As an analyst with a background in financial regulation and technology, I’ve been closely following the cryptocurrency regulatory landscape in Washington D.C. With several high-profile bankruptcies and industry collapses in recent years, it’s no surprise that crypto has remained a contentious issue among policymakers.

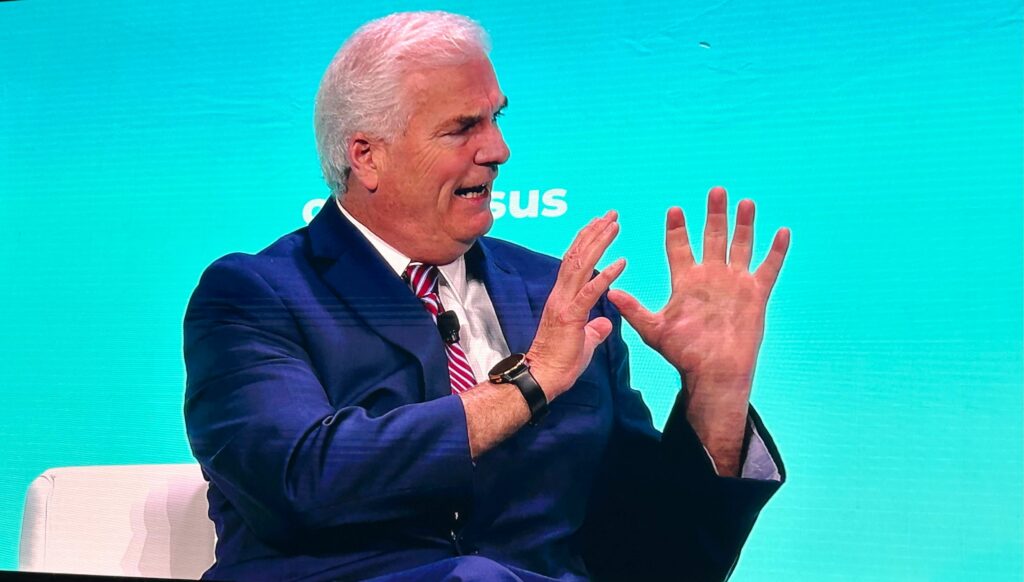

At the Consensus 2024 conference, I, as a researcher, had the opportunity to listen to Republican majority whip Tom Emmer share his insights into the ongoing regulatory efforts concerning cryptocurrencies in Washington D.C.

As a researcher studying the cryptocurrency market, I’ve observed that the sector has continued to be a subject of intense debate amongst U.S. policymakers following the bankruptcies of several crypto companies and the collapse of FTX in 2022. Industry players such as Coinbase have been actively advocating for clear-cut regulations to provide certainty and stability within this dynamic market.

The Securities and Exchange Commission (SEC) and Senator Elizabeth Warren from Massachusetts have taken a stance against cryptocurrencies. They’ve initiated efforts to regulate the industry more strictly and have advocated for stricter guidelines regarding the use and management of digital assets.

At first glance, cryptocurrency faced a tough challenge, but advocacy efforts and the quick spread of blockchain technology have influenced conversations in the Democratic and Republican parties in Washington.

As a researcher, I’ve come across an interesting finding regarding the Financial Innovation and Technology for the 21st Century Act (FIT 21) and the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121 (SAB 121). According to House Majority Whip Tom Emmer, the support for FIT 21 and opposition to SAB 121 represent a bipartisan effort to protect American innovation in the digital economy and limit the SEC’s potentially unconstitutional actions against crypto assets.

“Emmer stated that SEC Chair Gary Gensler exceeds his jurisdiction on a regular basis and blatantly disregards the SEC’s mandate,” is one way to paraphrase the original statement.

The GOP’s top ranking member in the House of Representatives, Emmer, subtly implied that Warren’s clout within the White House could be waning, potentially leading to more impartial talks regarding digital assets. In his perspective, the administration’s comment on FIT 21 showed a readiness to compromise and seek consensus on legislation as elections draw near.

Crypto regulatory timeline

As a researcher studying political developments, I’ve come across Emmer’s perspective that this election year could lead to finalizing rules, yet he cautioned against taking anything for granted. The congressman added that the Farm Implementation Table 21 (FIT 21) is still under review in the Senate and may require additional hearings before being sent back to the House for further deliberations.

A proposed legislation opposing Central Bank Digital Currencies (CBDCs) is being considered, with critics voicing concern over the Federal Reserve’s implementation of CBDC pilots and projects without obtaining prior congressional authorization.

Emmer is optimistic that progress will be made on crypto legislation following the elections, and he thinks the voting power of the approximately 40 million Americans investing in digital assets could be influential in this process. This perspective was echoed by Meltem Demirors, the chief strategy officer at CoinShares, during the Consensus OG Survivors panel discussion.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Castle Duels tier list – Best Legendary and Epic cards

- Fortress Saga tier list – Ranking every hero

- Grimguard Tactics tier list – Ranking the main classes

- Mini Heroes Magic Throne tier list

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Seven Deadly Sins Idle tier list and a reroll guide

- Maiden Academy tier list

2024-05-30 00:04