As a researcher with a background in finance and a keen interest in the digital asset space, I find Paolo Ardoino’s response to Deutsche Bank analysts’ questions about Tether’s solvency and USDT’s stability quite intriguing. Ardoino’s assertion that Deutsche Bank has no room to talk due to its history of fines and sanctions is a valid point, considering the International Monetary Fund’s assessment of the bank as the riskiest in the world.

Tether CEO Paolo Ardoino addressed inquiries from Deutsche Bank analysts concerning Tether’s financial soundness and the reliability of its USDT stablecoin.

Ardoino quoted the recent analysis from Deutsche Bank, remarking that the bank had lost credibility on the matter after making such a comment in his X account.

The CEO of Tether expressed concerns, citing Deutsche Bank’s past record of penalties and disciplinary actions, which cast a shadow on its credibility to pass judgment within the financial sector. Ardoino reminded us that the IMF had previously labeled Deutsche Bank as the most risky bank globally.

As a financial analyst, I would express my concerns about Deutsche Bank’s past record of fines and penalties by saying, “Given my perspective as an observer of the financial industry, Deutsche Bank’s history of being subjected to significant fines and penalties casts a shadow over its ability to pass judgment on other institutions in the same sector.”

Paolo Ardoino, Tether CEO

Based on feedback from commentators, it has been mentioned that Deutsche Bank has incurred over $20 billion in penalties for a total of 99 infractions since the year 2000. Consequently, the bank may want to refrain from casting judgement upon other organizations with regard to risk management, product design, or regulatory compliance.

Since 2000, Deutsche Bank has acknowledged and disclosed payments totaling $20,011,467,563 for a sum of 99 infringements. It’s important to note that this figure only represents the admitted offenses and publicly known information. The following are the leading categories of misconduct, which should spark less conversation about risk management, product design, or regulatory compliance:

— Gabor Gurbacs (@gaborgurbacs) May 10, 2024

As a researcher, I’d like to share an earlier finding from my team at Deutsche Bank. In our study on the stablecoin market, we identified some potential vulnerabilities within this asset class. Notably, we pointed out the opacity surrounding Tether, the company behind the USDT stablecoin, as a significant concern.

Deutsch Bank analysts pointed out that due to Tether’s dominance in the stablecoin sector, a potential collapse of USDT could result in more severe repercussions.

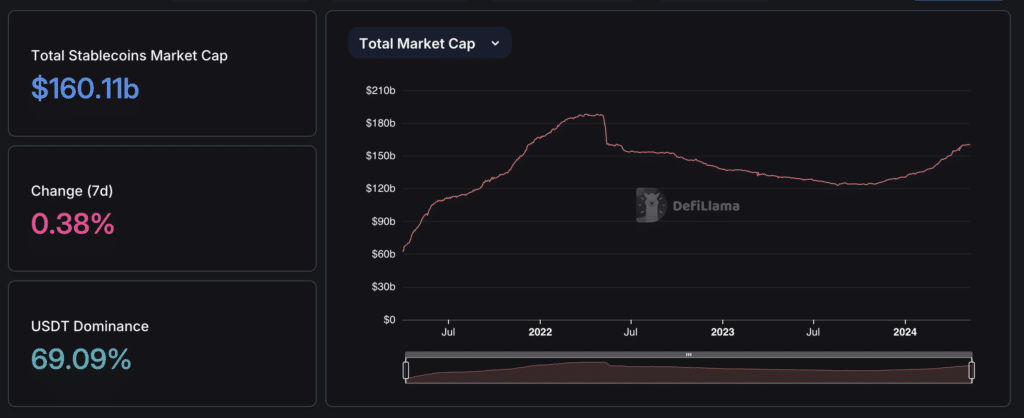

Based on DefiLlama’s data, the aggregate value of stablecoins surpasses $160 billion. Among them, USDT holds the undisputed top position, accounting for approximately 69% of the market share.

As a crypto investor, I’ve noticed the significant role Tether plays in the market. But a word of caution: some regulations proposed in the US might potentially lessen Tether’s influence.

Read More

- BODEN PREDICTION. BODEN cryptocurrency

- GHST PREDICTION. GHST cryptocurrency

- BETA PREDICTION. BETA cryptocurrency

- STRD PREDICTION. STRD cryptocurrency

- Mango Markets Exploiter Found Guilty Of Fraud And Manipulation

- GBP EUR PREDICTION

- MATIC PREDICTION. MATIC cryptocurrency

- LOOKS PREDICTION. LOOKS cryptocurrency

- BRN/USD

- TNSR PREDICTION. TNSR cryptocurrency

2024-05-10 17:49