In the grand theater of cryptocurrency, where most altcoins are flailing like fish out of water, Ethena’s price stands tall, a veritable colossus amidst the chaos. While the market bleeds, with losses ranging from 8% to a staggering 20% in the last 24 hours, our dear Ethena (ENA) merely dips its toes, trading at a modest $0.40 with a mere 3% decline. Talk about a cool cucumber! 🥒

What’s the secret sauce behind this resilience? A recent fundraising fiesta, of course! Ethena has managed to charm investors and secure a whopping $100 million for the launch of iUSDe, its shiny new institutional-focused dollar-pegged token. This little gem was tucked away in December, but only now is it making headlines, thanks to Bloomberg’s sleuthing. Major players like Franklin Templeton and Dragonfly Capital Partners are in the mix, proving that even in a downturn, there’s always room for a good party! 🎉

Now, let’s talk about iUSDe. It’s not just any token; it’s a regulated version of Ethena’s existing synthetic dollar, crafted for those traditional financial institutions that want a taste of crypto without diving headfirst into the digital deep end. Guy Young, the mastermind behind Ethena Labs, spilled the beans in a January blog post.

And wait, there’s more! A source close to the action revealed that some of the proceeds from this token sale will be funneled into developing Ethena’s very own blockchain. Because why not? 🚀

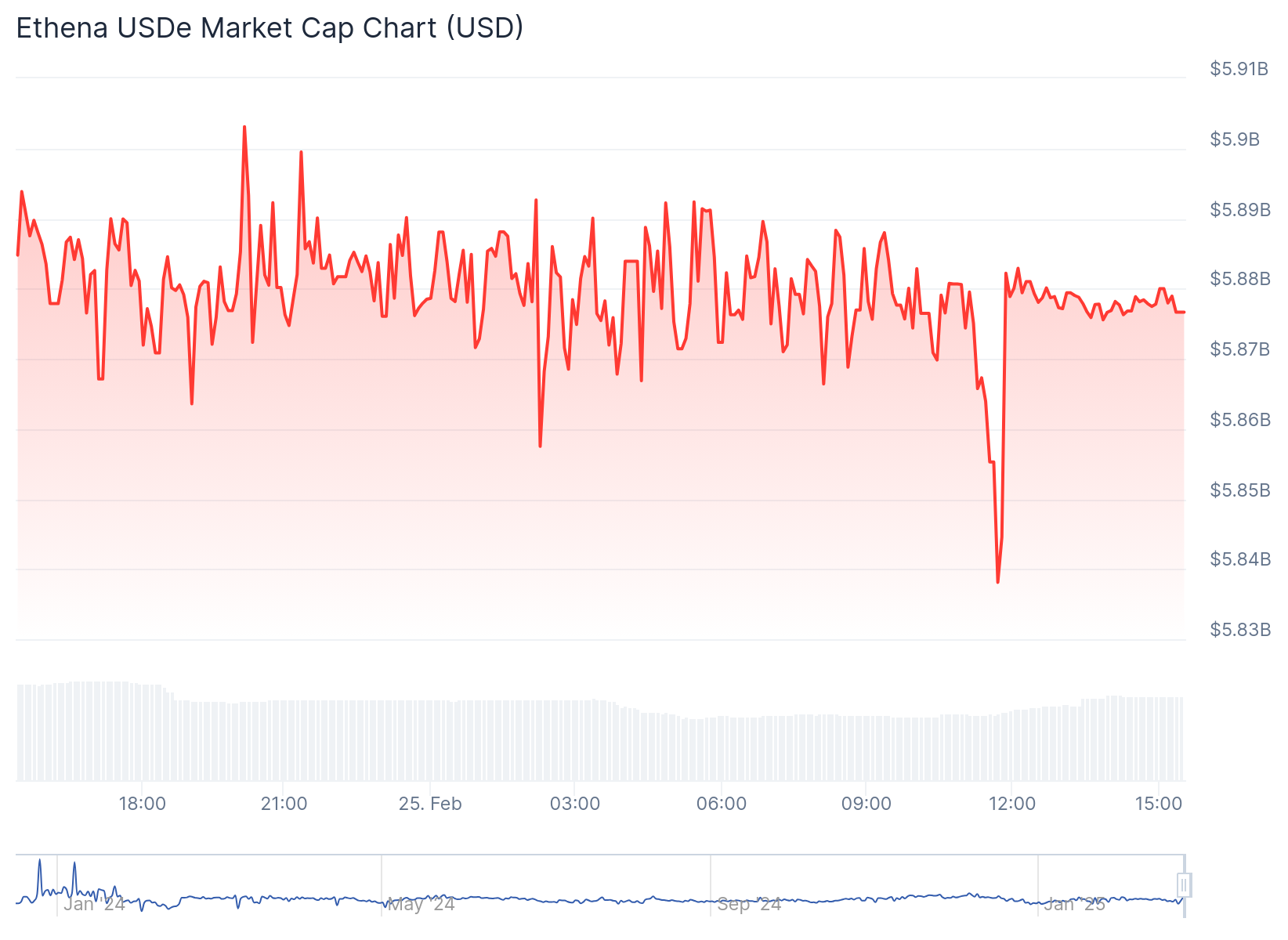

But hold your horses! Another reason for ENA’s price resilience is the insatiable demand for Ethena’s existing stablecoin, USDe. With a market cap flirting with $6 billion, USDe is the belle of the ball, generating substantial yields even when the market is throwing tantrums. Once upon a time, yields peaked at 60%, but now they’ve settled around a cozy 9%. Still better than your grandma’s savings account! 💸

From the technical trenches, trader AlejandroBTC is waving a flag of optimism for ENA’s price trajectory. He’s noted that the asset is nestled within a familiar accumulation range, reminiscent of a previous 300% surge to $1.25 back in December 2024. If history is any guide, we might just be on the brink of another wild ride! 🎢

$ENA a good buy in this area for accumulation, better to stack and forget it imo.

— Alejandro₿TC (@Alejandro_XBT) February 24, 2025

However, let’s not get too carried away. Ethena’s long-term sustainability is as uncertain as a cat on a hot tin roof. The yield generation relies on the basis trade strategy, which dances to the tune of market conditions. When funding rates are high, the yields soar, but in a bearish market, well, let’s just say it’s a bit of a rollercoaster. 🎢

Read More

2025-02-25 15:50