- Oh dear, short-term holders are making a swift exit, darling! Reduced speculative appetite and weak near-term conviction, how…tedious. 🙄

- Liquidation clusters are building near $80K, because, of course, they are. Increasing risk of cascading sell-offs, how delightfully dramatic! 🎭

Bitcoin‘s [BTC] price was teetering just above $83K, a mere whisper away from disaster, as of the 4th of April. 📆

The entire crypto market, a veritable powder keg, is on edge, with signs pointing to a possible drop below $80K. And if that happens, technical models suggest a slide toward the $68K zone could follow, because why not, really? 🤷♂️

A Bitcoin Rally that was DOA, Sweetheart

In the case of BTC, the asset surged to $88,580 after President Donald Trump announced sweeping tariffs, because, well, Trump. 🙃 But the rally was as short-lived as a summer fling.

Prices fell sharply as traders weighed the risks tied to global trade uncertainty, aka the ultimate party pooper. 🎉

Not to mention, markets reacted faster than a debutante at a ball. The S&P 500 dropped 4%—its biggest daily loss since the pandemic lockdowns. Roughly $3 trillion in value was wiped out across U.S. stocks, oh the humanity! 🤑

Of course, crypto didn’t escape the panic, because it never does, darling. Bitcoin fell to $82,220 that same day and has struggled to reclaim higher ground since, poor dear. 🤕

Is $80K the New Maginot Line, Then?

Recent data shows buyers defending the $80K zone, but technical signals like the death cross are flashing caution, like a stern nanny. 🚨

Another concern comes from realized price data, because one can never have too many concerns, darling. 🙅♂️

