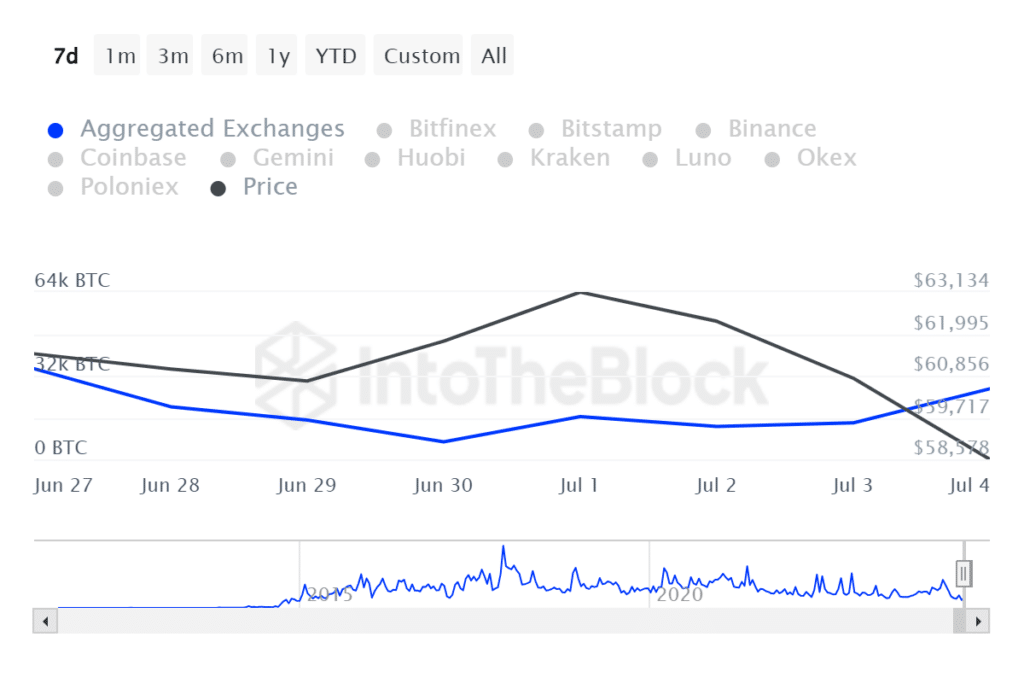

As an experienced financial analyst, I’ve closely monitored the cryptocurrency market, and the recent selling pressure on Bitcoin is a cause for concern. The data from IntoTheBlock is particularly troubling, with over 21,000 Bitcoin transferred to centralized exchanges in just one week, amounting to approximately $1.2 billion.

Bitcoin faced persistent selling pressure as deposits into exchanges grew, indicative of a bearish market outlook.

As a data analyst, I’ve examined the latest figures from IntoTheBlock, and the findings are noteworthy. In just the past week, crypto investors have transferred over 21,000 Bitcoin (BTC) to major exchanges such as Binance and Coinbase. The monetary value of these transactions reached an approximate $1.2 billion, with BTC trading around $55,000 on Friday.

Why is Bitcoin down?

The significant 21% drop in Bitcoin’s value over the past month can be attributed to various reasons, including intensified selling from investors due to economic uncertainties, institutional weakness, government interventions, debt settlements, and overall market volatility.

The inflation figures in the United States indicated a deceleration, yet didn’t meet the threshold for the Federal Reserve to lower interest rates. Instead, the central bank kept its firm monetary stance, diminishing investor confidence while they await the Fed reaching its 2% inflation goal.

As a researcher studying the cryptocurrency market, I’ve observed that after the block rewards were halved, reducing miner income by half, many miners had to sell large quantities of crypto to cover operational costs. Despite Bitcoin remaining below its March peak of $73,000 and exhibiting sideways or downward trends since April, mining stocks experienced significant losses during this period.

