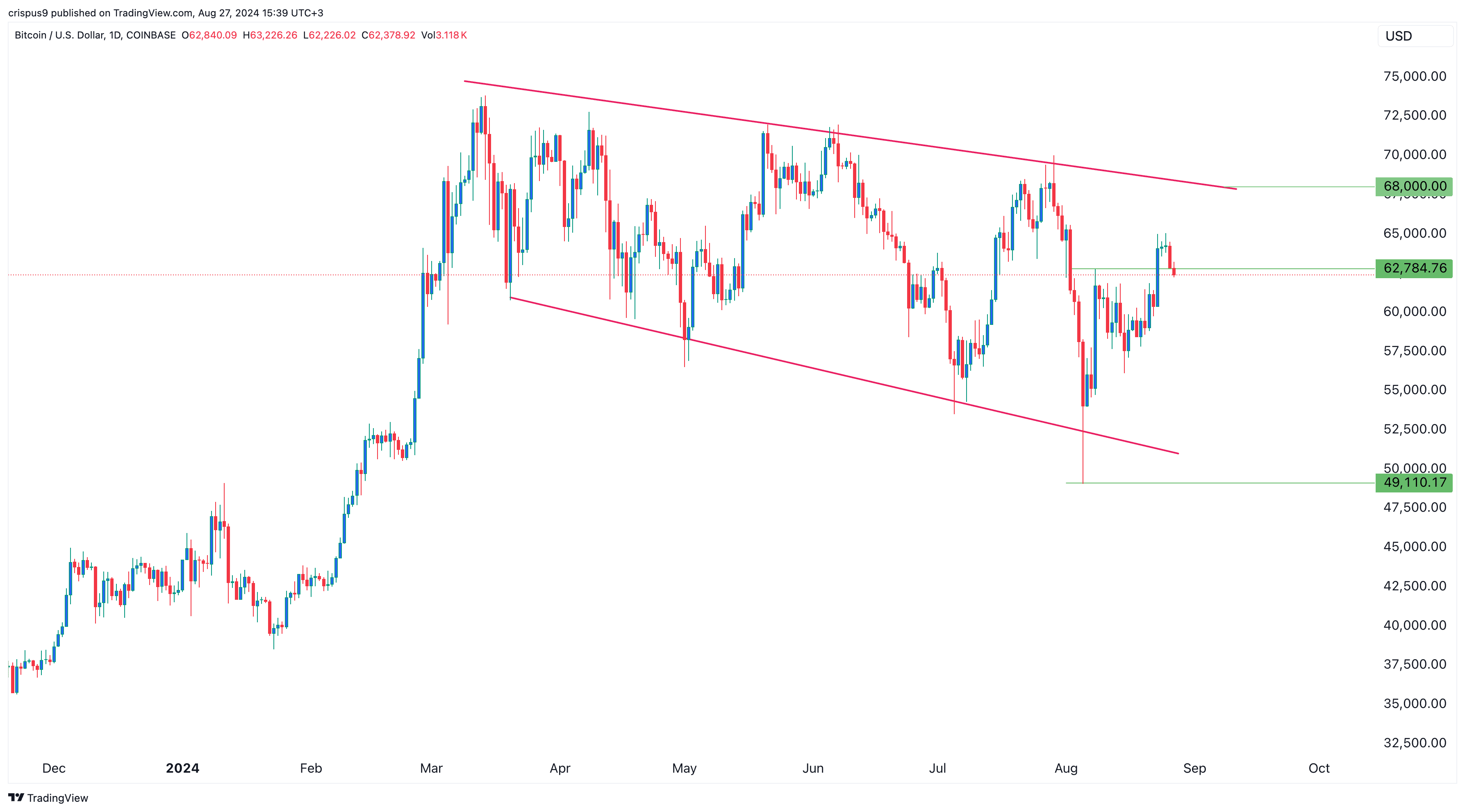

As a seasoned analyst with over two decades of experience in financial markets, I have seen many ups and downs, bull markets, and bear markets. However, my current perspective is that Bitcoin (BTC) may be poised for another rally towards the $68,000 resistance level.