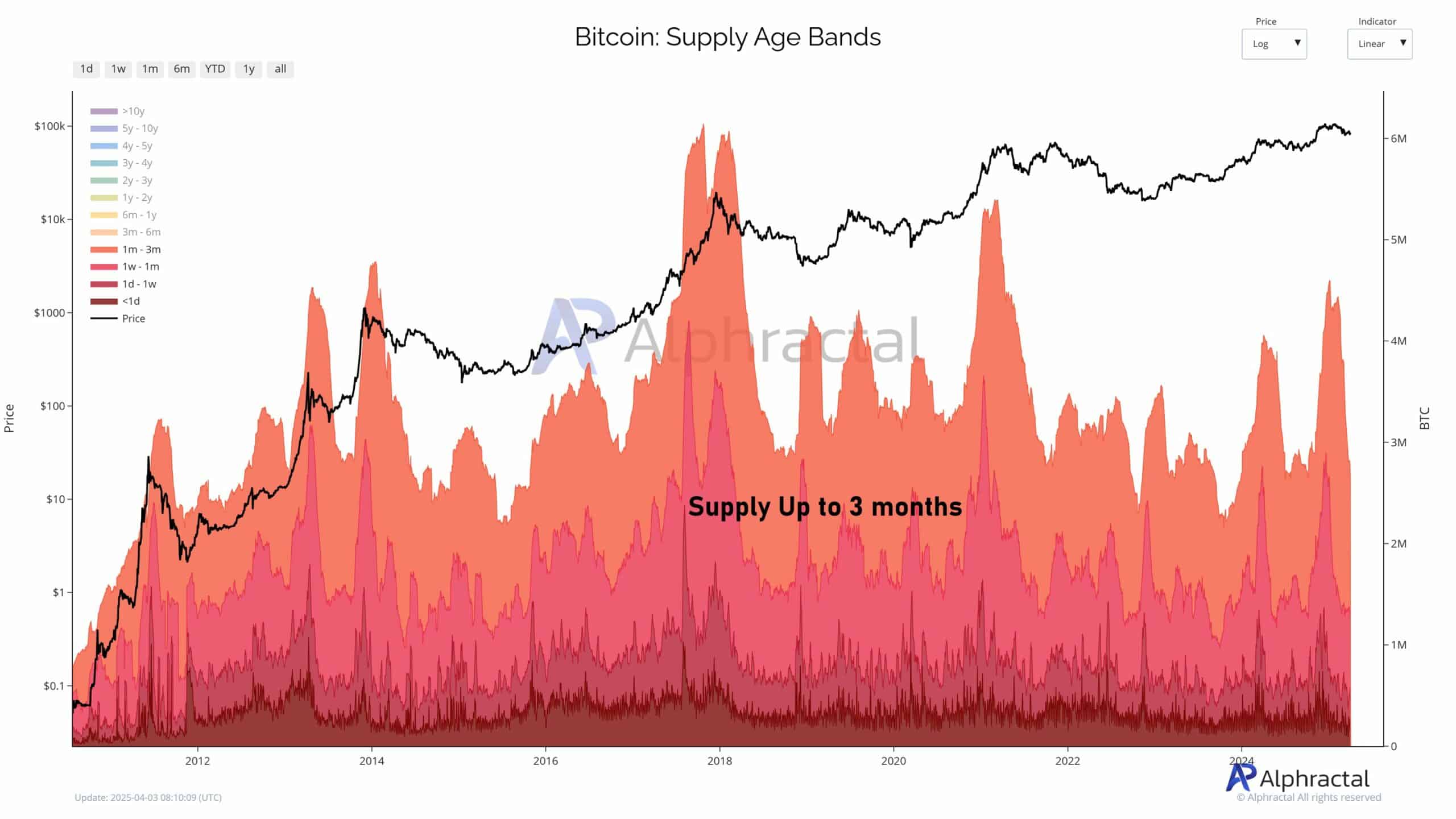

There’s a steep drop in coins held for less than three months. These short-term holders, historically tied to bullish phases, are now fading faster than a ghost at dawn. 👻

In the past, spikes in short-term holder supply led Bitcoin’s biggest bull runs, but now? *cricket sounds* 🦋

At the time of writing, that figure had dropped below 15%, a decline that suggests reduced speculative interest and reflects a broader market cool-down, or as I like to call it, a ‘yawn’. 😴

BTC Open Interest Sinks, and So Does Hope, Apparently

Moreover, Open Interest has dropped 37.5%, falling from over $80B to below $50B since late 2024, mirroring Bitcoin’s slide from $106K to $84K, a veritable waltz of despair. 💔

Without leverage, price swings tend to shrink, but when liquidation clusters build, sharp moves can still occur, like a surprise party, but not the fun kind. 🎂

Liquidation heatmaps show where leveraged trades could unwind, and a recent 7-day heatmap shows a heavy build-up of long liquidations just below $80K, because of course it does. 📉

If Bitcoin loses $80K with volume, a cascade toward $68K is likely, per analyst Joao Wedson, who probably knows more about this than I do, darling. 🙏

