From the prospects of BTC hitting $100,000 in 2024 — to search interest for the “Bitcoin halving” — here’s a data-driven look at this rare event.

Bitcoin is lumbering up for its fourth halving — and no two events are the same.

The markets are unrecognizable from where they were even four years ago.

Here are five fascinating facts about the 2024 halving.

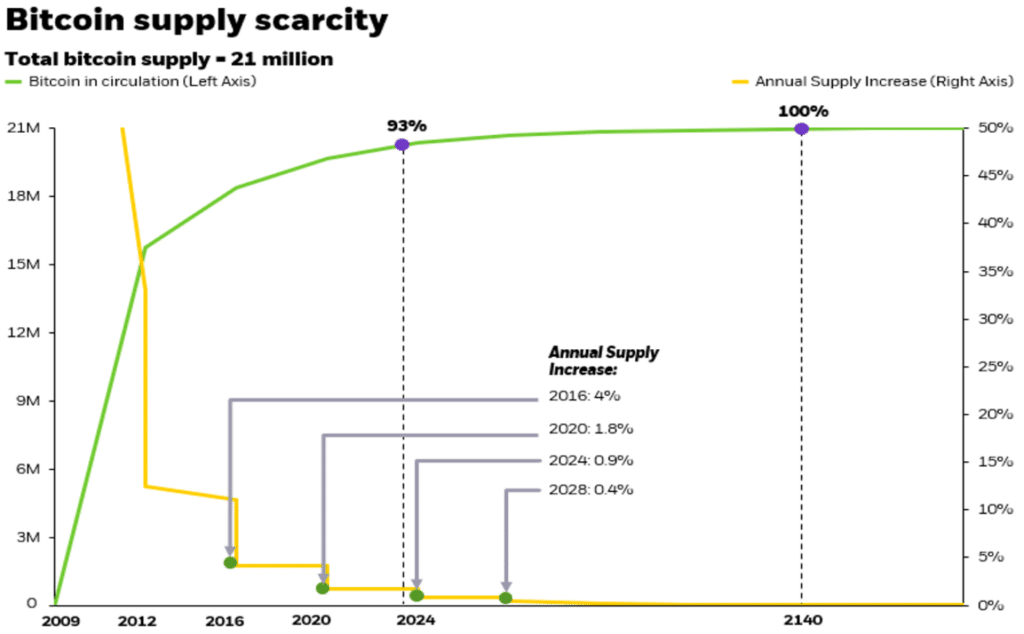

1. There isn’t much Bitcoin left

Bitcoin has been structured, so most of its total supply is already in circulation.

Starting from the halving event, approximately only 1.3 million Bitcoins remain to be mined as rewards. This amount must sustain the mining process till the year 2140.

Starting from the present, approximately 450 Bitcoins will be generated daily. Consequently, around 657,000 Bitcoins are estimated to enter the market until the year 2028.

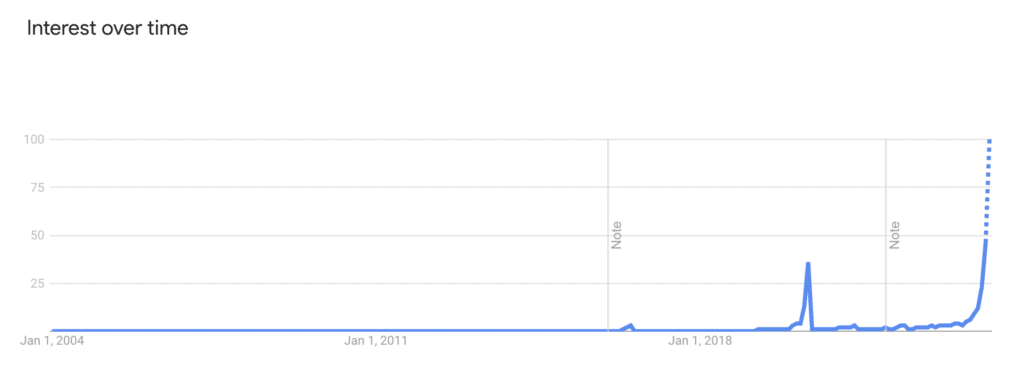

2. Google searches for “Bitcoin halving” are smashing records

In 2016 and 2020, there were small increases, but now, more than ever, an unprecedented amount of people are eagerly seeking information regarding the 2024 event known as the halving.

According to Google Trends, Nigeria, The Netherlands, Switzerland, Cyprus, and Slovenia have expressed the greatest level of interest among all countries regarding the impending 50% reduction in block rewards.

3. BlackRock is feeling *very* bullish

A prominent global company leading in asset management made headlines by introducing a Bitcoin-linked exchange-traded fund, following the trend of investing in the cryptocurrency’s current market value.

For the initial time, numerous institutional investors have the opportunity to invest in the halving event without personally holding the digital asset.

