As a seasoned crypto investor with battle scars from more than a few market rollercoasters, I’ve learned to expect the unexpected – and the wild price swings we’re seeing right now are no exception. While it’s always exhilarating to witness Bitcoin’s meteoric rise, the subsequent plunge can be a harsh reminder of the volatility that comes with this space.

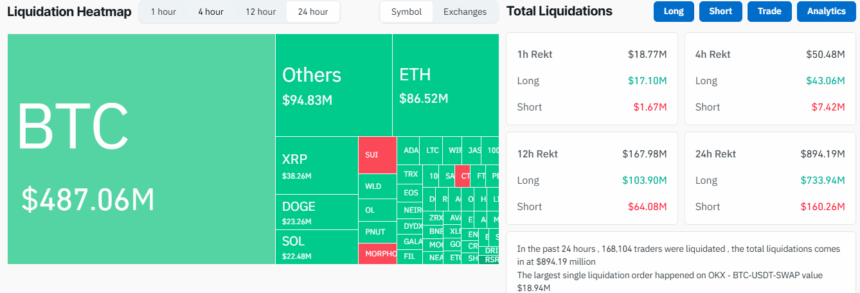

The extreme fluctuations in Bitcoin‘s price have sent shockwaves through the cryptocurrency market, leading to massive sell-offs or “liquidations.” Over the last 24 hours, these liquidations amounted to an astounding $894.03 million, impacting a total of 168,056 traders. The largest single liquidation took place on OKX, involving a BTC-USDT-SWAP order worth approximately $18.94 million.

The turmoil started as Bitcoin reached a remarkable high of $103,900, only to drop sharply to $90,400 on Binance within a single night. Yet, optimistic traders (bulls) soon appeared, driving the price up again, with Bitcoin currently standing at $97,898.

Most of the closures involved long positions totaling approximately $733.49 million, whereas short positions contributed an additional $160.36 million. Here’s a breakdown of how these liquidations unfolded across various periods:

- 1 Hour: $18.22M ($17.02M longs, $1.20M shorts)

- 4 Hours: $50.18M ($42.67M longs, $7.51M shorts)

- 12 Hours: $166.08M ($103.25M longs, $62.83M shorts)

- 24 Hours: $893.85M ($733.49M longs, $160.36M shorts)

The quick ups and downs of Bitcoin underscores the continuous instability found within the crypto market. Some investors profited from these price changes, but many others experienced significant financial setbacks.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2024-12-06 15:00