As a researcher observing the financial landscape, I’ve noticed that the price of Bitcoin has seen a decline over the past two days, following the wane of last week’s positive momentum in both the crypto and stock markets.

After reaching an all-time high of $64,960 on August 26, Bitcoin (BTC) has since dropped to $62,300. Despite this dip, there are four key factors that suggest the coin could bounce back and challenge the significant resistance level at $68,000 again.

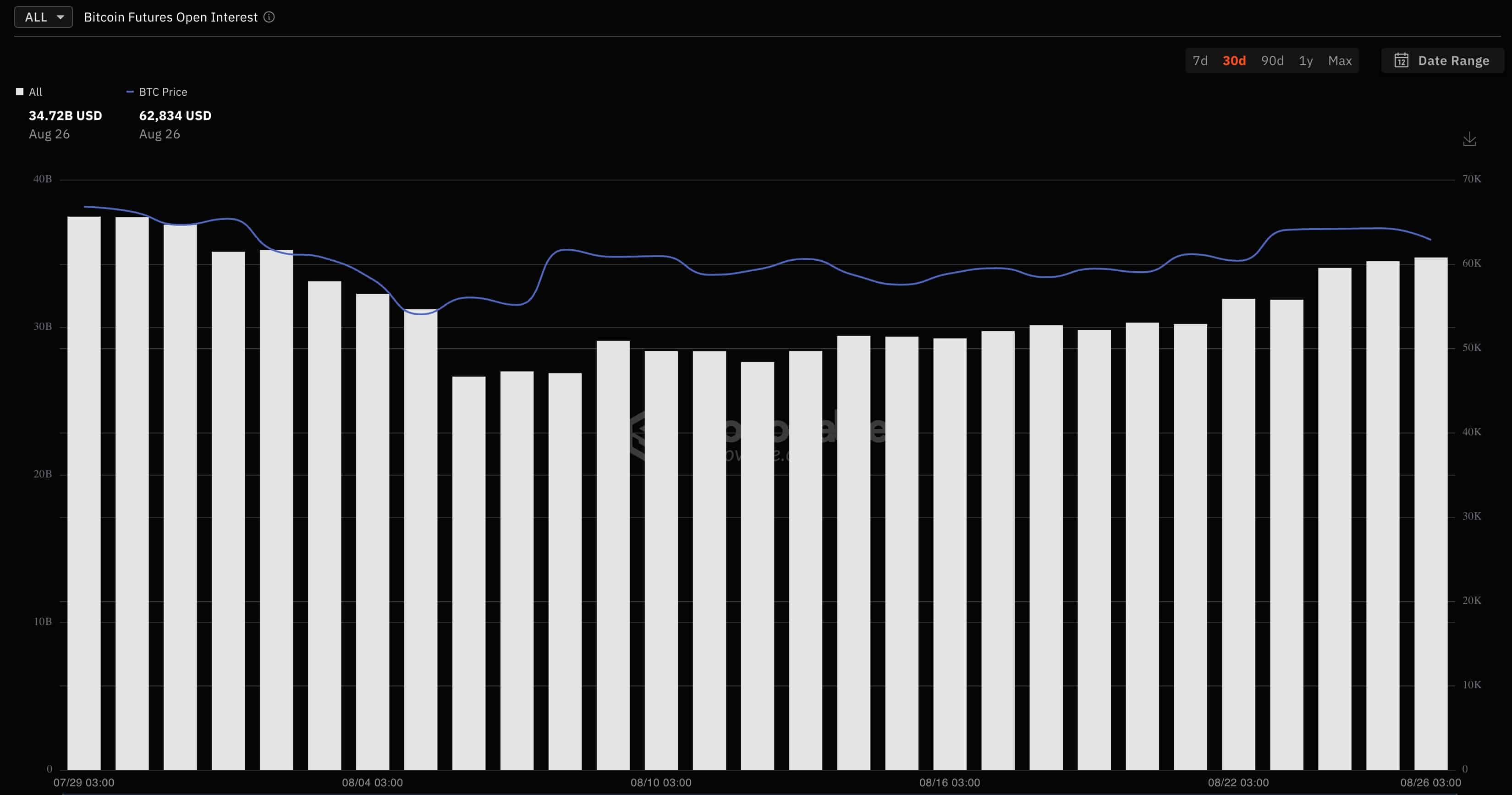

Futures open interest is rising

The data from SoSoValue indicates a significant resurgence in the demand for Bitcoin in the futures market. On August 26, interest reached an impressive peak of $34.7 billion, which is the highest it’s been since August 2, and significantly higher than the month’s lowest point on August 26 of $26.65 billion. Moreover, this surge in demand has persisted for three consecutive days.

The Open Interest in futures represents the quantity of contracts that haven’t been closed out yet. When this number is large, it means there are a greater number of traders involved in the market, suggesting increased demand from market participants.

Spot Bitcoin ETF inflows

As an analyst, I’ve noticed a consistent uptick in Bitcoin demand within the Exchange-Traded Fund (ETF) market. Interestingly, data indicates that most ETFs recorded inflows on Monday, August 26, marking the eighth consecutive day of such inflows. The total inflows surpassed $202 million, a slight increase from the $252 million recorded on Friday.

Last week, these funds boosted their total by approximately $506 million, following an increase of around $32 million the previous week. This upward trend could persist. To date, exchange-traded funds focused on Bitcoin (Spot Bitcoin ETFs) have attracted over $18 billion in investments, with the iShares Bitcoin Trust leading the way in activity.

In their latest disclosures, hedge fund giants such as Millennium Management, Citadel, Schonfeld, and Susquehanna have been found to own Bitcoin Exchange-Traded Funds (ETFs). Major Wall Street banks, including Goldman Sachs and Morgan Stanley, have also jumped on the bandwagon by investing in these Bitcoin ETFs.