According to Jay Jacobs, a BlackRock executive, the iShares Bitcoin Trust, currently managing $18 billion in assets, is the swiftest-expanding exchange-traded fund (ETF) ever, and we’re merely at the beginning. In his recent post on platform X, he stated:

Many advisors and institutions are only now beginning the process of learning about Bitcoin, which could take several months or even years before they decide if it’s suitable for their portfolios.

Jay Jacobs

In his latest blog entry, Jacobs highlighted the significance of bitcoin’s “halvings” in upholding its value as a clear-cut cryptocurrency with a limited quantity.

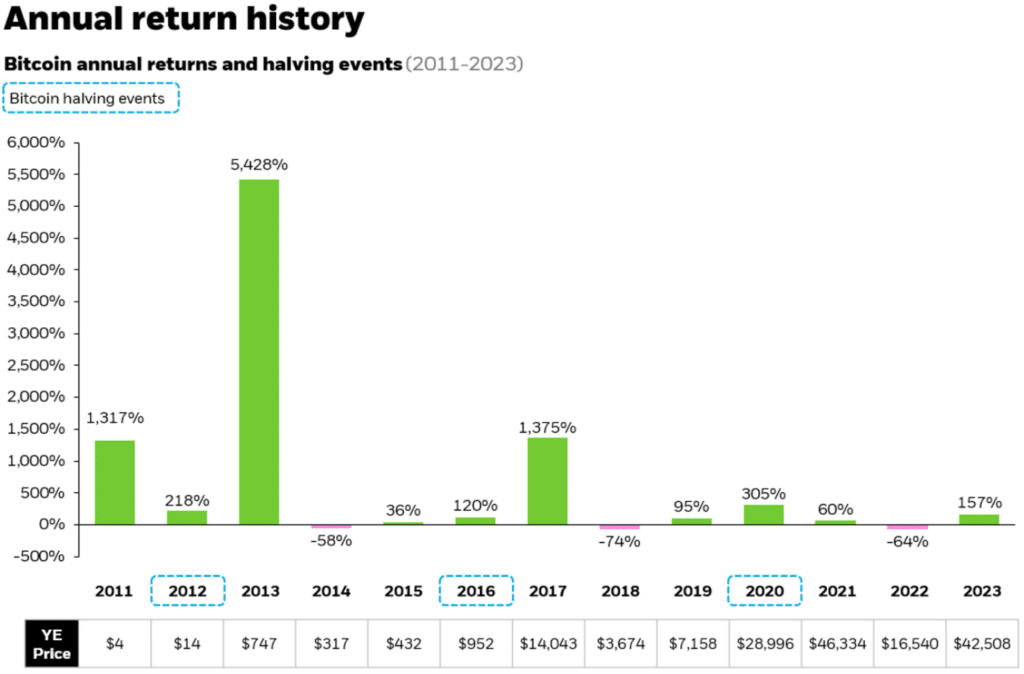

He additionally presented a graph indicating that Bitcoin has historically achieved its best annual gains following a halving – recording a surge of 5,428% in 2013 and 1,375% in 2017.

In contrast, the third halving in 2020 brought about some distinct differences. Bitcoin’s remarkable increase of 305% that year outpaced the more modest 60% growth seen in 2021.

Reaching a new peak price prior to the Bitcoin halving for the very first time, it is yet unknown how long this ongoing bull market will persist.

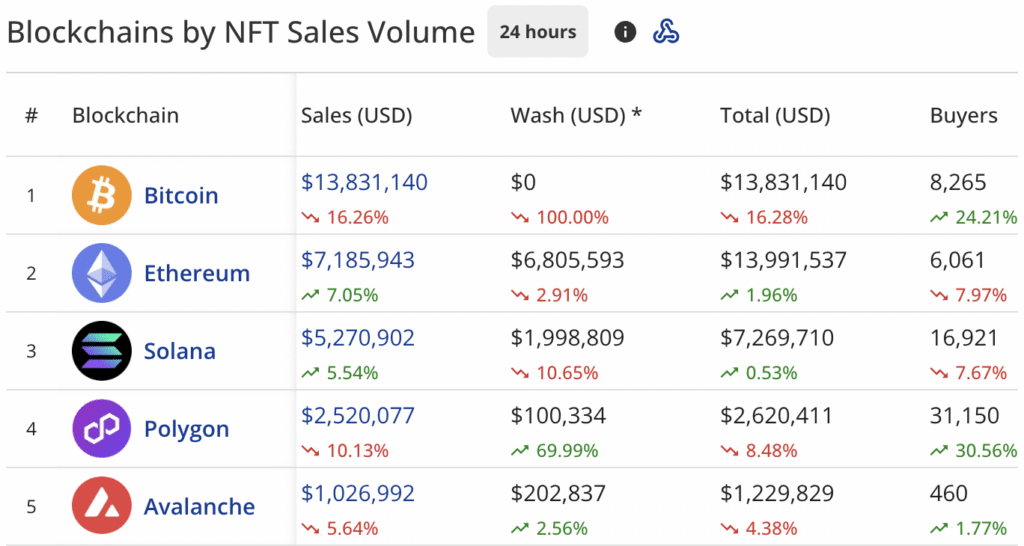

4. Bitcoin Ordinals are popping, too

In simpler terms, Ordinals is a new concept in the Bitcoin world that functions similarly to non-fungible tokens (NFTs), which have recently gained popularity.

