As a seasoned researcher with years of experience tracking the cryptocurrency market, today’s events have been a rollercoaster ride. The sudden dip and subsequent recovery are reminiscent of the volatile nature of this digital frontier that I’ve grown to love.

Earlier today, there was an unexpected drop in the cryptocurrency market, leading to a surge in the number of forced sales (liquidations). However, it appears that this downward trend may be slowing or even reversing.

Based on figures from CoinGlass, approximately $178 million in cryptocurrencies were liquidated within the last day, signifying a substantial 292% rise compared to previous periods. The majority of these losses, amounting to around $153 million, were suffered by optimistic traders who held long positions.

As an analyst, I’m observing a 2% decrease in the total open interest within the cryptocurrency market over the last 24 hours. At present, this figure stands steadily around the $55 billion mark.

As a crypto investor, I’ve noticed from the data that a significant number of liquidations have occurred predominantly in the positions held by retail traders. Interestingly, the single largest liquidation, valued at a staggering $2 million, was executed on the OKX platform.

In terms of liquidations, Ethereum (ETH) currently tops the list at around $55 million, while Bitcoin (BTC) trails behind with approximately $35 million.

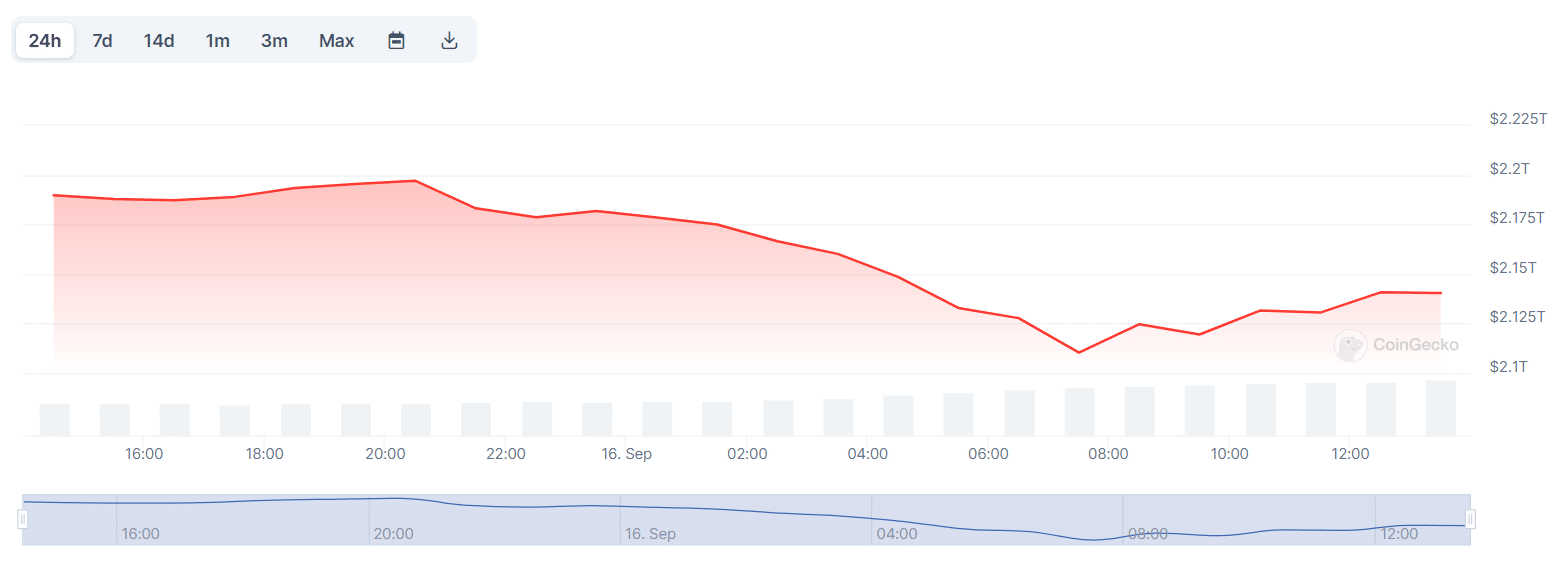

Over the last day, significant sell-offs have led to a drop in the crypto market. As per data from CoinGecko, the total global cryptocurrency market value has decreased by 3.6% and currently stands at approximately $2.14 trillion.

Bitcoin dropped to an intraday low of $58,150 but soon regained momentum to the $59,000 mark.

As reported by CryptoQuant, the amount of Bitcoin wallets transferring funds to exchange platforms has decreased to approximately 132,100 – a figure not observed since the year 2016.

The number of depositing addresses for Bitcoin exchanges is at its lowest since 2016, which may imply fewer investors are selling their coins immediately on these platforms. This could suggest a decrease in the pressure to sell.” – Paraphrased by AI Assistant

— CryptoQuant.com (@cryptoquant_com) September 16, 2024

The gauge suggests that fewer people are selling Bitcoin, which typically means reduced selling pressure and less volatile price movements.

According to an article published by Crypto News on September 15th, more than $1.3 billion in Bitcoin was withdrawn from centralized platforms during the past week. The current trends and signals from Bitcoin’s on-chain activity suggest a possible increase in its value (bullish momentum).

However, macro events could still shift the market direction despite the bullish investor sentiment.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2024-09-16 13:28