This week, the value of Bitcoin plummeted due to continued uncertainty over the bond market and the Federal Reserve’s perceived tough stance.

As a crypto investor, I’ve noticed a significant dip with Bitcoin (BTC) dropping below the $95,000 mark, which seems to have sparked a more intense sell-off among altcoins. Nevertheless, there are encouraging indicators suggesting that this digital coin might rebound and potentially reach as high as $122,000 by January.

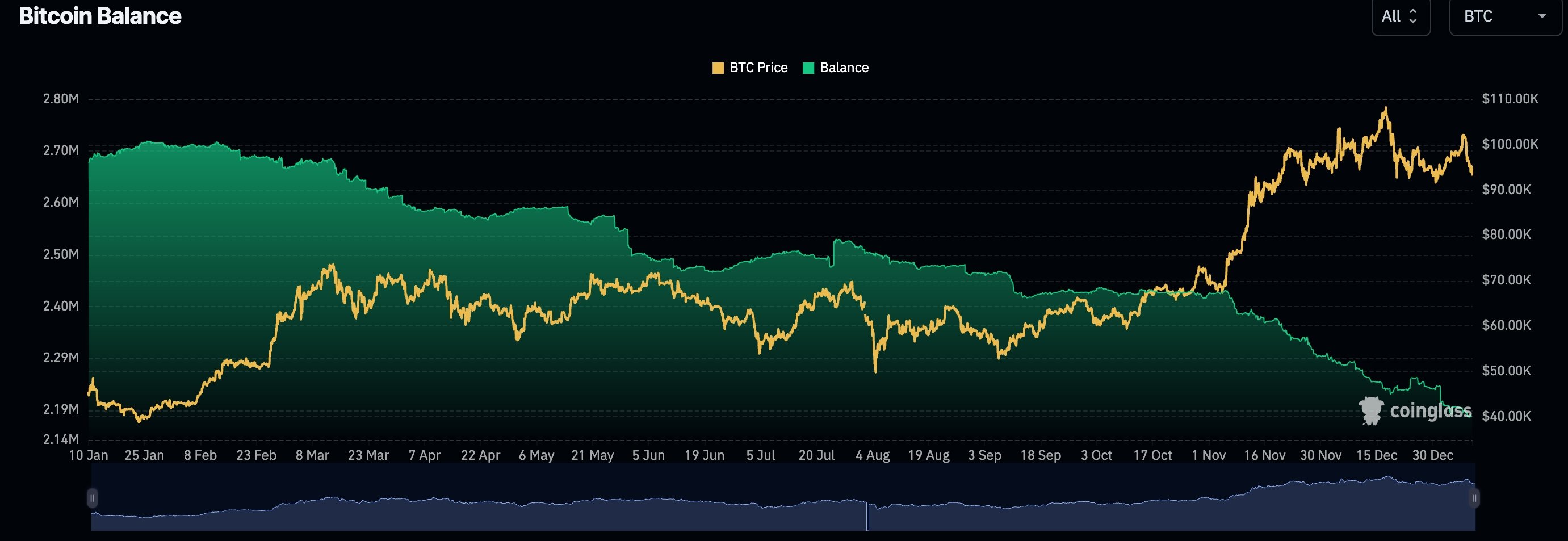

Bitcoin balances on exchanges are falling

A significant factor that could potentially cause Bitcoin’s price to increase in January is the persistent discrepancy between demand and supply. This year, we have seen a steady upward trend in demand, which is indicated by increasing investments in Bitcoin-related Exchange Traded Funds (ETFs).

