As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the meteoric rise of Sui (SUI). Having closely followed its journey since its inception, I must admit that this blockchain network has proven to be quite the surprise package.

Suisei, a well-known blockchain platform, has recently been among the top performing cryptocurrencies. It’s reached a five-month peak in its value.

For the past three weeks, the value of the SUI token has been on an upward trend, increasing more than 240% from its all-time low in August. This surge has boosted its market capitalization to over $4.17 billion.

1. DeFi ecosystem is growing

Sui, sometimes compared to Solana (SOL), is thriving thanks to increasing interest among users and developers. Outside sources demonstrate that the value locked within its decentralized finance system has skyrocketed to an all-time high of $860 million, a significant increase from $383 million in August.

Among the standout Sui decentralized applications (dApps) experiencing an increase in assets are Suilend, Scallop Lend, and Cetus, amassing a combined value of more than $137 million in assets.

Additionally, Sui has pulled in approximately $378 million in stablecoins, a figure that is expected to grow as they have now initiated the use of Circle’s USD Coin.

🎉Exciting News: Circle’s native USD Coin ($USDC) will be making its appearance on Sui soon! 🌟

— Sui (@SuiNetwork) September 17, 2024

Moreover, Sui’s decentralized trading platforms are experiencing a surge in activity, largely because of their affordably priced transactions. The volume surged by 50% within the past week to reach $428 million, positioning it as the 9th largest player in the sector. It has managed to outperform well-known blockchains like Tron and Avalanche.

As a researcher delving into this ecosystem, I’ve observed a significant surge in network activities, which translates to an escalation in transaction volumes. According to Suiscan’s findings, the number of transactions has soared beyond half a million (548,000), marking a peak not seen since May. Over the past six months, this figure has increased by a substantial 21%, reaching a staggering 1.91 billion transactions.

2. Sui is becoming a big player in gaming

As I delve into the dynamic landscape of the blockchain sector, I find myself increasingly impressed by Sui’s strategic moves within the blockchain gaming niche. This sector, recognized as a promising application of blockchain technology, positions Sui as a significant player to watch in this space.

Developers have introduced various gaming resources, such as the user-friendly zkLogin tool for effortless gamer onboarding. Additionally, it offers a kiosk to allow developers to establish personalized trading guidelines. Some of its other key aspects encompass secure closed-loop tokens and simultaneous transaction processing capabilities.

As a researcher, I am particularly intrigued by the upcoming launch of a gaming console, which boasts integrated blockchain functionalities. When placing a pre-order for this console, users are invited to establish a new digital wallet. Upon receipt of the device, this wallet will securely house a one-of-a-kind Non-Fungible Token (NFT), uniquely tailored to the user’s purchase.

Speaking from my perspective as a crypto investor, I’ve noticed a significant spike in the open interest for Sui’s futures market. On September 20th, this figure reached an all-time peak of $453 million, indicating a growing interest and confidence among investors.

3. Sui has strong technicals

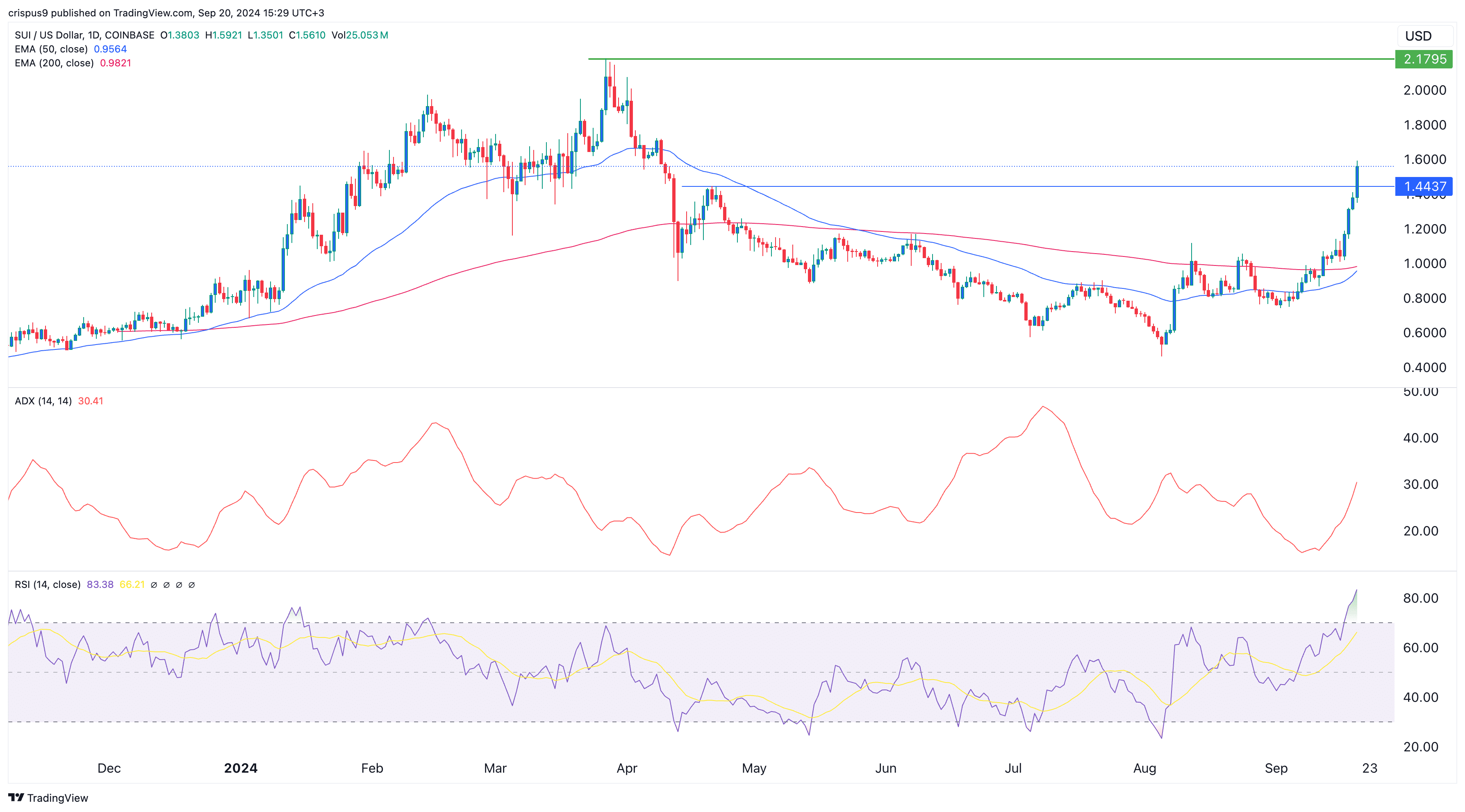

Sui leaped as well, driven by its robust technical indicators. The resurgence began on August 5, marked by the creation of a tiny hammer candlestick – a commonly recognized reversal pattern in price analysis methods.

Sui’s recent movement has seen it surpass both its 50-day and 200-day moving averages, which are on track to create a ‘golden cross.’ This technical pattern is usually interpreted as a positive or bullish signal. Additionally, the Average Directional Index (ADX) has climbed up to 30, while the Relative Strength Index (RSI) has increased to 83.

As an analyst, I’m observing some positive indicators that imply Sui could experience a bullish trend in the short term, potentially leading to an increase in its value. If this upward movement continues, we should keep an eye on the $2.17 mark, as it represents Sui’s highest swing in March and sits approximately 40% above its current level.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-09-20 16:10