Ah, mon cher ami, the market has been quite the rollercoaster ride, n’est-ce pas? Intraday data reveals a tumultuous day for our beloved UNI, with a sudden drop of nearly 8% in a single session! At the moment, the asset is trading just below $6.94, leaving traders and investors with a sense of caution.

Intraday Breakdown Highlights Market Fragility

In a recent post, our esteemed analyst Crypto Signals (@crypto_signals) has identified a sharp breakdown in UNI’s short-term structure. Using a 5-minute candlestick chart captured at 14:20 UTC on July 4, 2025, the analyst noted a rapid decline from $7.22 to below $7.00 within minutes. The chart shows a cluster of steep red candles, indicating heavy intraday selling and possible stop-loss triggers.

//bravenewcoin.com/wp-content/uploads/2025/07/Bnc-Jul-5-82.jpg”/>

The nature of this move indicates short-term market weakness, with possible liquidity gaps contributing to the sharp descent. Traders now watch for a potential rebound toward $7.10, which remains a nearby resistance point.

Uniswap Price Prediction: Price Action Extends Bearish Trend

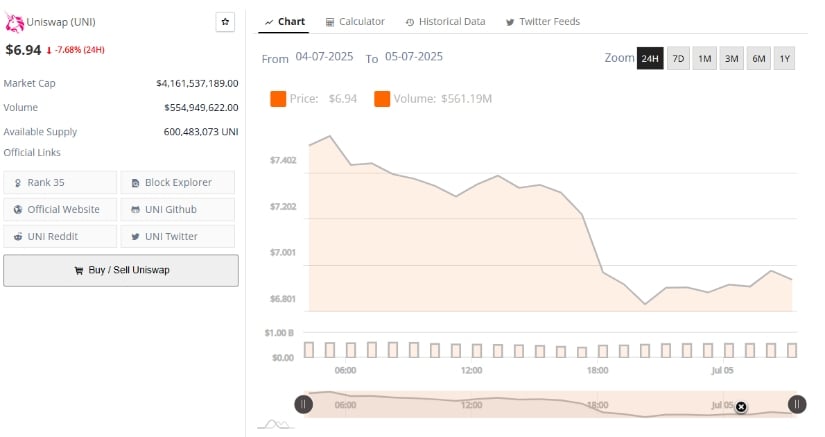

The 24-hour chart for UNI from July 4 to July 5 confirms an extended bearish trajectory, with the token falling from above $7.40 to a closing price of $6.94, reflecting a 7.68% loss. The chart reveals sustained selling throughout the session, particularly after breaching the key $7.00 threshold. Price movement remained unidirectional for most of the day, with no significant upward reversals, highlighting prevailing bearish momentum.

Trading volume reached $561.19 million, nearly matching the previous day’s level of $554.9 million, indicating active participation despite the downtrend. However, most of this volume appeared on the sell side, and there was little evidence of support-building during the decline.

Uniswap’s market capitalization dropped to $4.16 billion, suggesting broader market skepticism or capital outflows from DeFi-related assets. For recovery to materialize, UNI would need to reclaim the $7.10–$7.20 zone with stronger buyer engagement.

Technical Indicators Signal Elevated Risk

The daily chart for UNI/USD shows that Uniswap closed at $6.933 on July 4, marking a 7.25% decline. A wide-bodied red candle and minimal lower wick confirm strong seller control from the session high of $7.635.

The price broke below the 20-day Simple Moving Average (SMA) of the Bollinger Bands ($7.085), indicating bearish positioning within the current volatility envelope. UNI now trades closer to the lower band, suggesting potential testing of the next major support zone around $6.35.

The Awesome Oscillator (AO) remains marginally positive at 0.192, but red histogram bars suggest weakening bullish momentum. While the AO still sits above zero, a continuation of red bars could lead to a bearish crossover.

This would signal a growing downward momentum and raise the likelihood of a deeper correction. If UNI fails to regain footing above the $7.08 midline, further downside toward $6.35–$6.00 could unfold. A price rebound would require both volume confirmation and improvement in the AO’s trajectory to reestablish upward momentum.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

2025-07-06 00:34