A satoshi, which is the smallest unit of a Bitcoin (equivalent to 0.000001 BTC), can store rare messages, images, or videos due to its small size.

The interest in Ordinal crypto collectibles has skyrocketed, an increase even after Binance stopped providing support for them.

According to data from CryptoSlam,Ordinals saw a staggering $13.8 million in sales within the last 24 hours, surpassing the sales figures of Ethereum and Solana combined.

The initial satoshi block mined following the halving event is particularly anticipating due to its rarity, as it will only be one of a total four such blocks in existence.

Casey Rodarmor, who created the Ordinals protocol, has said it’ll have “epic” rarity.

In the opinion of Tristan, the founder of Ordiscan, being selected as the fortunate miner to obtain this sat could lead to an enormous profit that outweighs any decrease in block rewards. He expressed this idea in a published blog entry.

With a supply of only 3 Epic sats contrasted to the abundant 410 Rare sats available in the market, each Epic sat’s worth can reasonably be anticipated to exceed that of a Rare sat by a factor of at least 10, given their rarity and higher demand.

Tristan, Ordiscan founder

The total price tag, we hear you ask? A cool $1 million.

5. The short-term outlook is uncertain

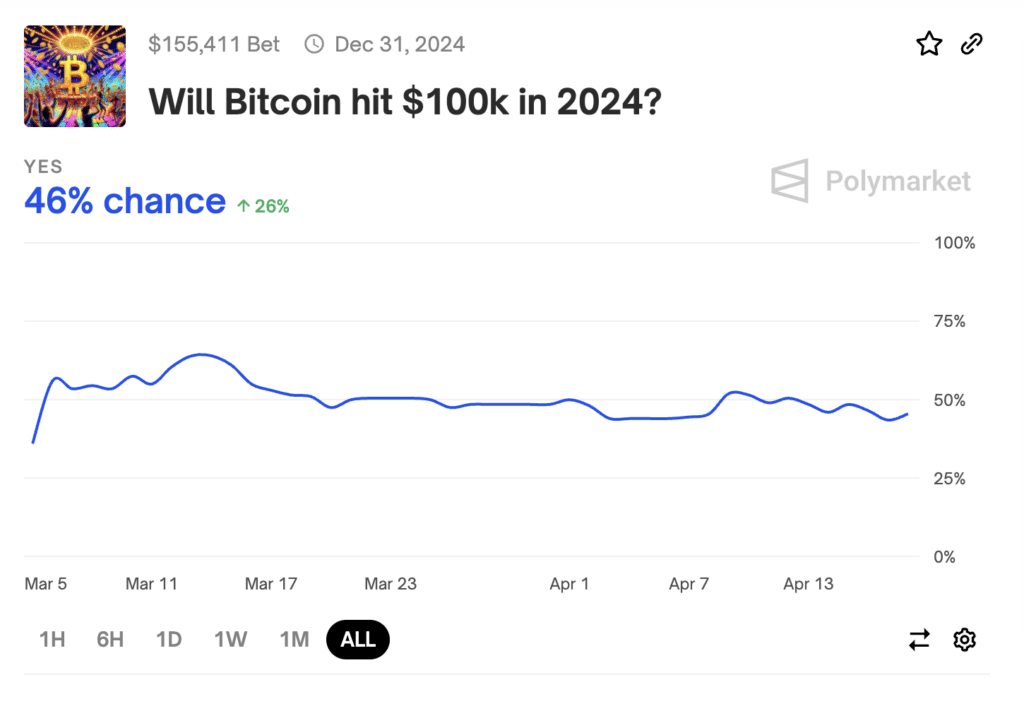

Making Bitcoin price forecasts haphazardly is common, but in wagering markets, individuals put their funds behind their words.

Based on the information from Polymarket, Bitcoin’s outlook seems less favorable in the past few months.

According to recent data, the probability of Bitcoin reaching $100,000 this year, as perceived by bettors, is approximately 46%. However, optimism surrounding this price point has decreased in the last few weeks. Conversely, only a small percentage (11%) anticipate Bitcoin to surpass $250,000 by the end of the year.

As the Bitcoin halving approached, the digital currency momentarily dropped to its cheapest point since February, and around 17% of respondents predicted that it wouldn’t surpass $60,000 on the actual day.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2024-04-18 21:59