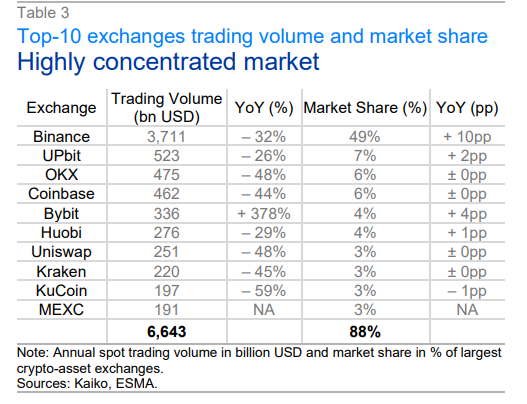

A recent study conducted by the European securities regulator reveals that approximately 90% of all cryptocurrency trades are handled by just ten exchanges. This suggests a significant level of concentration in the crypto market.

A new report from the European Securities and Markets Authority (ESMA) reveals a high degree of dominance in the crypto trading market, causing apprehension about its possible effects on market equilibrium. The study, named “Crypto assets: Market structures and EU relevance,” discloses that around 90% of all trades are facilitated by just ten crypto exchanges. Among these, Binance is responsible for nearly half of the global trading volume.

In total, Binance, Upbit, and OKX account for approximately 60% of the market share. Bybit has reported a remarkable 380% surge in trading volume during the past year, whereas Coinbase experienced a 44% decrease for the same timeframe, according to recent research. The European Securities and Markets Authority (ESMA) has raised concerns about this level of market control, voicing worry over the potential repercussions of a significant asset or exchange collapse on the wider cryptocurrency community.

Additionally, our research reveals that market liquidity can significantly differ between exchanges, with greater liquidity typically observed in larger trading platforms.

The European securities regulatory body noted that contrary to common perception, cryptocurrencies do not reliably act as safe investments during market turbulence. Instead, they are closely linked to equities, and no dependable connection with gold has been identified.

Although European regulations like the VASP license for crypto exchanges have been implemented, this research indicates that a significant number of transactions on these licensed platforms may still take place outside the EU. This highlights the importance of ongoing surveillance and regulatory action in the crypto market.

Read More

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Gold Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Every Upcoming Zac Efron Movie And TV Show

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- USD CNY PREDICTION

2024-04-11 14:43