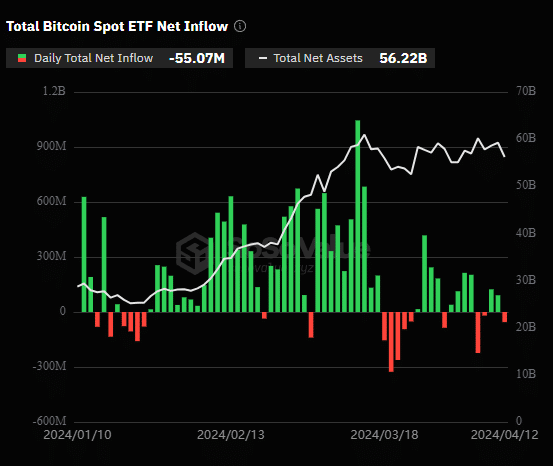

Spot Bitcoin ETFs, or exchange-traded funds, saw a net outflow of $55 million on Friday, April 12.

The data indicates a change in direction after ETFs experienced nearly $215 million in combined inflows for the previous two days.

Bitcoin ETFs ahead of halving

Based on information from SoSo Value, the biggest amount, totaling $166 million, was taken out of Grayscale’s GBTC product on Friday.

The GBTC ETF is experiencing significant withdrawals prior to the upcoming halving event, with a further $154.9 million departing on April 8.

In contrast, BlackRock IBIT saw the biggest inflow of $111 million on Friday for its ETF.

On Friday, there was a significant sell-off that left its mark on the crypto market. Bitcoin saw a decline of almost 5% within a day, bringing its price down to around $65,000. The rest of the market mirrored this trend, leading to approximately $900 million in total liquidations.

Last week, Bitcoin ETFs experienced a weekly outflow of approximately $298.4 million, representing a net withdrawal of funds from the market over three business days.

In spite of continuous withdrawals from Grayscale Bitcoin Trust (GBTC), Grayscale’s CEO, Michael Sonneshein, maintains a positive outlook. He stated recently that the GBTC outflows might have reached a balance. Sonneshein is confident that the rate of outflow will decrease noticeably as Grayscale reduces its Bitcoin ETF charges.

The steady withdrawal of funds from the ETF market may be due to a pause before Bitcoin’s halving event. It is widely believed that this event typically triggers a more significant bull run for Bitcoin. Consequently, investors might sell off their holdings temporarily to secure profits and later buy back when prices drop.

On the other hand, there’s a strong possibility that investors are hesitant about the upcoming halving not triggering significant price increases similar to past years. This is because Marathon Digital has recently suggested that Bitcoin may have already reached its peak following the approval of the ETFs earlier in 2021.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-04-13 15:29