As a seasoned analyst with over two decades of experience in the stock market, I have seen my fair share of bull runs and bear markets. The current situation with MicroStrategy (MSTR) is quite intriguing. On one hand, the stock has experienced a significant pullback despite Bitcoin reaching record highs, which is unusual given their strong correlation.

Despite Bitcoin hitting an all-time high this year, the share price of MicroStrategy has fallen by 27%, marking a significant decrease from its peak in 2021.

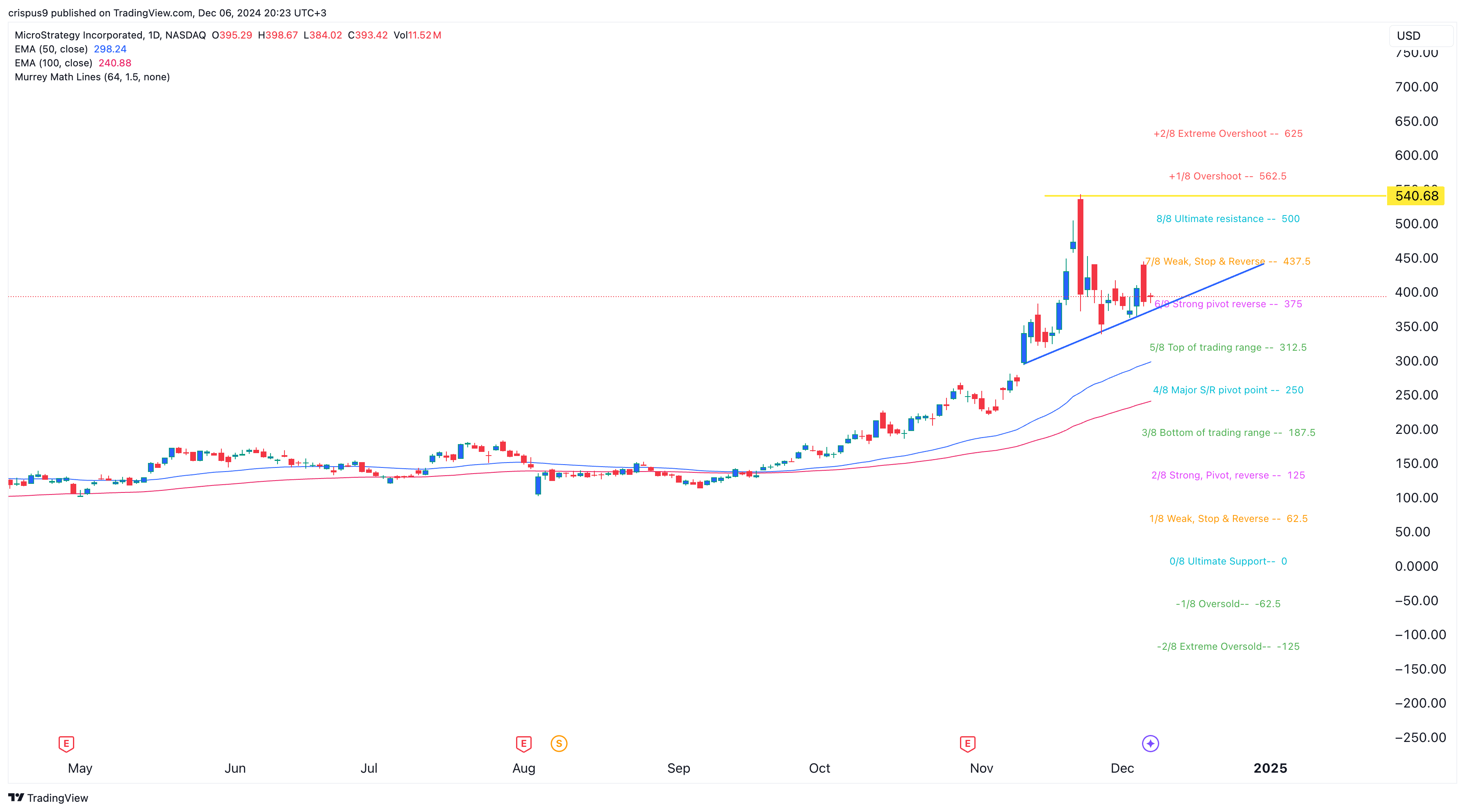

On December 6th, MSTR shares were being traded at $390, marking a continuation of a downward trend that started on November 21st when the stock reached its peak price of $541. Despite this recent dip, MicroStrategy has been one of the top-performing stocks in 2021, boasting an impressive increase of over 500% and a market capitalization surpassing $91 billion. Additionally, it holds the title of the highest gainer within the Russell 2000 index.

Two plausible explanations exist for the stock’s dip this month. The first could be that investors are cashing out their profits, given the stock’s upward trend.

It’s worth noting that investors might express apprehension regarding its valuation, currently estimated at approximately $91 billion. This high value seems disproportionate when you consider MicroStrategy owns roughly 402,100 coins, valued under $40 billion. Consequently, there exists a substantial gap of around $50 billion that the struggling original data analytics business may not be able to bridge.

Consequently, certain investors think it’s likely that the company’s value will decrease over time so that it aligns more closely with the worth of its Bitcoin holdings.

Despite some reservations, many Wall Street experts remain hopeful that there’s further growth potential in the stock. As reported by Yahoo Finance, analysts from firms like Cowen, Barclays, Benchmark, and Bernstein are particularly optimistic. The average prediction for the stock price stands at $492, which is above its current value of $390.

As a crypto investor, I’ve noticed that MicroStrategy’s stock performance seems to echo the trends of other companies heavily invested in Bitcoin. For instance, Marathon Digital, holding the second-largest amount of Bitcoin, has dropped by approximately 14% from its November high. Similarly, Coinbase, Riot Platforms, and Hut 8 Mining have all seen their shares pull back too.

What next for MSTR stock?

MicroStrategy’s shares have experienced a dip, nevertheless, they continue to hover over an upwardly trending line that connects their lowest points since November 11th. Moreover, it’s worth noting that the stock is also above both its 50-day and 100-day moving averages, which indicates a possible foundation for further growth.

As an analyst, I’ve noticed that the stock has hit a significant turning point based on the Murrey Math Lines tool, often referred to as a strong pivot reverse point. If Bitcoin continues its upward trend, it’s likely we might witness a rebound in this stock. This is according to the expectations of many analysts.

If this event transpires, it’s expected that the stock price could further escalate, with buyers aiming for a new peak of $540. Exceeding this figure would suggest additional growth, possibly reaching an exaggerated high of around $625.

Instead, if the price falls below the upward trendline, it might signal a potential change in direction and a decline toward the 100-day moving average at $240. This price point aligns with a significant support and resistance level according to Murray Math Lines.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-12-06 21:18