The Securities and Exchange Commission (SEC) in the United States has issued a warning of potential regulatory action against decentralized finance (DeFi) exchange Uniswap.

On April 10, Uniswap revealed they had received a Wells notice from the SEC’s Enforcement Division. This notice is part of a wider regulatory action by the securities agency, with chair Gary Gensler maintaining that the majority of cryptocurrencies created on blockchains are subject to current financial regulations.

Gensler frequently describes the cryptocurrency sector as being similar to the “lawless frontier” and has taken steps to regulate it by using enforcement measures.

Uniswap founder reacts

Hayden Adams, the founder and CEO of Uniswap, expressed frustration and disappointment on platform X, but stated his readiness to confront the SEC and defend his business.

Today, Uniswap Labs was given a warning letter from the Securities and Exchange Commission (SEC). I’m not shocked by this development, but I am frustrated, disappointed, and prepared to defend ourselves. I firmly believe that the offerings we provide comply with the law and that our efforts are aligned with the progress of the crypto industry. However, it has become evident that the SEC holds a different perspective.

— hayden.eth 🦄 (@haydenzadams) April 10, 2024

Uniswap, in a blog post responding to the SEC’s notice, disagreed with allegations that most cryptocurrencies represent investment contracts. Similar to other industry leaders such as Coinbase, Uniswap maintained that the majority of traded tokens are actually stablecoins, utility tokens, and commodities like Bitcoin (BTC) and Ethereum (ETH). In simpler terms, Uniswap challenged the claims suggesting most cryptocurrencies function as investment contracts, instead emphasizing that a significant portion consists of tokens with other uses or functions.

Although the SEC often states that most tokens qualify as securities, it’s essential to understand that tokens are merely digital files, similar to PDFs or spreadsheets. They can represent various forms of value and don’t inherently equate to securities. Just as not every sheet of paper is a stock certificate, not all tokens fall under this category. We are certain that the offerings we provide are both lawful and revolutionary.

Uniswap’s April 10 blog post

Based on DefiLlama’s figures, Uniswap is the leading decentralized finance (DEFi) exchange with a total value locked of over $6.2 billion spread across 16 different blockchains. According to CoinGecko statistics, this exchange accounts for approximately 22.5% of all cryptocurrency trading activity.

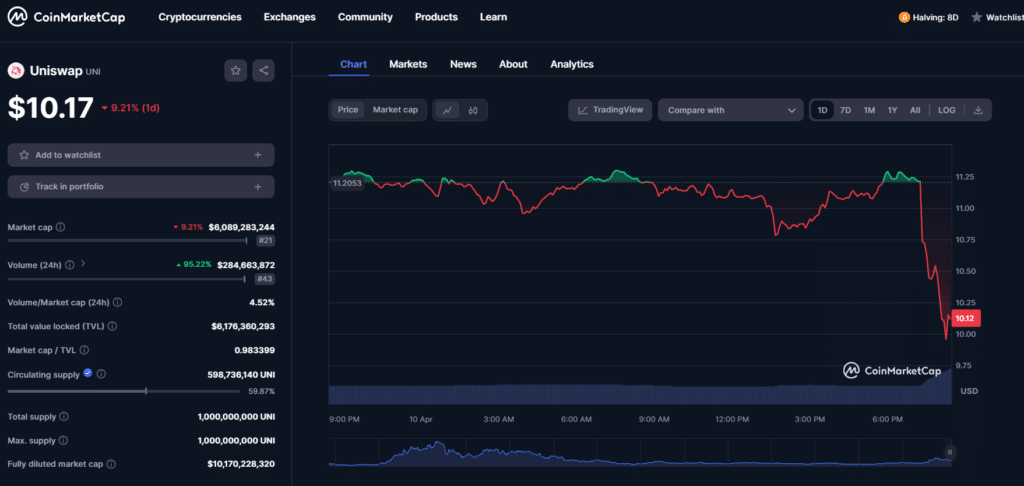

Following the news, the UNI token declined by over 9% and traded for around $10, per CoinMarketCap.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-04-10 22:38