As a researcher studying Bitcoin Exchange Traded Funds (ETFs), I’ve observed that the flows into these investment vehicles have slowed down. Moreover, trading activity for Bitcoin-backed products on Wall Street has followed the price trends, according to ETF authority James Seyffart.

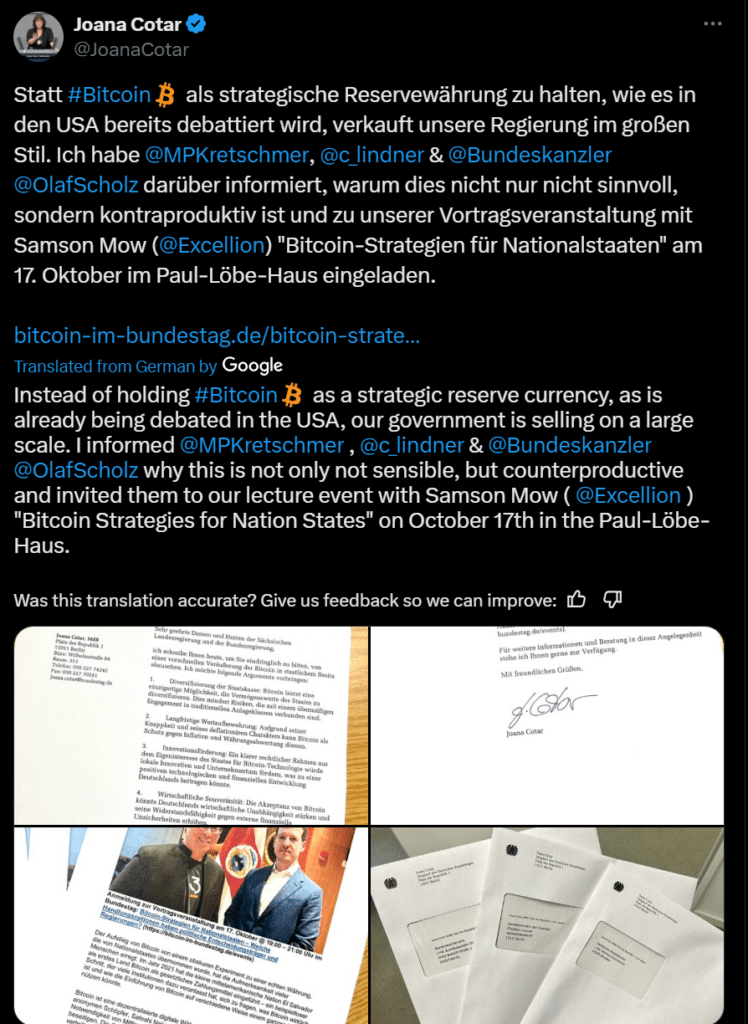

Over the past fortnight, officials from both Germany and the United States have transferred large quantities of Bitcoin to cryptocurrency exchanges. A German politician has voiced opposition to the government’s sale of Bitcoins, advocating instead for their use as a financial reserve.

In the United States, authorities transferred $240 million worth of confiscated Bitcoin from the Silk Road case to Coinbase. Normally, such transactions are initiated by entities intending to sell in public markets. It’s also been pointed out that the U.S. government employs a platform that has faced SEC lawsuits for alleged regulatory breaches.

The decline of 2% in Bitcoin’s value on Friday can be linked in part to Mt. Gox’s repayment process. According to crypto.news, this now-defunct cryptocurrency exchange initiated user compensation ten years after one of the biggest Bitcoin heists occurred.

The widespread downturn in the cryptocurrency market is primarily driven by Bitcoin’s decline over the past few months. According to IntoTheBlock, this dip resulted in a loss of 8% within the last 24 hours and brought the total market value down to $2 trillion – its lowest point in the past five months. Despite this recent setback, cryptocurrencies have seen substantial growth, increasing by 24% over the previous six months and an impressive 73% in the last year.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

2024-07-05 18:02