The unpredictability of crypto markets is growing as traders become more cautious about the possibility of Ethereum (ETH) going in reverse direction.

Analysts at QCP Capital anticipate that apprehension in the cryptocurrency market will persist due to the worsening tensions between Iran and Israel in the Middle East. Furthermore, with the poor showing of US stocks, numerous traders are shunning risk at this time.

Alternative contract financing often implies a loss, implying that a significant amount of long-term Bitcoin (BTC) leverage has been eliminated. However, analysts emphasize that there remains robust interest in Bitcoin within the cryptocurrency market, unlike Ethereum (ETH).

The financing costs for Bitcoin’s criminal element remain relatively stable, with the later part of the curve maintaining yields above 10%.

QCP Capital analysts

Based on the present trends of major cryptocurrencies, specialists advise approaching purchases of Bitcoin (BTC) and Ethereum (ETH) with caution and only when their prices are considerably lower than the current market value.

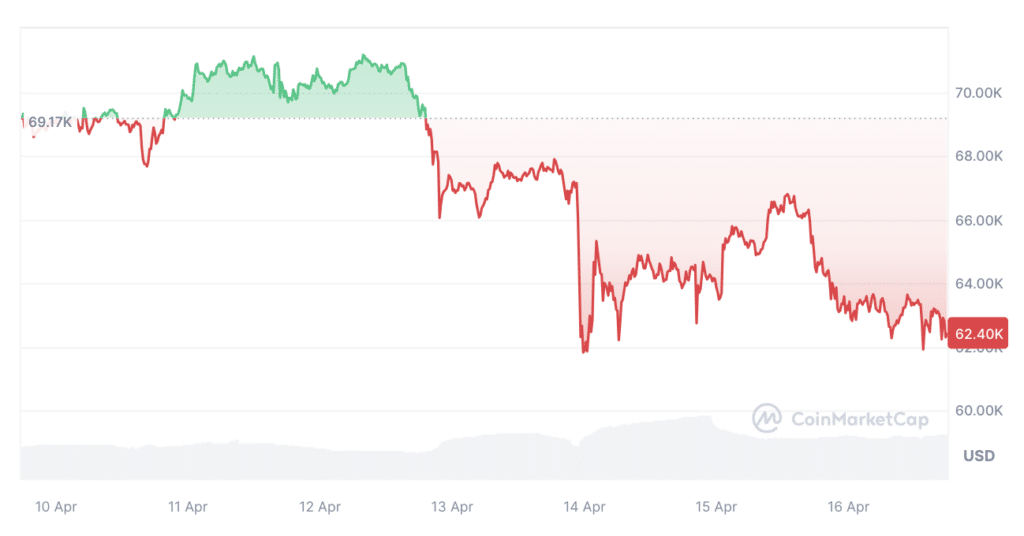

On the night of April 14th, Bitcoin’s price took a significant hit following reports of Iranian attacks against Israel. This resulted in a steep 8% decline, pushing the price below $62,000 – its largest drop since March 2023. According to figures from CoinMarketCap, however, the price had regained some ground and was currently sitting at $62,300 at the time of publication.

Last week, QCP Capital believed that the upcoming Bitcoin halving would not only decrease the miner’s reward for mining a Bitcoin block to 3.125 BTC, but it might also lead to an significant surge in demand for Bitcoin.

Some additional factors fueling the growth were the rise in investments towards spot ETFs and news that Citadel, Goldman Sachs, UBS, and Citi have signed up with BlackRock to manage their exchange-traded funds (ETFs). BlackRock will serve as the broker-dealer responsible for creating and redeeming shares of these ETFs.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2024-04-16 18:24