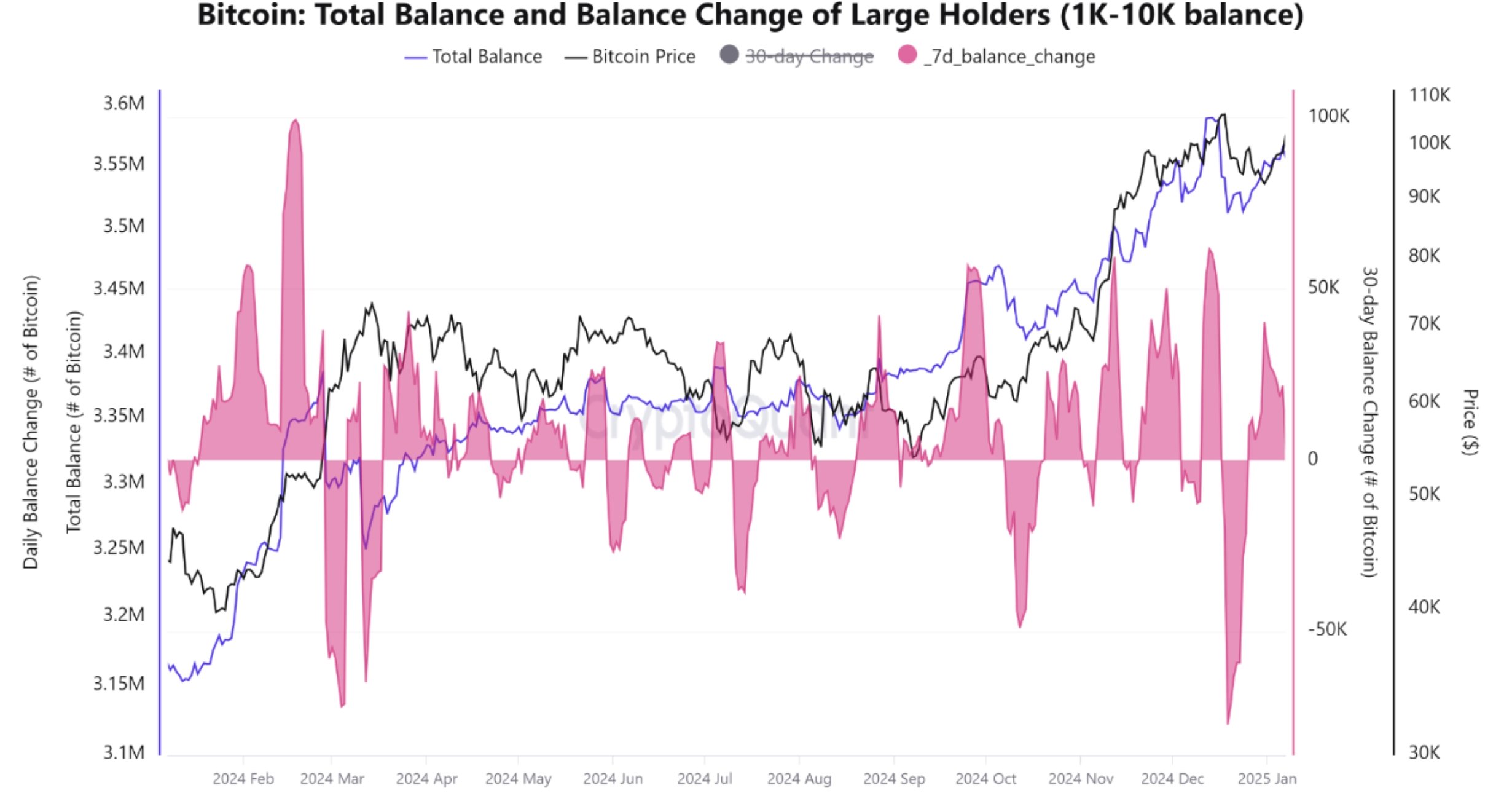

This year, Bitcoin ETFs collectively have amassed approximately $1.3 billion in assets, and companies such as MicroStrategy have persistently risen. Additionally, significant Bitcoin investors (often referred to as “whales”) have been steadily increasing their holdings, accumulating an additional 34,000 coins since December.

The amount of Bitcoin available for trading is diminishing, as indicated by the reduction in Bitcoin balances on cryptocurrency exchanges. As per CoinGlass, the quantity of BTC coins stored on these platforms has reached a multi-year low, currently standing at approximately 2.1 million, down from 2.72 million in January 2024. Consequently, this discrepancy between demand and supply could potentially lead to advantages for Bitcoin in the near future.

FTX distributions and Donald Trump inauguration

A significant factor influencing Bitcoin’s price is the impending distribution of approximately $16 billion from the FTX Estate to investors and creditors. This sum is primarily stored in stablecoins such as Tether (USDT) and USD Coin (USDC). Some recipients might choose to convert these into cash, but a portion may opt for cryptocurrencies like Bitcoin instead.

Moreover, Donald Trump’s inauguration on January 20 could mark the beginning of a fresh wave of crypto regulations. Although many market participants may have already factored in these changes, there is a possibility that Bitcoin (BTC) and other altcoins might increase before this event takes place as well as following Gary Gensler’s departure from his position.

Bitcoin price has strong technicals

Bitcoin’s technical signs point towards a possibility of continued growth in January. On the weekly graph, BTC has created a bullish pennant figure, indicated in blue. This pattern is characterized by a long straight line followed by a triangle-like compression. The recent price movement reflecting a pause is all part of this pennant configuration.

The upward trajectory of Bitcoin is being sustained by its 50-week and 100-week Exponential Moving Averages, indicating a strong bullish trend continues. Furthermore, the Market Value and Relative Value Indicator has shifted to 2.4, suggesting that it remains undervalued.

Firstly, it’s worth noting that Bitcoin hasn’t hit the goal set by its cup-and-handle chart pattern yet. The ‘cup’ formation in this context has a 75% depth. If we measure from the top of the cup, it suggests a potential target price of approximately $123,000.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Gold Rate Forecast

- Every Upcoming Zac Efron Movie And TV Show

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Silver Rate Forecast

- USD CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- EUR USD PREDICTION

2025-01-09 17:07