As a seasoned analyst with over two decades of market experience under my belt, I can confidently say that the current crypto market outlook is bearish, and it’s not just the red sea I’m navigating, but a stormy ocean. The recent plunge in Bitcoin (BTC) and other major tokens, along with the sharp drop in the overall market cap, paints a grim picture for investors.

On Monday, the cryptocurrency market was dominated by shades of red, as the Fear & Greed Index dipped into the ‘Fear’ region at 35. This shift resulted in a majority of tokens experiencing a decline exceeding 20%.

In the last 24 hours, Bitcoin (BTC) tumbled by approximately 17%, with other significant coins such as Pepe (PEPE), Ethereum (ETH), Solana (SOL), and Notcoin (NOT) showing even steeper declines. Combined, the total value of all cryptocurrencies has decreased from nearly $3 trillion in March to around $1.8 trillion currently.

Crypto outlook seems bearish

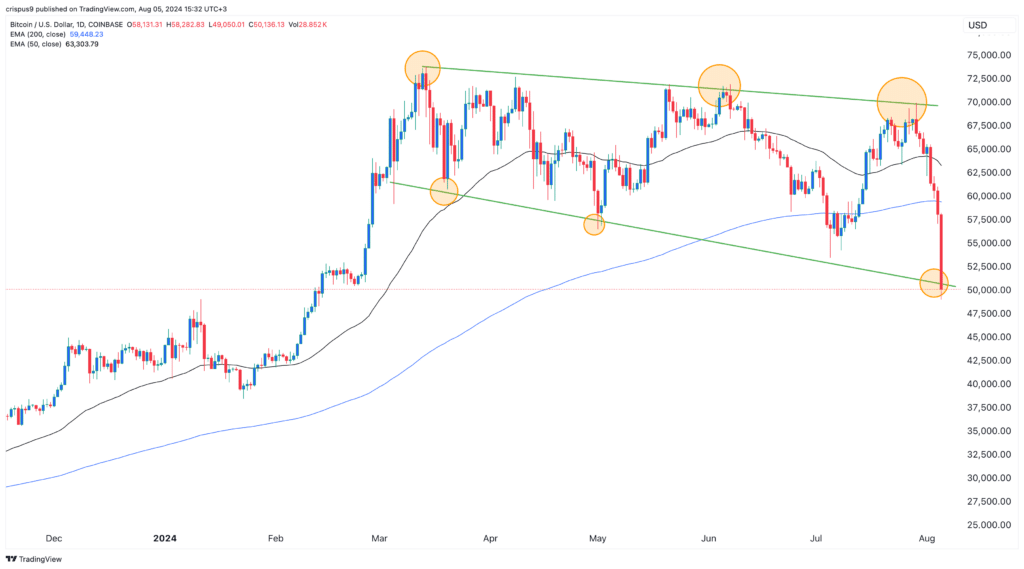

The forecast for Bitcoin and similar cryptocurrencies appears to be quite pessimistic, as Bitcoin has been creating a sequence of successively lower troughs and peaks, often referred to as a downtrend. Notably, it has dipped below the lower boundary of the widening triangle pattern known as a falling broadening wedge.

Essentially, Bitcoin’s current price movement is now lower than its 50-day and 200-day average prices, indicating that the market bears (those who sell) currently have stronger influence over the market.

Additionally, it appears that apprehension among cryptocurrency investors has risen significantly, as the Fear & Greed Index has plunged to 35 – a level indicating fear dominates the market. Historically, cryptocurrencies tend to decrease when there is widespread fear in the investment community.

Moreover, the value of crypto liquidations surpassed $1 billion on Monday, while bearish trading volume increased significantly on major cryptocurrency exchange platforms.

As an analyst, I’ve observed a notable trend emerging. One of the primary factors driving this shift is the distinct approach taken by the Bank of Japan, which stands in contrast to institutions such as the Bank of England and the European Central Bank.

Additionally, it’s becoming increasingly close in the U.S. presidential race, and there’s an increasing likelihood that Donald Trump may not secure another term. Interestingly, Trump enjoys a positive sentiment amongst cryptocurrency investors.

The bull case for Bitcoin and altcoins

Despite the increased likelihood of a recession, as suggested by Goldman Sachs and the rising Sahm Rule index to 0.53, there remains a strong argument for optimism in the crypto market. The Sahm Rule takes into account the average unemployment rate in the U.S. over a period of twelve months.

The chance of an economic downturn increases significantly if the Sahm Rule surpasses 0.50%, and current statistics show that it’s now at 0.53%. This suggests that a potential recession may be on the horizon.

As a seasoned economist with years of experience analyzing economic trends, I have learned to keep a keen eye on indicators like the Sahm Rule. The latest data shows that the Sahm Rule recession indicator has jumped from 0.43 in June to 0.53 in July, a significant increase that cannot be ignored. This rule signals a downturn when the unemployment rate increases by 0.5 percentage points above its previous 12-month low.

— The Kobeissi Letter (@KobeissiLetter) August 3, 2024

It might surprise you that stock markets and cryptocurrencies tend to thrive during economic downturns, which can be attributed to the actions of the Federal Reserve. In case of a recession, the Fed is likely to reduce interest rates more swiftly than initially projected. As per Polymarket traders, a substantial 0.50% rate cut could occur in September, while ING analysts predict four cuts this year.

Reducing funds in this sector could significantly affect the market, as a substantial sum of $6.1 billion has been invested in money market funds, currently yielding approximately 5%. When interest rates decrease, it’s probable that these investors will shift their funds towards riskier assets such as stocks and cryptocurrencies.

During the COVID-19 pandemic, stocks surged following the Federal Reserve’s decision to lower interest rates down to zero.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Castle Duels tier list – Best Legendary and Epic cards

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Seven Deadly Sins Idle tier list and a reroll guide

- Cookie Run Kingdom: Raspberry Cookie Toppings and Beascuits guide

- Starseed Asnia Trigger tier list and a reroll guide

2024-08-05 16:30