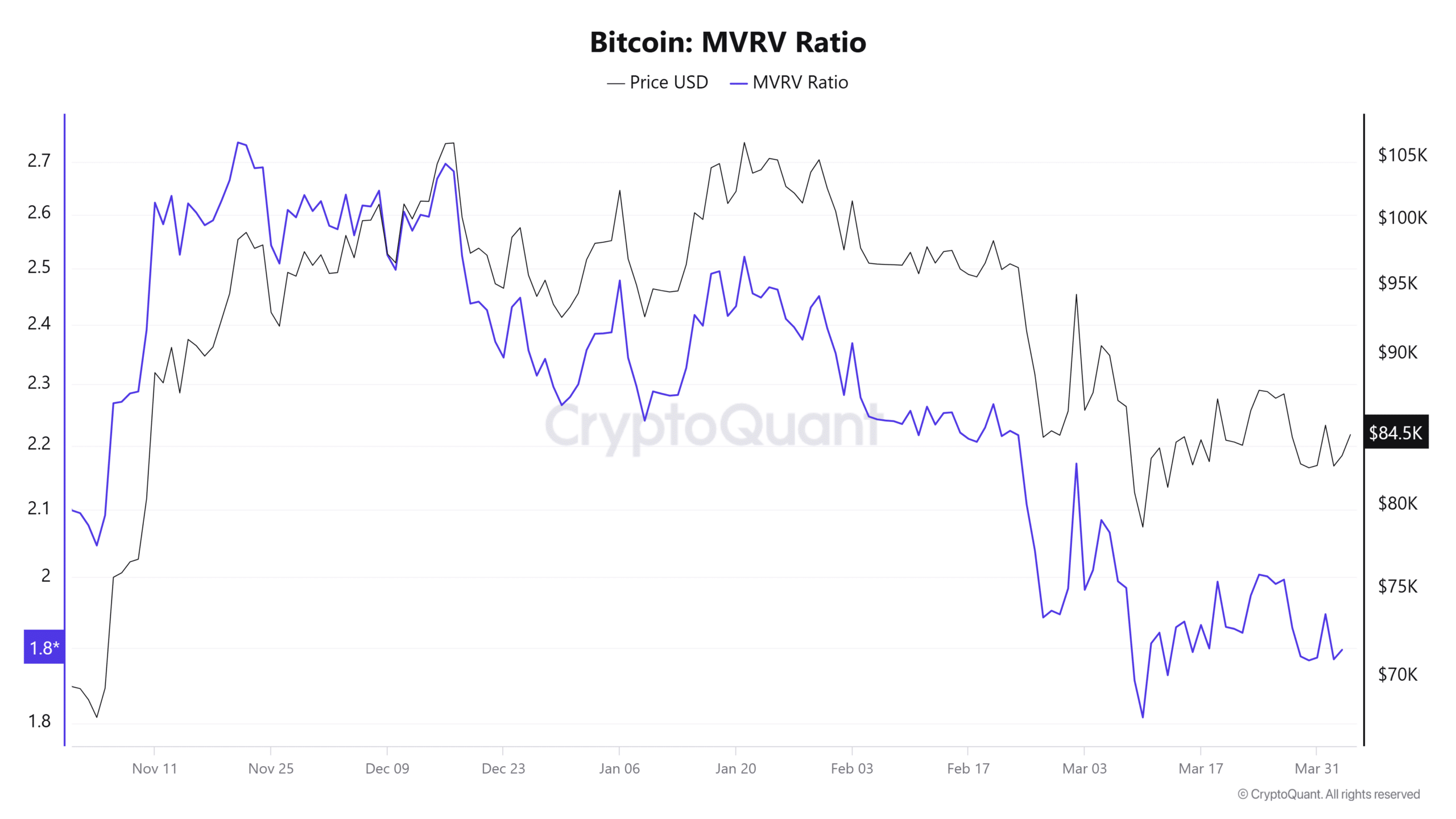

The MVRV Wake-Up Call, or Not

Another red flag, because we’re not done yet, sweetie, is the MVRV Ratio, which has fallen from 2.74 in November to below 2.0 in April, signaling fading speculation and a shift toward long-term holding, aka the crypto equivalent of a warm blanket. 🧸

In fact, exchange netflows tell a similar story, one of outflows dominating, signaling that investors are moving coins to cold storage, not preparing to sell, or so it seems, darling. 🤫

For example, on the 3rd of February alone, over 60,000 BTC exited exchanges, a single-day outflow that’s almost as impressive as my wit. 😏

The takeaway, darling? Sellers are not necessarily rushing to exit, but new buyers aren’t stepping in either, a crypto conundrum, indeed. 🤔

Bitcoin’s position above $80K is as fragile as a socialite’s ego, and if that level breaks, a move to $68K could follow, as bearish signals align, like a perfectly choreographed ballet, but not the fun kind, sweetie. 🩰

With leverage fading and macro risks rising post-tariff, the next few days may decide whether this is a short-term dip or the start of deeper consolidation, or as I like to call it, ‘crypto limbo’. 🤹♂️

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-04-04 23:09