As a seasoned crypto investor with over a decade of experience in this wild and unpredictable world of digital assets, I must say that the recent buying spree by World Liberty Financial has caught my attention. Having seen countless projects rise and fall, it’s intriguing to see one backed by none other than the Trump family making such significant moves.

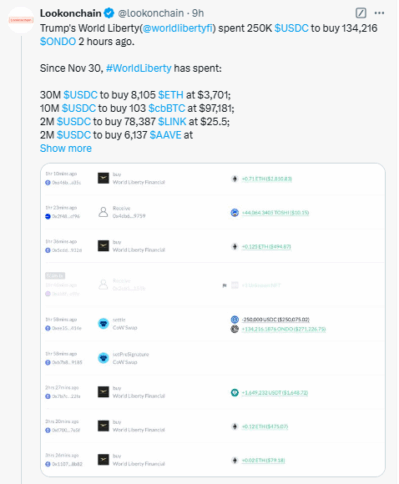

In December, World Liberty Financial – the cryptocurrency initiative associated with Donald Trump and his family – has been actively purchasing a variety of digital currencies. Approximately $45 million was invested in assets like Ether (ETH), Coinbase Wrapped Bitcoin (cbBTC), Chainlink (LINK), and others.

On December 15th, World Liberty acquired $250,000 in Ondo (ONDO), a token linked to decentralized finance (DeFi). This move came after they purchased $500,000 of Ethena (ENA) on the previous day.

Breakdown of the project’s buying activity

- $30 million in Ether (ETH)

- $10 million in Coinbase Wrapped Bitcoin (cbBTC)

- $2 million in Chainlink (LINK)

- $2 million in Aave (AAVE)

- $500,000 in Ethena (ENA)

- $250,000 in Ondo (ONDO)

This brings their total spending for December to $44.75 million.

What is World Liberty Financial?

World Liberty’s token sales didn’t quite follow their intended course. The project encountered difficulties in selling its $300 million World Liberty Financial (WLFI) token, with less than a quarter sold thus far. But then, events took a positive turn when Justin Sun, the founder of the Tron blockchain, invested $30 million in WLFI tokens, making him the project’s biggest backer and consultant.

AaveDAO Collaboration

On December 13, World Liberty gained attention within the Decentralized Finance (DeFi) community not just for its regular purchases, but also due to an approval of a proposal by AaveDAO – the self-governing body behind the Aave protocol.

The plan enables World Liberty to initiate a similar system to Aave’s protocol, facilitating loans and repayments of digital currencies such as Ether, Wrapped Bitcoin, along with stablecoins including USD Coin (USDC) and Tether (USDT).

Why the Buying Spree?

Based on Nicolai Søndergaard’s findings at Nansen, World Liberty’s extensive investments in established cryptocurrencies such as Ether and Aave could serve as a strategic move to bolster their credibility within the crypto sphere. By doing so, they may aim to increase investor confidence and draw in more investors, who might be influenced by the growing value of these recognized assets.

Cow Protocol’s Surging Popularity

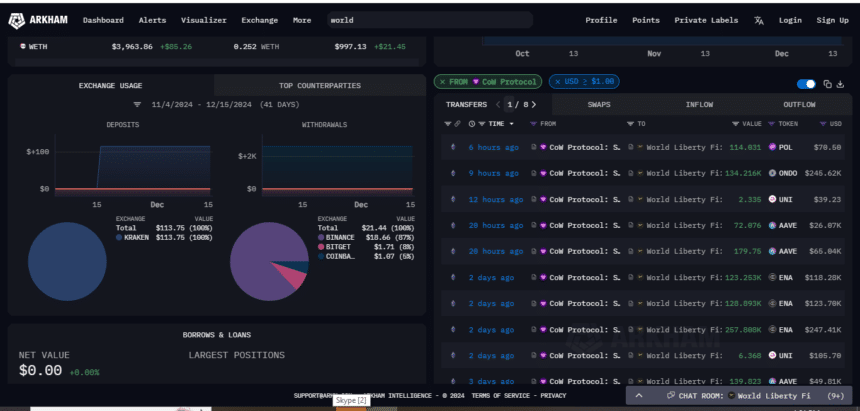

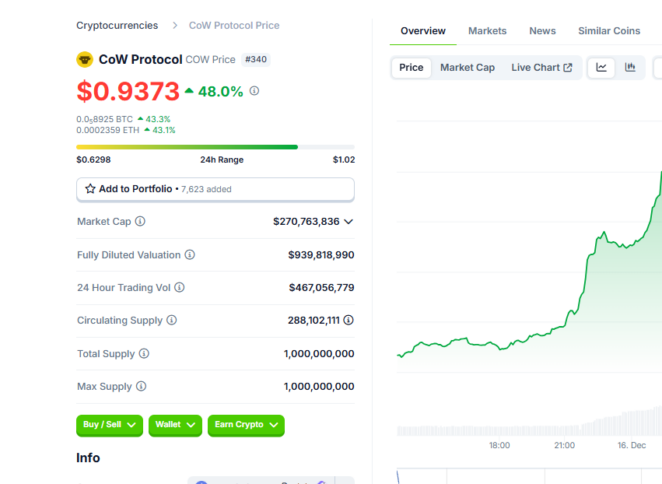

Beyond my personal shopping spree, I’ve also contributed to market fluctuations through World Liberty’s transactions using the Cow Protocol.

Cow Protocol’s tokens have experienced a significant price increase of nearly 50%, currently being worth approximately $0.9373. This surge is attributed to the Trump family’s recent purchases, which has elevated the market capitalization to an impressive $270 million and the 24-hour trading volume to a massive $467.48 million, representing an astounding 745% rise in just one day.

Read More

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- CRK Boss Rush guide – Best cookies for each stage of the event

- Mini Heroes Magic Throne tier list

- Kingdom Come: Deliverance 2 Patch 1.3 Is Causing Flickering Issues

- Athena: Blood Twins is an upcoming MMORPG from Efun, pre-registration now open

- Fortress Saga tier list – Ranking every hero

- Grimguard Tactics tier list – Ranking the main classes

- Call of Antia tier list of best heroes

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

2024-12-16 15:49