As a seasoned analyst with over two decades of experience in the financial markets, I find the recent developments in Ethereum intriguing. The increased outflows from derivative exchanges, as highlighted by Amr Taha, suggest that institutional investors might be taking a more cautious approach towards ETH. This could potentially reduce selling pressure and decrease borrowing amounts for short positions.

After dropping below the $2,200 mark on September 7, there was an uptick in withdrawals of Ethereum from derivatives trading platforms.

Based on findings by analyst Amr Taha from CryptoQuant, approximately 40,000 Ethereum (ETH), valued around $90 million, were withdrawn from derivative exchanges over the weekend. The withdrawals commenced a few hours following the ETH price reaching a local minimum of $2,172 on Saturday, September 7th.

This suggests that a larger amount of ETH is being taken out of derivative exchanges, potentially indicating decreased pressure to sell.” – Paraphrased by MeMyselfAndI— CryptoQuant.com (@cryptoquant_com) September 9, 2024

The analyst suggests that higher withdrawals might signal a decrease in selling urgency, potentially limiting the need for additional borrowed funds to establish new short positions.

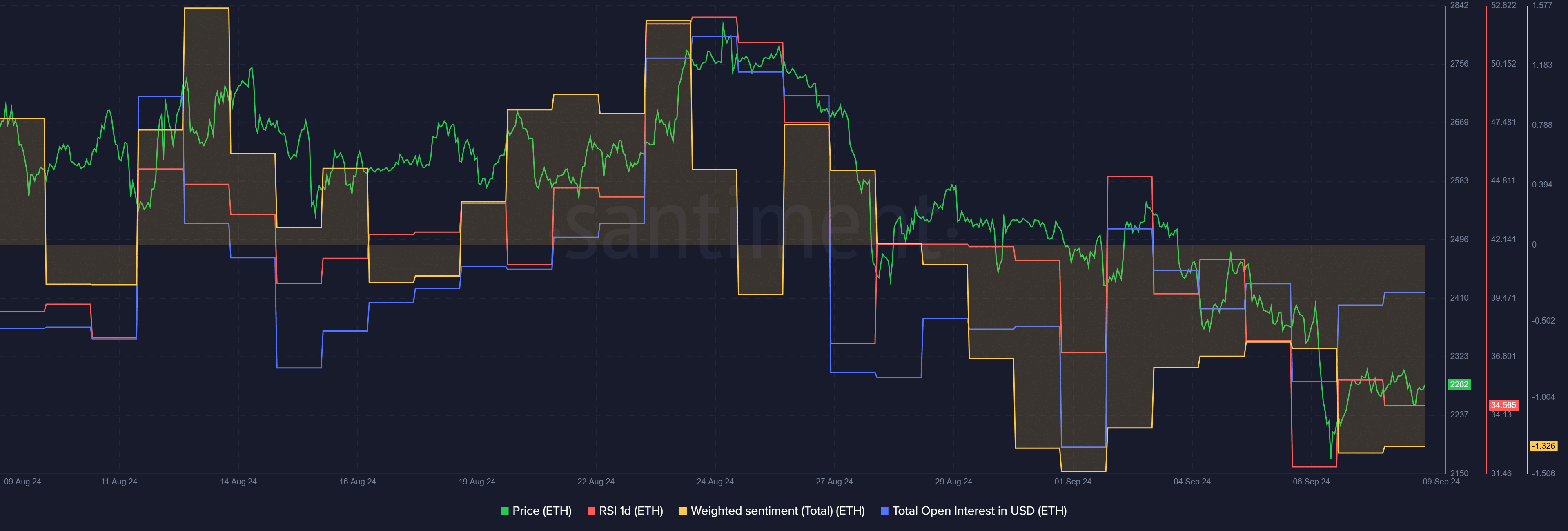

According to Santiment’s data, the total value of Ethereum (ETH) contracts open in the market dropped by approximately $171 million on September 6, reaching a level of around $4.78 billion. Interestingly, this decrease was largely recovered, and as we speak, the open interest is back up to $4.93 billion.

At the moment of this writing, Ethereum has risen by 1.3% over the last 24 hours and is being traded at approximately $2,325. In addition, its daily trading volume saw a significant increase of 33%, amounting to around $12.4 billion.

As a crypto investor, I’ve been noticing some interesting trends. According to the data from the market intelligence platform, Ethereum’s Relative Strength Index (RSI) is currently sitting at 34. This suggests that Ethereum, being the second-largest cryptocurrency, appears to be oversold at its current price point due to a lot of Fear, Uncertainty, and Doubt (FUD) circulating in the market right now.

Although there have been significant withdrawals of ETH from derivative trading platforms, the overall feeling towards Ethereum, based on Santiment’s data, is still predominantly negative.

As an analyst, I’ve noticed that Ethereum exchange-traded funds (ETFs) based in the United States experienced back-to-back withdrawals last week. Since their debut in July, these investment vehicles have seen a total of $568.5 million in net outflows.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-09 12:32