bitcoin distinguishes L2s that are hosting decentralized applications (dApps) from those relying on marketing tactics or speculative price movements for their success.

As a researcher delving into the world of blockchain technology, I can’t help but marvel at the strides made by Stacks with their groundbreaking Nakamoto Release. This innovative development, known as sBTC, introduces a trustless two-way pegging mechanism that significantly boosts Bitcoin’s performance.

Furthermore, Stacks boasts a TVL (Total Value Locked) exceeding $68 million, as many leading Bitcoin dApps are choosing to develop on this platform. Gradually but consistently, these developers are contributing to the enhancement of Bitcoin’s TVL-to-market-cap ratio, which was only 0.2% in May 2024 compared to Ethereum‘s 17%. In simpler terms, more and more applications are being built on Stacks, helping Bitcoin’s locked value increase relative to its total market value, while Ethereum has a much higher ratio.

As Bitcoin decentralized applications (dApps) continue to advance, leading venture capitalists and investors are supporting the development of AI-enhanced interoperability and linking solutions. These technologies will enhance Bitcoin’s liquidity by enabling users with minimal technical expertise to effortlessly transfer funds into the Bitcoin ecosystem. AI Agents, for instance, will simplify the process of moving funds to the Bitcoin system without requiring intricate technical knowledge or experience. This way, they can easily incorporate Bitcoin dApps into their workflows while also leveraging other blockchain networks at the same time.

In simpler terms, this means that in the near future, the growth of one party will not come at the expense of another, leading to all-around advancement. This prediction suggests that the next ‘DeFi Summer’ on Bitcoin is becoming increasingly real and not just a hopeful expectation. It’s no longer considered an idealistic perspective.

BTCfi appears to have identified its key factors influencing growth, which could potentially see it grow to match or even surpass DeFi on Ethereum in the near future. Given Bitcoin’s substantial market dominance of over 54%, there is significant potential for it to outgrow these expectations significantly.

The biggest appeal of BTCfi innovations is that they primarily enhance and expand the underlying native asset. It is not a zero-sum game where projects extract the maximum value at the cost of end-users and devs.

Instead, it’s about uniting our efforts to foster grassroots empowerment and achieve financial independence. Decentralized applications (dApps) built on Bitcoin serve as the foundation for this goal. They embody an ideology that positions technology not only as a tool for immediate personal profits but also as a driver of individual autonomy and freedom. The aim is to create a positive impact in the lives of more than one billion future crypto users, ultimately leading to a world that is not just financially improved but also better in many other aspects.

Krystal Zhang serves as a co-founder for Owlto Finance, a rapidly expanding financial bridge that boasts over two million users spread across more than 200 nations, with its main office in Hong Kong. Earning her Master’s degree in Accounting from the Chinese University of Hong Kong, Krystal has also gained experience at PwC, where she worked as a senior associate for two years, and Huobi, where she held the position of senior manager.

Read More

- Cookie Run Kingdom Town Square Vault password

- Fortress Saga tier list – Ranking every hero

- Cat Fantasy tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Mini Heroes Magic Throne tier list

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- XTER PREDICTION. XTER cryptocurrency

- Grimguard Tactics tier list – Ranking the main classes

2024-08-18 14:36