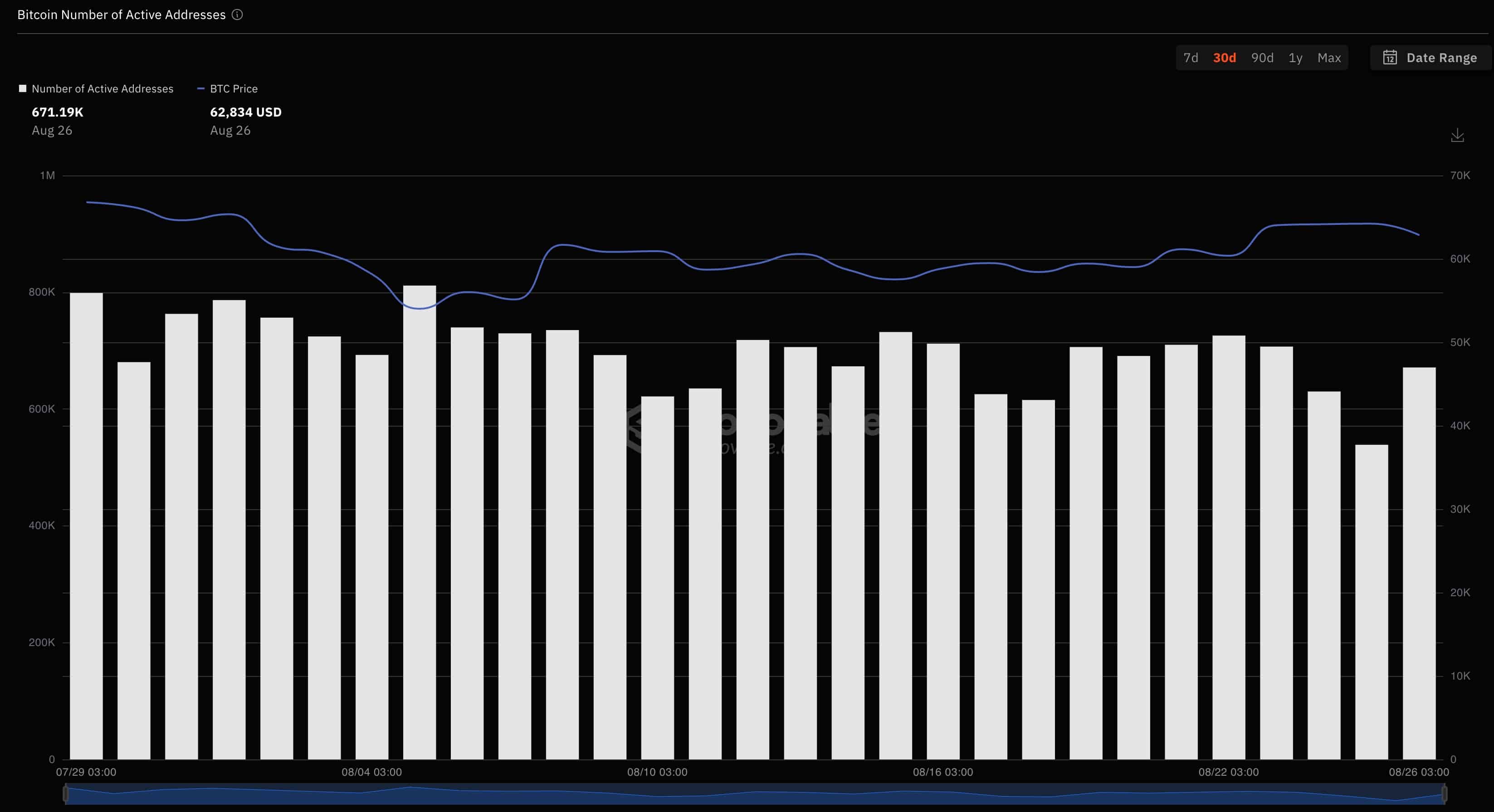

Bitcoin addresses are rising

Currently, data from blockchain indicates an increase in the number of active Bitcoin wallets. As reported by SoSoValue, this figure reached approximately 671,000 on August 6th, up from 538,000 just three days prior. The count is approaching the highest mark for the month so far, which stands at 725,000.

It appears that the number of new Bitcoin addresses being created has been increasing. On Monday alone, over 264,000 new addresses were added to the network, which represents an increase from the 253,000 recorded the previous day. This data suggests that the interest in Bitcoin within the cryptocurrency community remains strong.

Federal Reserve cuts

Moreover, Bitcoin could potentially gain from upcoming interest rate reductions, considering its historical response to such events. On Friday, Jerome Powell hinted that rate cuts might commence as early as September.

The extent of the reduction in the cut will be influenced by future data related to individual spending and employment outside farms. If the job market shows signs of weakness, it increases the likelihood of a significant 0.50% decrease.

As a crypto investor, I’ve noticed that Bitcoin tends to thrive when the Federal Reserve is reducing interest rates, much like it did in 2020 during the COVID-19 pandemic when the Fed intervened. Conversely, it saw a rise in 2017 as the Fed lowered rates and then a reverse in 2018 and 2022 when they increased. In 2028, the Fed raised rates four times, and again six times in 2022, reflecting rising inflation.

Furthermore, the figure of $68,000 holds significance as it aligns with the sequence of lower highs Bitcoin has been establishing since March. This trend started with a peak at $73,800, then dipped to $72,000 in June and further decreased to $70,000 in July. If Bitcoin surpasses $68,000, it will probably indicate a bullish breakout.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-08-27 16:04