On April 8, Bitcoin ETF trading volumes hit a record high of over $200 billion, even as investors withdrew funds from Grayscale’s GBTC and the market share changed hands. In simpler terms, more than $200 billion worth of Bitcoin ETF trades occurred on that day, despite Grayscale experiencing outflows and a transfer of market dominance.

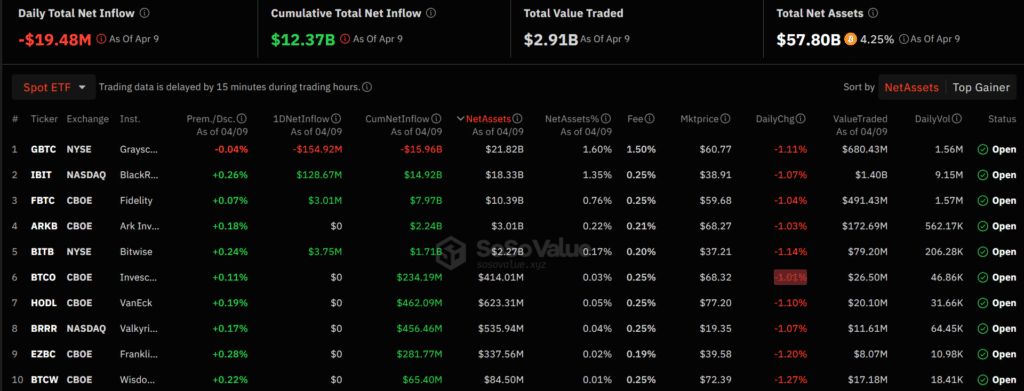

According to SoSoValue, a data tracker, Grayscale’s Bitcoin (BTC) ETF saw a loss of approximately $154.9 million. This contribued to a total outflow of around $19.4 million from the 10 U.S. spot BTC investment products. Among these, BlackRock’s IBIT fund was the biggest recipient of investor interest with an inflow of about $128.6 million. In simpler terms, Grayscale’s Bitcoin ETF lost $154.9 million, which brought the total withdrawal from all 10 U.S. Bitcoin investment products to $19.4 million. BlackRock’s IBIT fund attracted the most investor interest with a net gain of around $128.6 million.

The second largest inflow of the day, totaling $3.7 million, was recorded by Bitwise, following BlackRock. With $3 million in investments, Fidelity took the third place. However, six Bitcoin ETF issuers did not report daily net inflows due to volatile market interest preceding Bitcoin’s halving event.

Despite this, the total trading volumes have more than doubled since last month, reaching over $200 billion after the U.S. SEC’s approval of the listing in January.

Grayscale CEO: Bitcoin ETF outflows reaching equilibrium

Based on Reuters’ report, Michael Sonneshein, Grayscale’s CEO, stated that the number of investors leaving the crypto asset management firm may have balanced out. This equilibrium could be attributed to the finalization of bankruptcy proceedings involving notable figures in the industry, such as Sam Bankman-Fried and his company FTX.

According to crypto.news, FTX’s estate sold off approximately $2 billion worth of GBTC shares earlier on. Additionally, Sonneshein posits that a reduction in Grayscale’s fees could spark heightened interest in its Bitcoin ETF, acting as the current market leader and major issuer.

BlackRock seizes spot Bitcoin ETF market share

Grayscale is planning a shift in its approach to charging the highest fees for Bitcoin ETFs, as new competitors have taken a significant portion of the market share previously held by them. At the beginning of the year, Sonnenshein’s firm controlled more than half of the market, but their share has now fallen below 25%.

BlackRock, a long-time player on Wall Street, has surpassed Grayscale to become the largest player in the Bitcoin ETF market, holding approximately 52% of the market share. This is an increase from their previous 22%. Grayscale now ranks second, and Fidelity follows closely behind with a 16.9% share.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-04-10 18:00